The most searched keyword for all crypto searchers in the last 24 hours has been “crypto crash,” and yet shrewd cryptocurrency traders are still making big-brain moves.

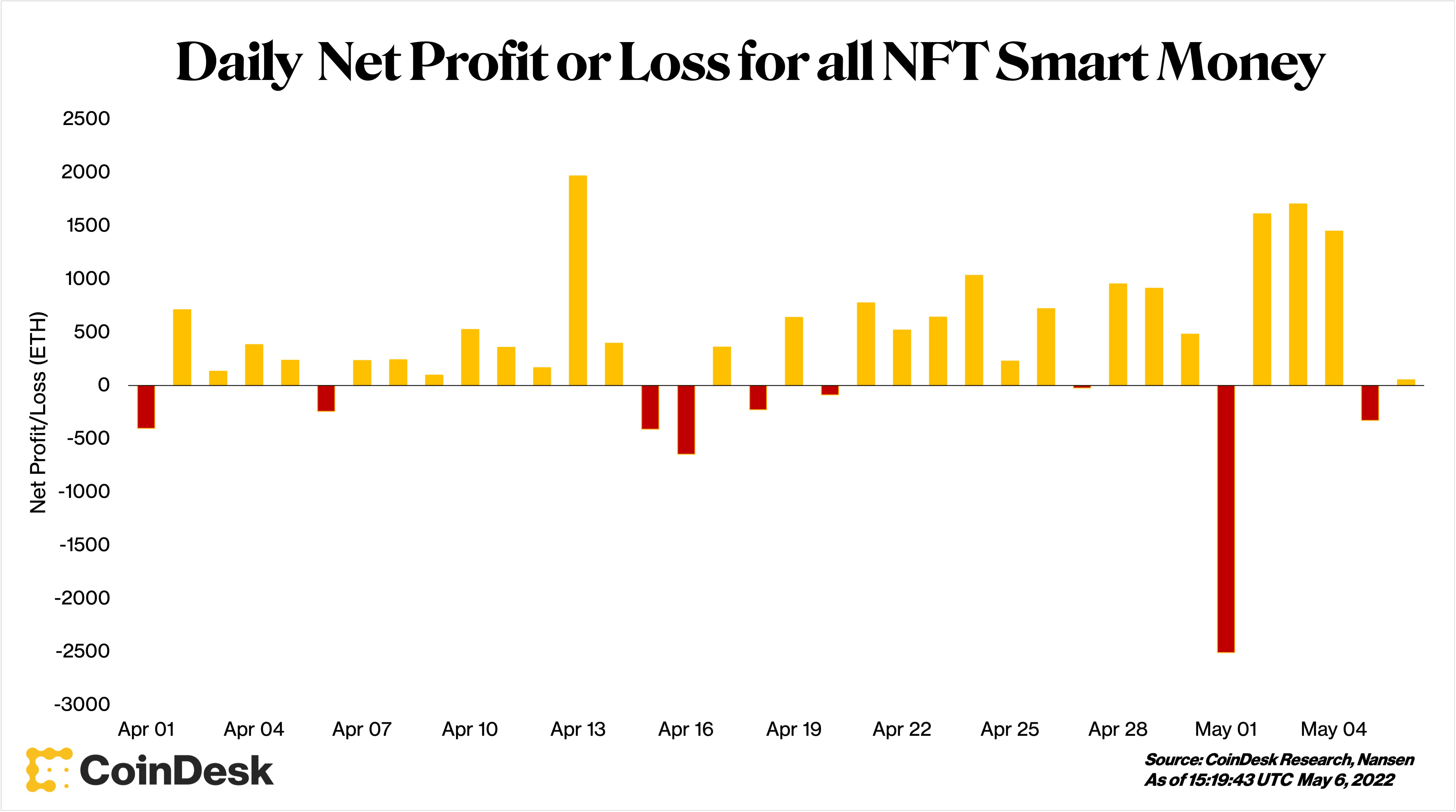

Data from blockchain analytics firm Nansen shows the daily net profit and loss for all smart money addresses trading NFTs (non-fungible tokens). Since April 1, there have been 27 days of profitable NFT trading and nine days of negative returns for smart money wallets.

