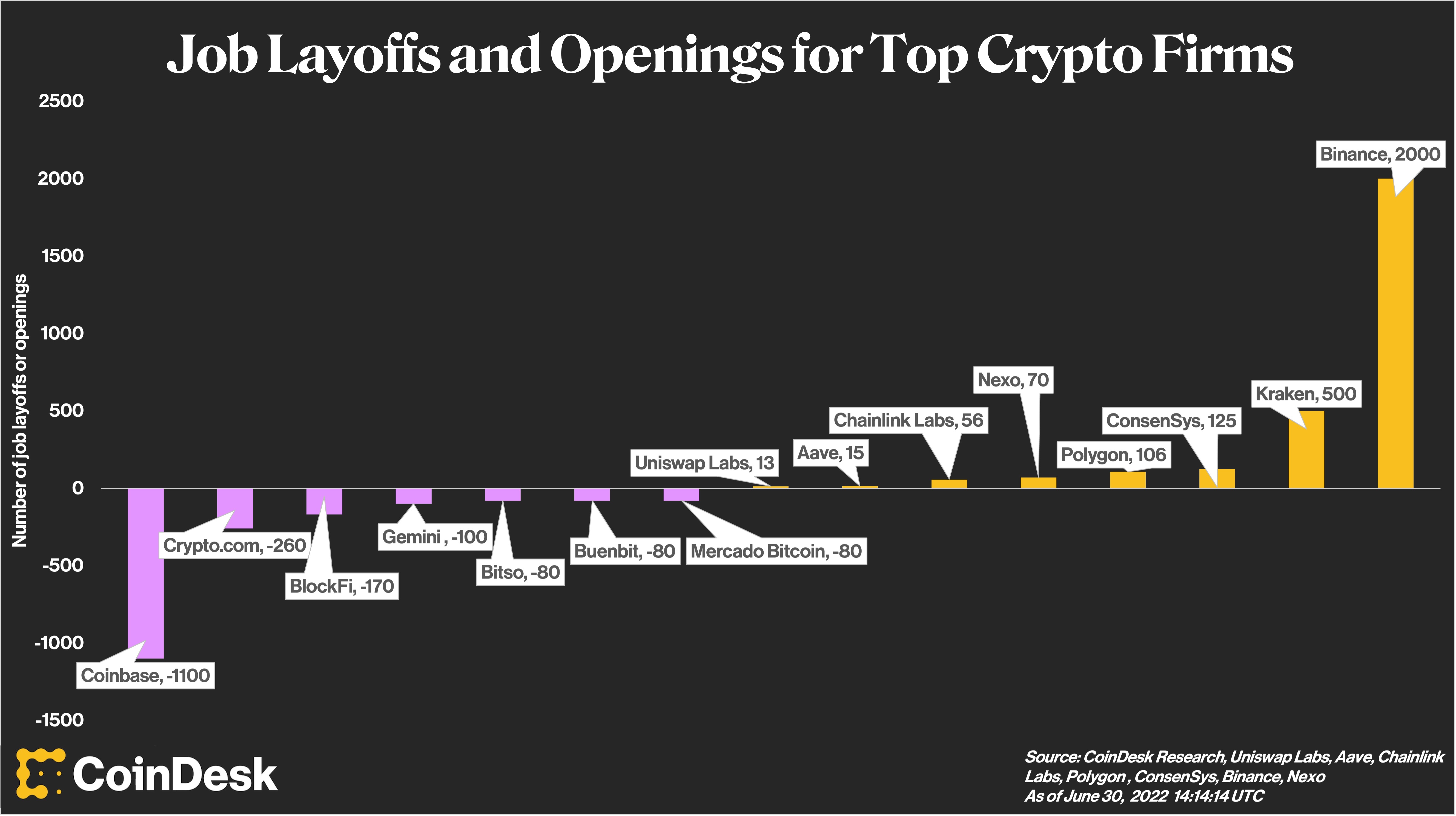

Job Layoffs and Openings for Top Crypto Firms (Sage D. Young)

The crypto community has not had a unified response in dealing with the current bearish cycle, characterized by Terra’s collapse a month ago, the loss of critical price support levels among most cryptocurrencies and the fallout from the Celsius Network’s potential bankruptcy and Three Arrows Capital's insolvency.

Some crypto firms were caught off guard by the increased risk arising from the carnage in the ecosystem, while other companies have been preparing for this moment to build.

One metric that illustrates how prepared crypto firms were to weather the turbulence is the number of job layoffs and openings.

Who’s cutting crypto jobs?

On one side, a group of crypto firms has significantly downsized its workforce. After freezing its hiring process and rescinding job offers, Coinbase laid off 1,100 employees. Crypto.com let go of 260 people, Gemini cut its workforce by roughly 100 people and BlockFi reduced the number of its employees by 170 individuals. Moreover, Bitso, Buenbit and Mercado Bitcoin – major cryptocurrency exchange platforms based outside the U.S. – each laid off 80 people from their respective companies.

The mass layoffs not only demonstrate how some giants in the crypto space are not bulletproof and susceptible to large market changes, but also practiced irresponsible behavior in terms of not having enough funds on the runway to keep promises to their staffs during the bear market.

According to the U.S. Bureau of Labor Statistics, the unemployment rate in the U.S. sits at 3.6% as of May 2022, and yet the number of large companies downsizing highlights the growing rumors concerning an incoming recession. On June 14, Coinbase’s CEO Brian Armstrong said in a note shared with all Coinbase employees, “We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period.”

Who’s hiring?

Despite mass layoffs by major players, there are companies that are hiring and even accelerating their hiring process.

Binance is looking to hire more than 2,000 people across Europe, Asia, South America and the Middle East. Binance CEO Changpeng Zhao said, “We will continue to grow our team as planned and see this moment in time as an opportunity to gain access to some of the industry’s best talent.”

Kraken is looking to add 500 staff members, ConsenSys is expanding its workforce with 125 open positions and Polygon has over 100 job opportunities even amid crashing crypto markets. Chainlink Labs, Aave and Uniswap Labs combined have posted more than 80 jobs to their career pages as well.

Crypto lending institution Nexo, which tripled their team in the past year, is not only actively hiring talent with over 70 open positions but also planning to open two dozen more job opportunities. Nexo said on Twitter, "We HODL and grow our people, regardless of market conditions. Challenging times are transformed into opportunities to create the future for the entire ecosystem. This is the cornerstone of our success."

Read More: What It Takes to Get a Job in Crypto

Crypto companies looking to accelerate hiring showcases the different responses organizations have to the bear market. While there are some crypto firms that admitted to growing too fast in a way that was unsustainable in a turbulent market, others are increasing the amount of talent within their organization to better position themself in an environment where black swans exist.

EDIT (June 30, 03:53 UTC): Included Nexo into the chart and the following after the paragraph that starts with Kraken: "Crypto lending institution Nexo, which tripled their team in the past year, is not only actively hiring talent with over 70 open positions but also planning to open two dozen more job opportunities. Nexo said on Twitter, "We HODL and grow our people, regardless of market conditions. Challenging times are transformed into opportunities to create the future for the entire ecosystem. This is the cornerstone of our success."

More from CoinDesk’s Future of Work Week

It may be a bear market, but there are still plenty of jobs to be had at crypto companies.

Crypto can make it faster and cheaper to pay workers. This article is part of the Future of Work series.

By adopting a more open, fluid model, traditional firms would find it easier to attract talent and end up with a more passionate, engaged workforce.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2HNGLGGSDVBIZGALXR4Q2MUCJI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)