Crypto market-making giant Wintermute is launching Bebop, a decentralized exchange (DEX) set to go live on Ethereum this summer.

Bebop will join the roster of existing DEXes on Ethereum, which includes Uniswap, SushiSwap and Curve.

“I believe that Bebop can be … more than just a tool to route to the best venue for execution,” said Evgeny Gaevoy, founder of Wintermute. “Bebop’s ambition is to redefine user experience in DeFi (decentralized finance), making the process of trading intuitive and hassle-free.”

Decentralized exchanges allow users to trade crypto tokens without the usual know-your-customer (KYC) checks, making them a popular alternative to centralized exchanges such as Coinbase (COIN) and Binance.

Unlike Uniswap and its various forks, the codebase for Bebop isn't open source, according to a Wintermute spokesperson.

The announcement comes on the heels of the April launch of Wintermute’s new zero-fee institutional trading platform, Wintermute Node.

What makes Bebop different?

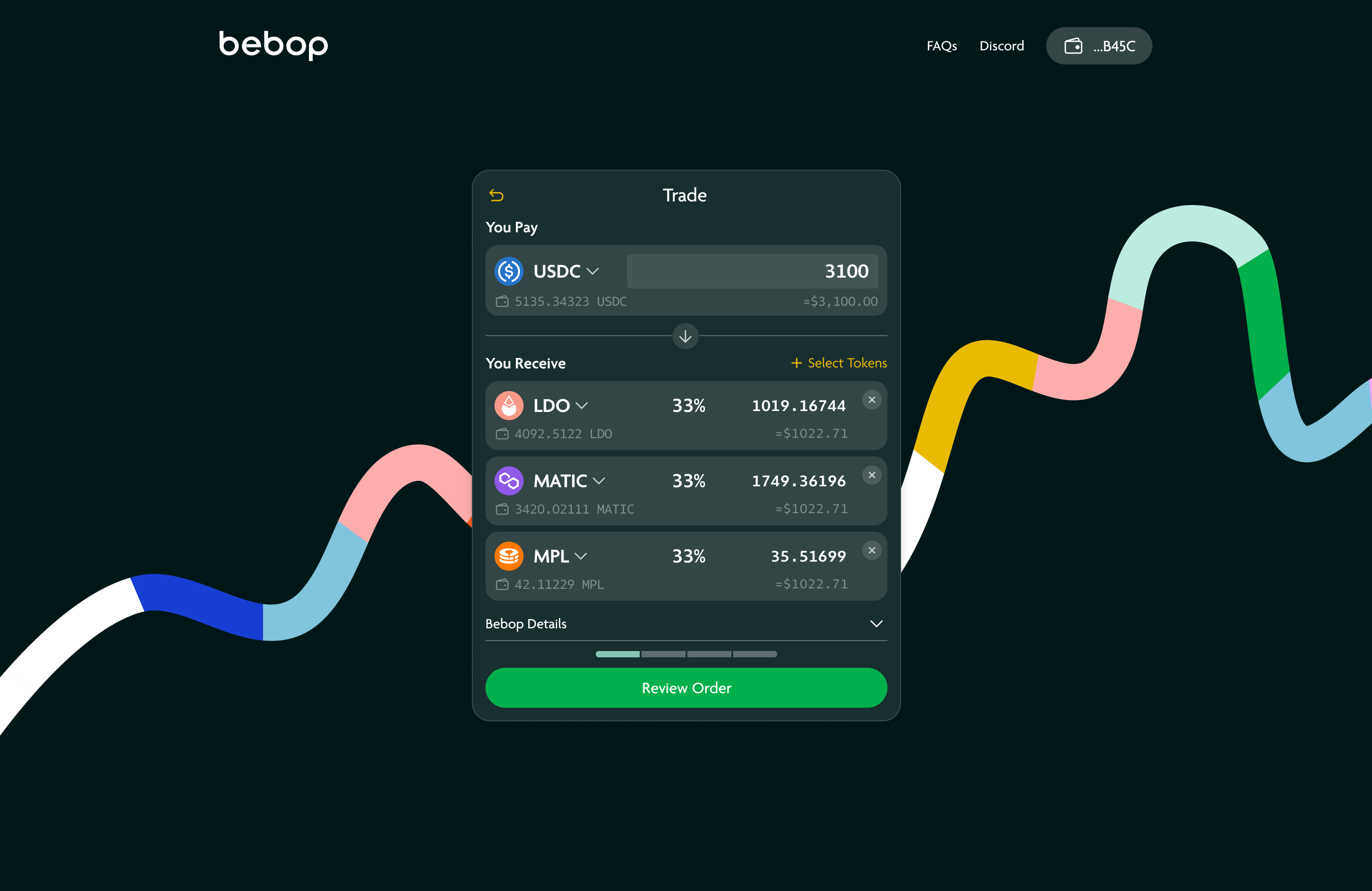

One key feature of Bebop is its ability to swap one token for a portfolio of tokens and, conversely, swap a portfolio of tokens for one token, allowing traders to enter or exit multiple positions via a single trade.

Bebop says this feature will be “especially important in fast markets” and save users in transaction costs.

Unlike Uniswap or Binance Smart Chain’s PancakeSwap, which follows the automatic market maker (AMM) model, Bebop is a "request for quote"-based (RFQ) platform.

In an RFQ model, customers submit an amount of a token or portfolios of tokens that they want to trade. Then, market makers respond with a customized quote.

“For one-to-one and multi-swap trades, Bebop utilizes an RFQ model for its exchange, where professional market makers provide top-quality liquidity to the protocol,” explained Bebop product manager Kat Fore. “For users, this means protection from unexpected slippage – they always transact at the price quoted.”

Bebop will allow users to swap many-to-one and one-to-many crypto assets (Source: Wintermute).

Additionally, Bebop will have a built-in “last look” mechanism, a feature common in foreign exchange markets that gives a market maker the ability to reject a trade for some period of time after the customer has agreed to the quote.

According to the spokesperson, Wintermute will be the sole liquidity provider for Bebop during the project’s soft launch. In future releases, Bebop will connect to other AMMs and start adding other liquidity providers.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DPBTHTJEAZBK7AZEYHPWQS4JME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)