Nansen considers a wallet to be “smart money” if it is “historically profitable,” meaning it meets at least one of several conditions, including the following:

- Being in the top 100 addresses in terms of estimated profits of their current NFT portfolio and the top 100 addresses based on an internal “hodler score metric.”

- Having at least more than or equal to five times in realized profits on multiple NFT collections that were minted in the last 60 months.

- Having made multiple trades on a decentralized exchange in a single transaction that are profitable in nature.

- Belonging to an investment fund that invests and manages money in crypto.

(CoinDesk Research, Nansen) (Nansen)

Since April 1, smart money has invested 4,864 ETH, returned a total of 17,581 ETH and netted 12,717 ETH in NFT trading.

It is clear that smart money is not infallible, nor is every trade profitable, as demonstrated by the few red bars (emphasis on few). The largest loss for smart money wallets trading NFTs was on May 1, the day Yuga Labs released its Otherdeed NFT collection, where investors spent over 64,000 ether on fees alone.

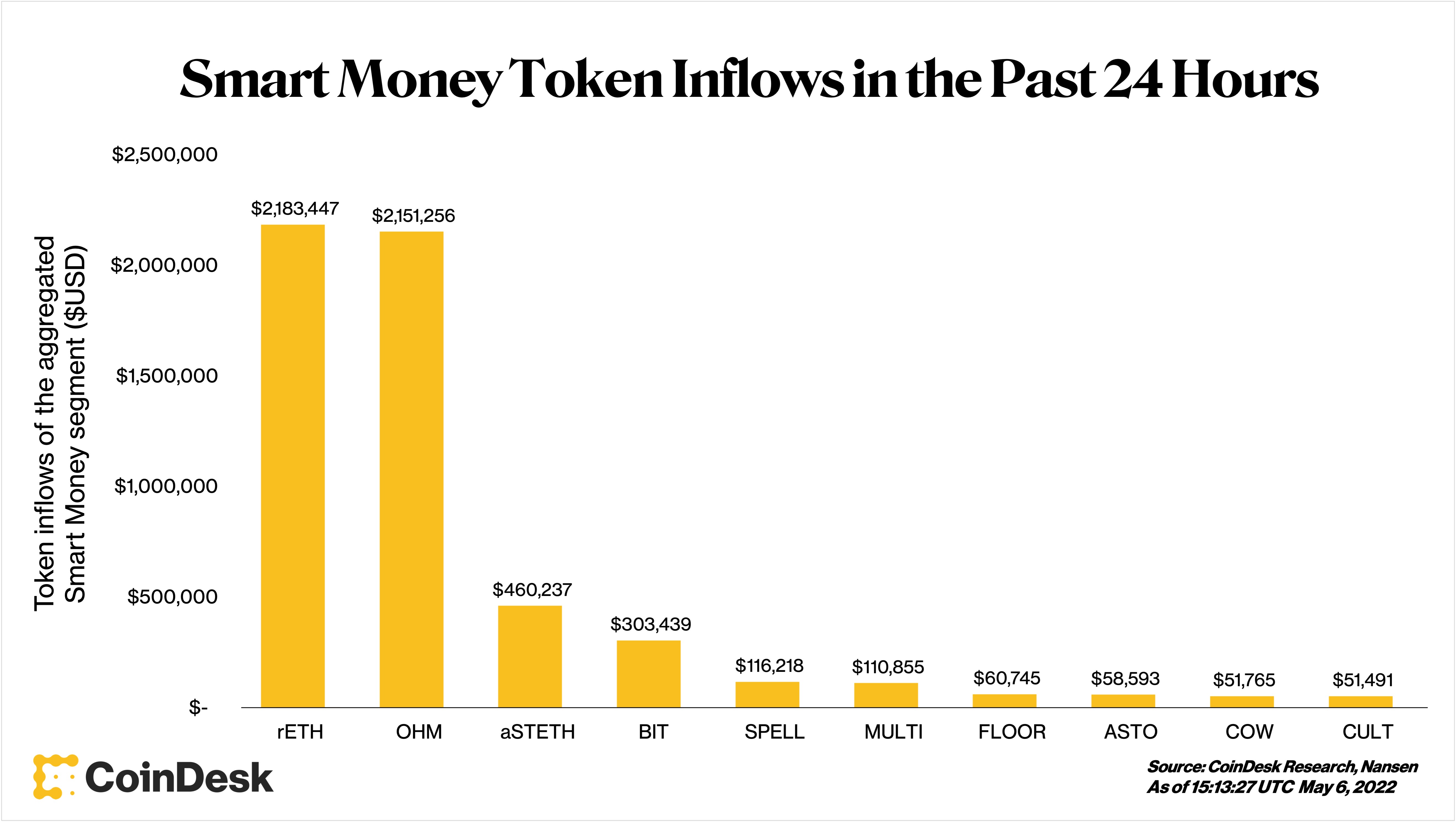

In the past 24 hours, $2.18 million worth of rETH and $460,000 worth of aSTETH has poured into wallets categorized by Nansen as “smart money.”

(CoinDesk Research, Nansen) (Nansen)

Even though the “Fear and Greed Index,” which looks at several factors including volatility, volume, dominance and search engine trends to capture market sentiment, shows we’re in a period of “Extreme Fear,” smart money traders aren't sitting by idly, given their accumulation of Ethereum’s staking derivatives rETH and aSTETH.

rETH is a token for Rocket Pools users that represents their locked ETH on the Ethereum Beacon Chain, and in comparison, aSTETH is Aave’s yield-bearing token for stETH, representing staked ether in Lido’s protocol.

Smart money inflows of rETH and aSTETH during a time when regular market participants are apprehensive demonstrate the attractiveness of staked ETH for smart money.

