Many people believe that crypto will increase access to financial services for underbanked communities.

These crypto proponents say that the abundance of mobile devices will allow people to skip banks altogether and to use crypto instead. More than five billion people in the world – nearly 70% – currently own a cell phone, according to the international mobile technology trade organization GSMA, and a large portion come from underserved areas with little if any access to banking services.

The crypto believers say that crypto, particularly some of the latest Web 3 innovations, offers hope for the underbanked, and that serving the underbanked is where crypto can be most useful. They add that traditional financial institutions’ slothlike service can’t compete with cryptocurrency technology.

But new crypto technologies are far from helping underserved communities escape their financial isolation. The companies behind crypto, including but not limited to decentralized finance (DeFi), have failed to provide user friendly apps, educational resources and other tools.

The tools themselves are often hard to use. As a result, bitcoin (BTC) and other cryptos have yet to make substantial inroads as usable currencies. Bitcoin’s volatility is also discouraging. How can people put faith in an asset whose price seems to rise and fall with the winds?

Indeed, even as public awareness about crypto mushrooms, and some of the world’s largest institutional investors launch their first projects to address demand for the asset, crypto has yet to approach parity with traditional currencies. Even in the United States, with its massive wealth and hubs of innovation, people rarely use crypto to pay rent, taxes or other common expenses. Relatively few retailers accept it.

What can crypto provide if the controls are hard to use and those who might use it don’t have enough willing partners to make the system work? They might as well be given fighter jets to fly.

To be sure, I remain a believer in crypto’s potential. I see bitcoin, and perhaps several altcoins one day becoming common forms of exchange. I view blockchain technology as a way to improve entrenched, centralized systems in financial services and perhaps every other industry. I believe that crypto can change lives because it serves the individual consumer’s needs.

But I would like to suggest an alternative approach to crypto, an intermediary step while we wait for the right conditions for widespread adoption to occur that makes more sense than trying to convert people unready for conversion.

Financial services organizations and policy makers would do better focusing on widening access to the services that the underbanked need to conduct transactions, even if those are not related to crypto. Underserved communities need help now, and whether this assistance is rooted in fiat currency and central banking systems should not hamstring the process.

A volatile asset

Crypto is more of an investment class than a payment method or new banking system. And while its trajectory has risen markedly in its short history, even with some massive dips, such as the current six-month decline from a high of nearly $70,000 in the fall of 2021, there is no guarantee of it holding its value from one day to the next. Such changeability is frightening for people dealing with survival issues, and perhaps accustomed to their own native currencies losing value quickly.

Such fear is particularly relevant now. Even before Russia’s invasion of Ukraine, inflation was soaring. Think the U.S.’s 8.5% inflation is high, look at other countries.

