Wintermute, a cryptocurrency market maker, is launching an over-the-counter (OTC) trading platform targeting institutional investors.

The new platform, Wintermute Node, is intended to be a one-stop shop providing price discovery, trading and exposure monitoring of digital assets. The single-dealer platform will charge zero fees and allow clients to directly access Wintermute’s liquidity over API and web interface.

Wintermute Node appears to be competing against the bevy of other institutional trading platforms on the market for access to crypto order flow – including FalconX and Coinbase Prime.

“The others are charging a lot,” Wintermute founder and CEO Evgeny Gaevoy told CoinDesk in an interview. “Our platform eliminates an extra layer of fees.”

While the new platform will not charge any fees, all of the orders placed through Node will be executed by Wintermute, giving the firm access to a greater volume of order flow. Users will be shown a bid-ask spread with prices that are identical to the spreads the firm shows to its counterparties across other venues, the firm told CoinDesk.

Crypto market makers, like their counterparts in traditional financial markets, quote buy and sell prices for token pairs and profit by pocketing the spread.

“We can also do more on the structured products side,” added Gaevoy, who rose to head the exchange-traded fund (ETF) business at market making firm Optiver before launching Wintermute.

The new Node API expands on Wintermute’s existing OTC API, which first launched in June 2021.

Trading volumes surge

Founded in 2017, Wintermute has grown to become one of the largest and most active crypto market participants. According to a press release, the firm currently trades in over 60 centralized and decentralized trading venues.

“We’re connected to the most liquidity sources – that’s the main thing differentiating us,” said Gaevoy, who added that Wintermute is active in making markets for over 250 tokens.

Most recently, Wintermute was one of two market makers retained by Yuga Labs – the company behind the non-fungible token (NFT) collection Bored Ape Yacht Club – to jump-start trading for its ApeCoin token.

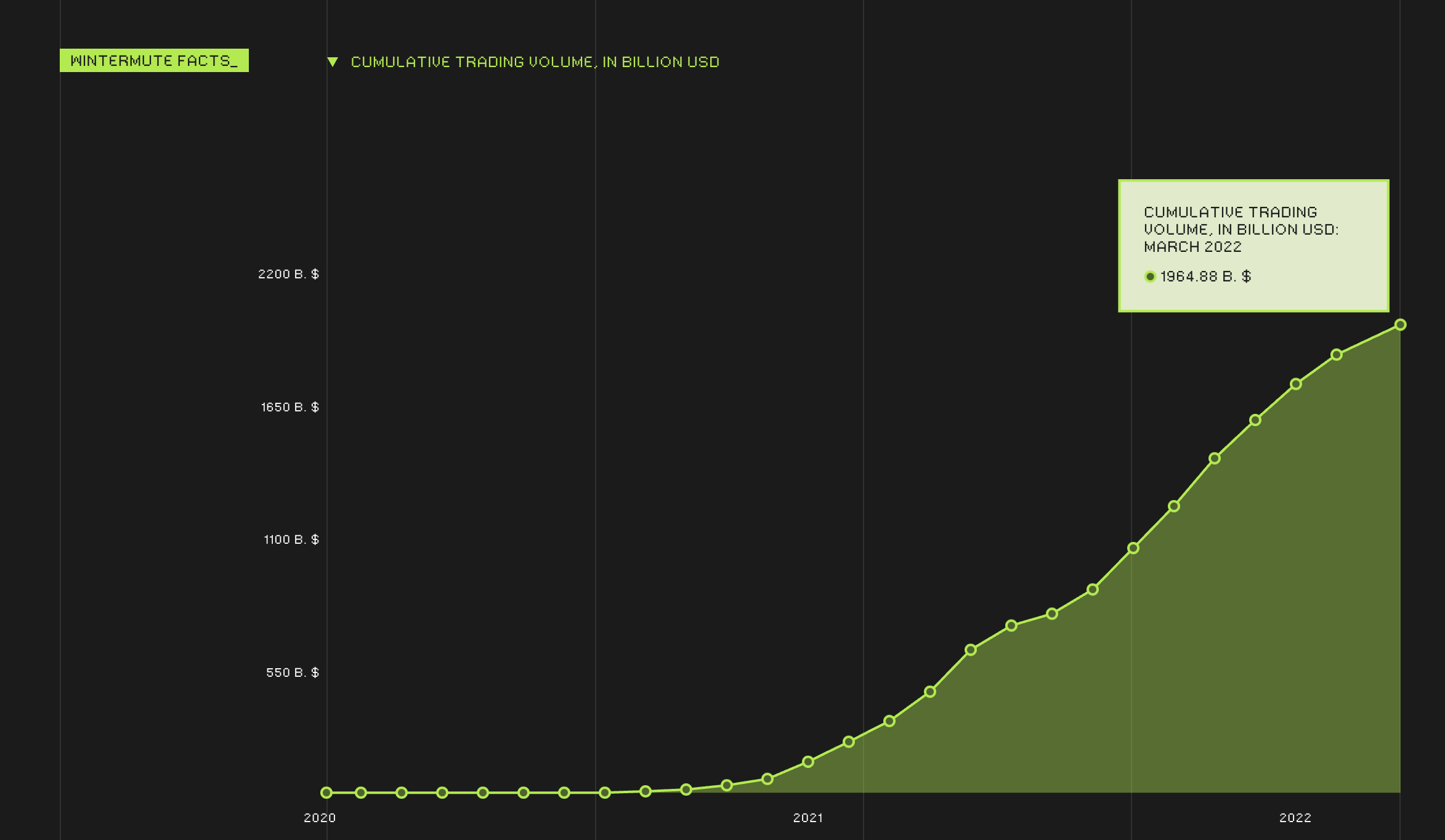

Since inception, Wintermute has done nearly $2 trillion in cumulative trading volume, with over 90% of that figure traded since 2021. The firm says it trades over $5 billion in volume daily.

“If you are a person or an entity active on exchanges, aggregators, brokers or borrowing-lending platforms, there is a good chance your transactions are actually executed by Wintermute,” said Gaevoy in a statement.

Wintermute cumulative trading volumes (Wintermute)

Vertical integration

With its new platform, Wintermute also appears to be vertically integrating its business model by building a direct pipeline to big crypto buyers and their order flow.

Wintermute has also been more active in the venture capital front, participating in over 40 seed and series A investments last year. Some of their investments include Aave, dYdX, Polygon and Paraswap.

The move follows in the footsteps of Jump Crypto and Alameda Research, other influential crypto market makers and perhaps two of Wintermute’s largest competitors in the space. Jump and Alameda both built up their trading businesses before expanding to venture capital and beyond.

“We want to cover more of the ecosystem," said Gaevoy. "The more counterparties we have, the more efficient we can be.”

Read more: Jump Crypto Wants You to Know Its Name

Institutional investors are increasingly prioritizing execution quality and minimizing fees, signaling the slow-but-sure maturation of crypto markets.

“Retail is not as sensitive when it comes to execution quality, but when you talk to funds or whales, they do care,” Gaevoy told CoinDesk.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5W2EL6X3JJELBDYLMMRJM3TGQY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DV7MYDYKMZETDKRTBUX7B5VOHY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZEHNAVGSVRDSVKX55HSAX4UIHI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SQIA5FR3XZD45C42OHL6ZAFK7Q.jpg)