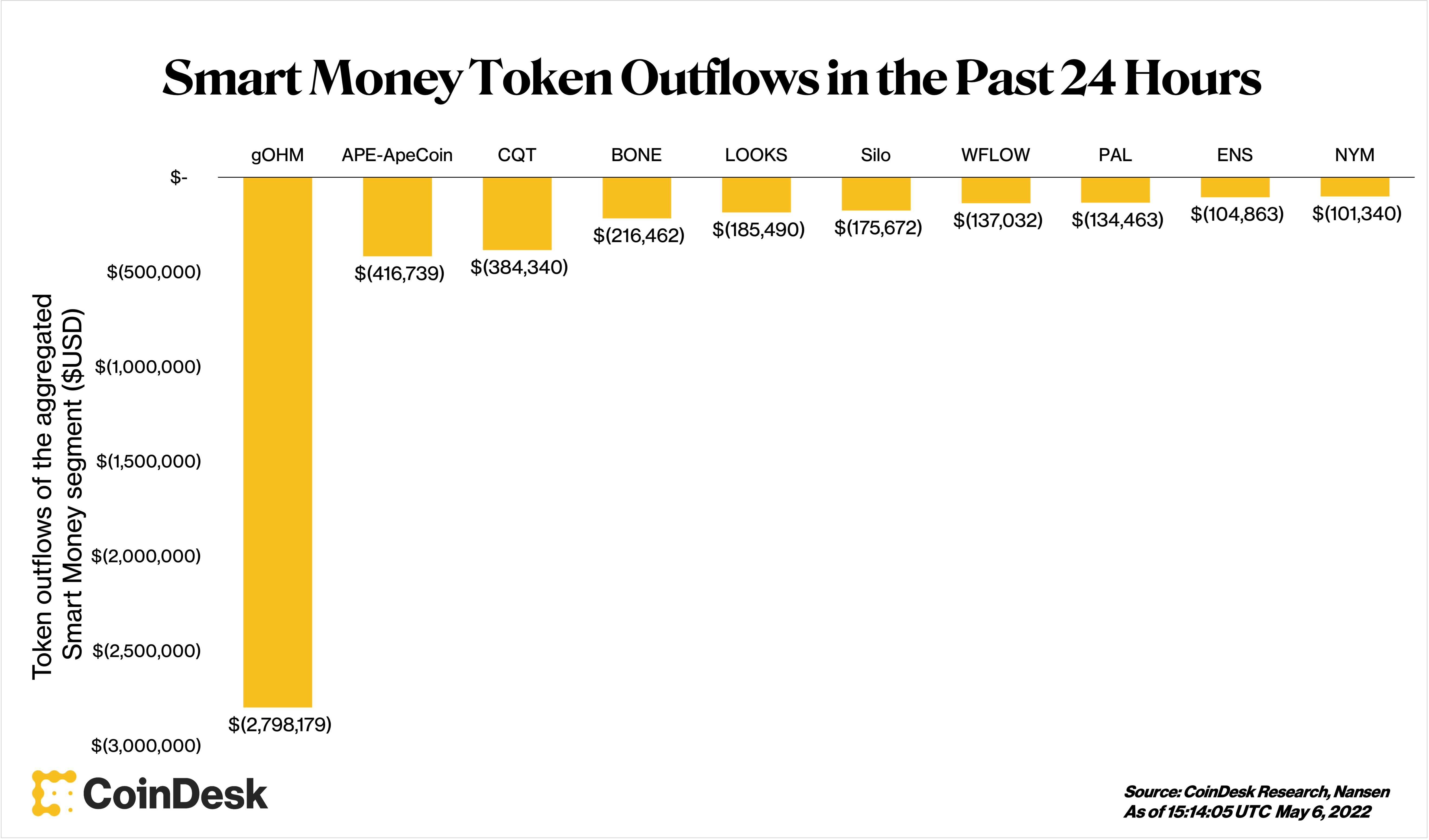

In the same 24-hour period, roughly $2.8 million worth of gOHM, the biggest outflow among tokens tracked by Nansen, has exited one smart money address, labeled as “🤓 Smart LP: 0x413.” At the same time, $2.2 million worth of OHM has entered into that same wallet, which can be seen here.

Smart LP, one of Nansen’s many smart money wallet labels, is identified as a wallet that made at least $100,000 by providing liquidity to decentralized finance (DeFi) platforms SushiSwap and Uniswap, excluding so-called impermanent losses.

Aside from this trade, just over $400,000 worth of APE, the governance token for ApeCoin DAO, moved out of smart money wallets Friday, continuing their recent trend of unloading APE.

Even though Yuga Labs’ NFT collections have high floor prices and consistently have massive volume activity, the associated token hasn’t fared as well. Every day since Monday, APE has been one of the top tokens to leave smart money wallets. Between Monday and Friday, a total of roughly $3.7 million worth of APE flowed out of smart money holdings. Over the same time frame, the price of APE dropped almost 23% from a high of $17.21 to $13.26, according to CoinMarketCap data.

(CoinDesk Research, Nansen) (Nansen)

Nansen is one of many firms that parse publicly available information about crypto transactions, although unlike Chainalysis and similar firms, its services are geared toward giving investors an edge rather than helping law enforcement catch bad actors.

While cryptocurrency addresses appear on public blockchains as random-seeming strings of letters and numbers, Nansen uses algorithms, its own investigations and information submitted by users to draw inferences about the entities behind pseudonymous wallets. It is important to note, however, that past performance is no guarantee of future results.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YK6QP7IP4VBYFGIOVSLXETV52U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)