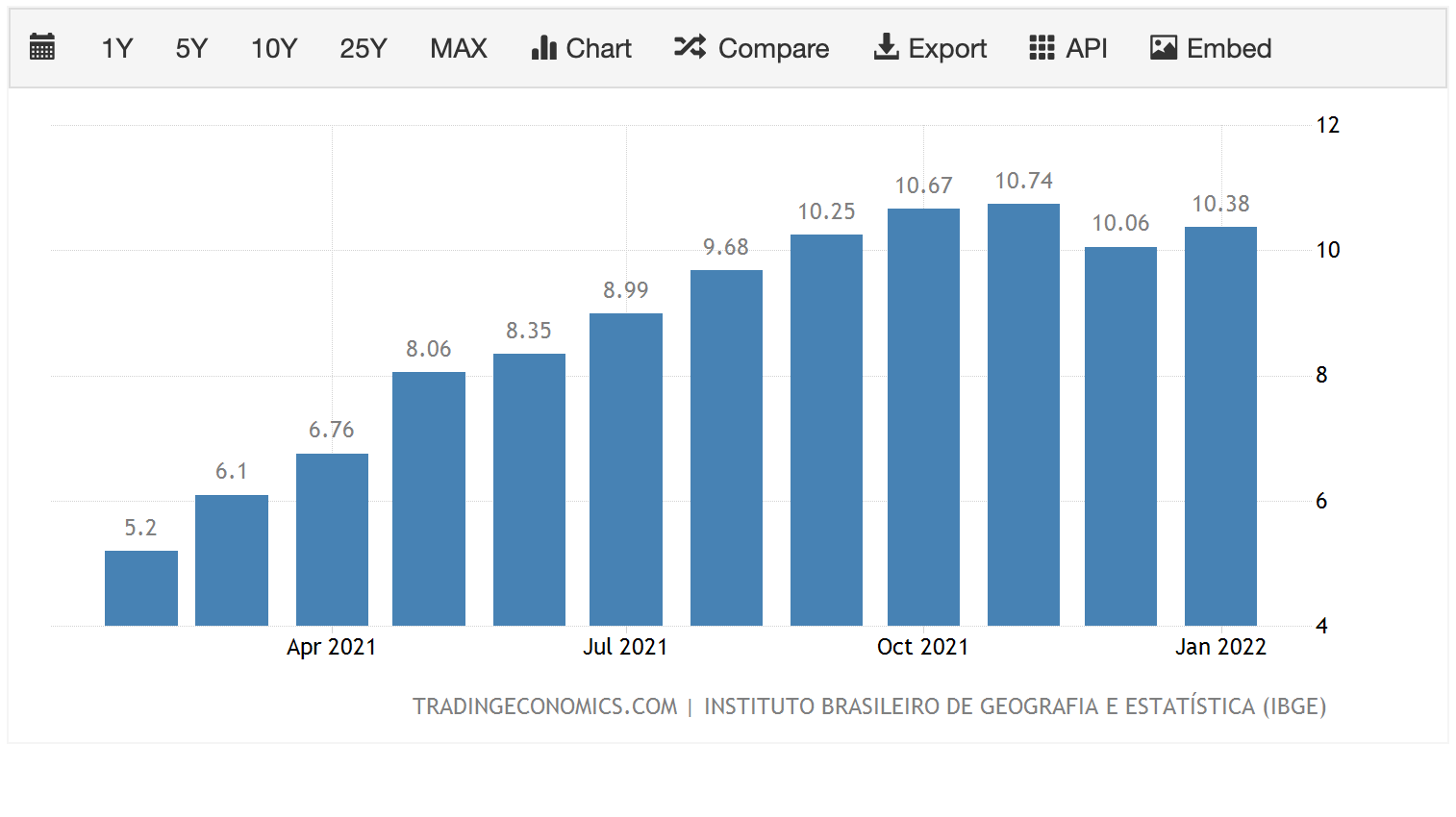

Brazil's monthly annual inflation. (TradingEconomics)

Brazil, which was once a model of economic improvement, now struggles with over 10% inflation. Nigeria, a business hub for sub-Saharan Africa, has been fighting nearly 16% levels, which represents an improvement from much of 2021 (see below). And a number of developing countries are higher, still.

Nigeria's monthly inflation (TradingView)

Stablecoins?

Some crypto observers believe that stablecoins may offer a better alternative to bitcoin because they are less volatile and seem more familiar by virtue of their ties to the U.S. dollar. The crypto startup Reserve is even trying to get people in South Africa and in other countries to use its stablecoin.

But stablecoins suffer from many of the same problems as BTC and other cryptos. They are difficult to fathom and to use. Not many people accept them.

The next time you visit a coffee shop, ask the barista if they accept USDC or terra. They’ll think you’re from outer space and point to their Square console.

The need for a better on-ramp

I don’t mean to sound discouraging. Crypto will one day be an option widely available for daily transactions. Its logic and efficiency are too compelling to ignore. But we have not yet arrived at that point. We are at a transitional stage in the global economy with communities that once seemed like unpromising bystanders starting to participate. But they need help now.

Instead of focusing on blockchain technologies that remain outside their grasp, albeit tantalizingly, they would be better served by on-ramps to centralized financial networks, particularly the U.S. monetary system that, at least for now, plays the pivotal role in financial markets. This is not to excuse these systems’ flaws.

We would not have blockchain technology and bitcoin if they were perfect. The Canadian trucker protests underscored centralized systems’ vulnerability to state oversight.

Inspired by the protests, David Heinemeier Hansson, the founder of programming language Ruby on Rails and a hardcore technologist, recently wrote that he could see a future for cryptocurrencies in countries during periods of unrest. He noted that crypto could help individuals circumvent state surveillance that has risen over the past two years amid the global COVID-19 pandemic and other chaotic events globally.

And we have seen crypto’s power in the ability of Ukraine supporters raising $100 million to fight off Russia’s unprovoked invasion. No traditional monetary system could have raised such an amount with the speed and efficiency of blockchain.

But people for now want a way to conduct their business. Even in underbanked areas, the most reasonable options still require a traditional financial services provider.

That will one day change as crypto continues to embed itself more firmly in our daily lives. But simpler technological innovations offer greater, immediate help for underserved populations.

Access to simple things like a bank account via a phone would be a more impactful first step than skipping over the basics and going right into crypto. That doesn’t sound like much, but for now it will have to suffice. Crypto’s time will come soon enough.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OCRP7ERAQVBWXAEN7EL23QKXUU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)