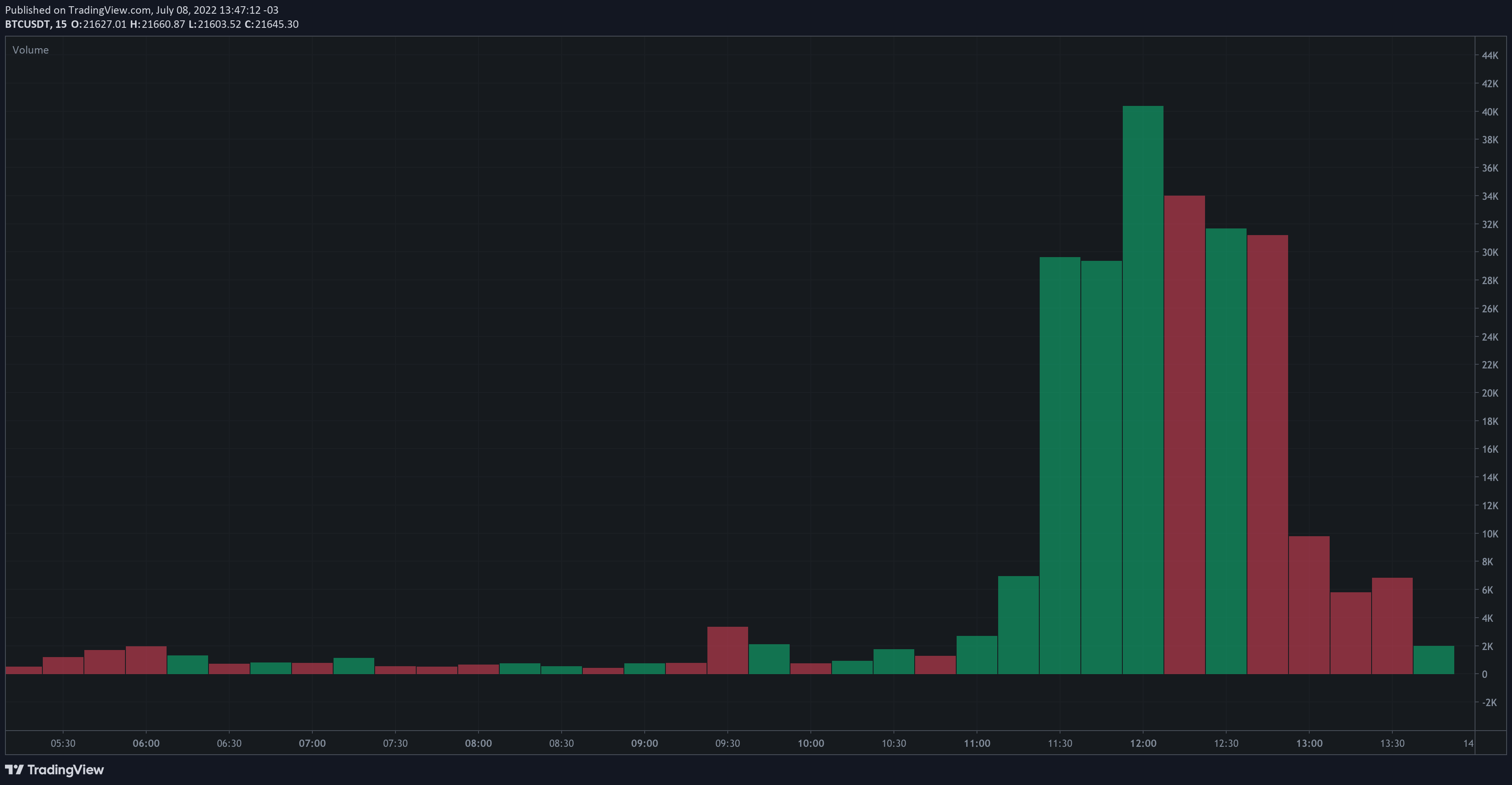

Binance trading volume spiked after its global zero trading fee policy went live Friday morning.

- Zero trading fees worldwide for 13 crypto pairs at Binance – the world’s largest crypto exchange by volume – began Friday at 14:00 UTC (10 a.m. ET). The move caused an explosion in trading at the exchange, with bitcoin/tether (USDT) spot volume surging to 320,000 coins within hours. The exchange hasn’t seen volume that high for even a full day since March 2020.

Chart from Binance website shows skyrocketing bitcoin trading volume on the crypto exchange immediately after 0% commission trading went live earlier Friday. (Binance)

- Binance CEO Changpeng Zhao attributed the surge to people trying to gain VIP tiers via high trading volumes. “We will exclude BTC trading from VIP calculations,” he tweeted. “Remove all incentives to wash trade. Announcement with details coming shortly.” A wash trade occurs when an investor buys and sells an asset for the purpose of artificially inflating the price.

- The exchange made the zero-fee announcement on Wednesday, with the plan becoming effective Friday on Binance’s fifth anniversary.

- “With the onset of the crypto bear market, exchanges like Binance have been seeking ways of attracting and retaining users on their platforms to ensure their slice of the depleted pie remains healthy,” CoinDesk reported at the time.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OTPRGDCX2NFTBJUZWAJA2HDZXI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C7UC7UF4WRG73LR4SJTW7EQBNI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EJTP22MPVVH4RGGUF3VPCFMQBU.jpg)