Su Zhu, co-founder of beleaguered digital assets fund Three Arrows Capital, is selling a home he purchased in Singapore in December.

Primitive Capital's Dovey Wan first spotted the offering, which is being conducted on a private basis according to sources in the Singapore real estate sector that spoke to CoinDesk.

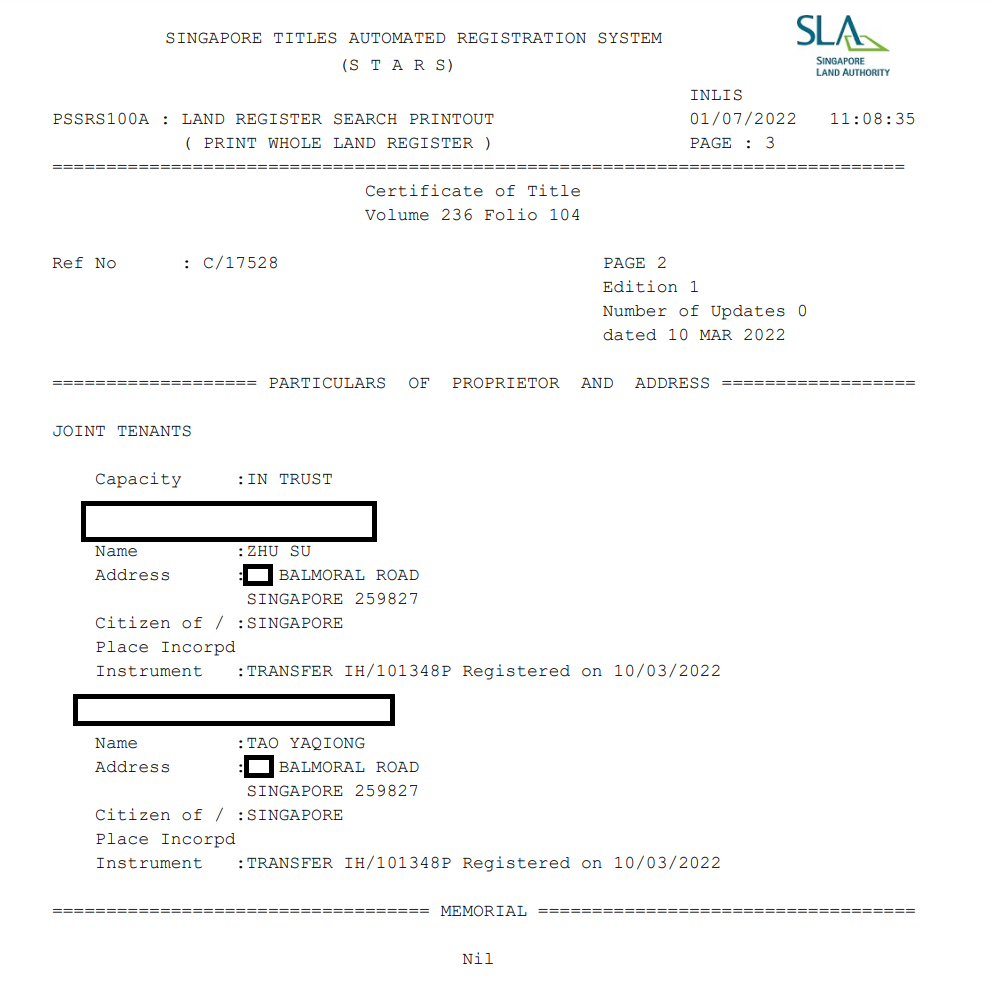

Zhu and his wife Tao Yaqiong purchased a detached house on Singapore's Yarwood Avenue in December 2021 for S$48.8 million ($35 million), according to title data from the Singapore Land Authority.

(Singapore Land Authority)

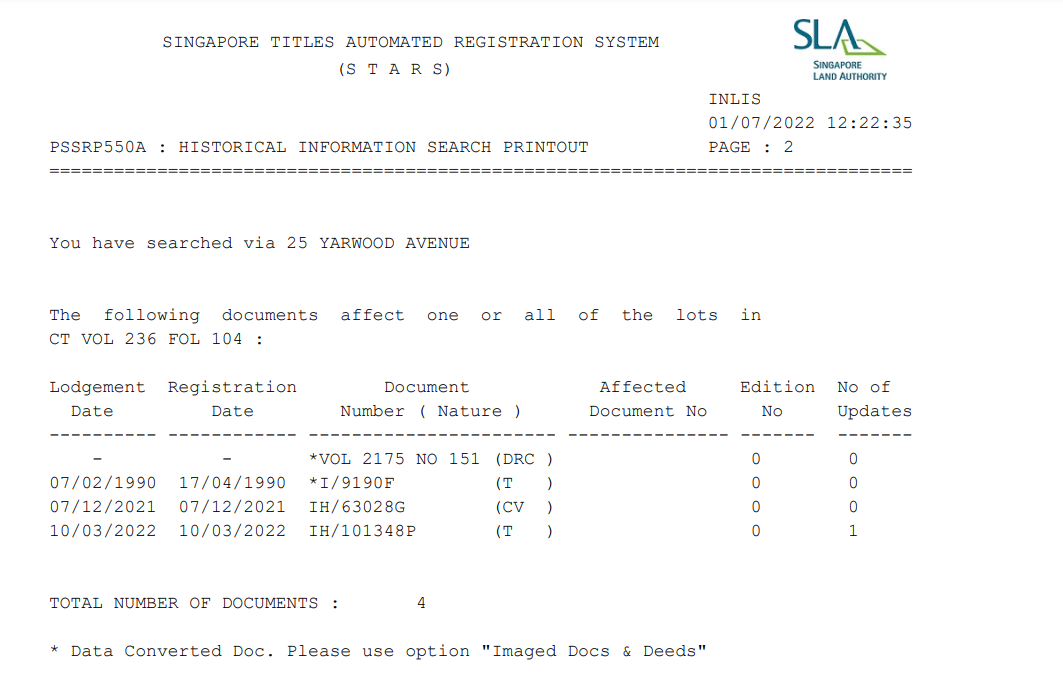

Records from the Land Authority show the couple moved the house's title to a trust for their three-year-old child in March.

(Singapore Land Authority)

The 31,000-square-foot home was constructed in 1990, title data shows, and was only sold once, to Zhu. Known locally as a Good Class Bungalow, these luxurious detached houses are home to Singapore’s elite.

Title searches show Zhu’s wife, Tao, owns another detached house, currently being renovated, worth S$28.5 million on Dalvey Road in Singapore. The couple also owns another home at the Goodwood Grand on Balmoral Road, worth S$6.25 million.

Although Zhu has his reasons for needing to sell the property, local media reports suggest the detached home market is softening given the global economic downturn.

Local newspaper Business Times reported in late June that so far this year the volume of transactions for detached homes were less than a third of the volume in 2021.

The paper also quotes Carin Puah, a senior director of capital markets at JLL, who said that prices are expected to remain firm for these homes despite the market decline because of the status symbol nature of a GCB.

“Owners will only divest if the price meets their expectation,” Puah said.

UPDATE (July 1, 2022, 17:42 UTC): Added source attribution.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WVO2WENPCND37O4I7WSBJRI3PY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)