Bitcoin’s inception in 2009 was steeped in hopes of doing away with trusted third parties for online peer-to-peer transactions. In fact, that is the first sentence in the abstract of its white paper.

Given the evolution of Bitcoin over the last 13 years, most notably elevated transaction fees, various cryptocurrency projects and protocols have popped up as a means to send online payments, both on Bitcoin and on other blockchains. Be it the increased adoption of Bitcoin’s Lightning Network or the tremendous growth of the gaggle of stablecoins, both collateralized and algorithmic, there’s no denying that cryptocurrencies are hyper-focused on solving payments.

This article is part of CoinDesk’s Payments Week series.

What follows is a snapshot of various data figures that outline the state of crypto payments.

Bitcoin’s Lightning Network capacity

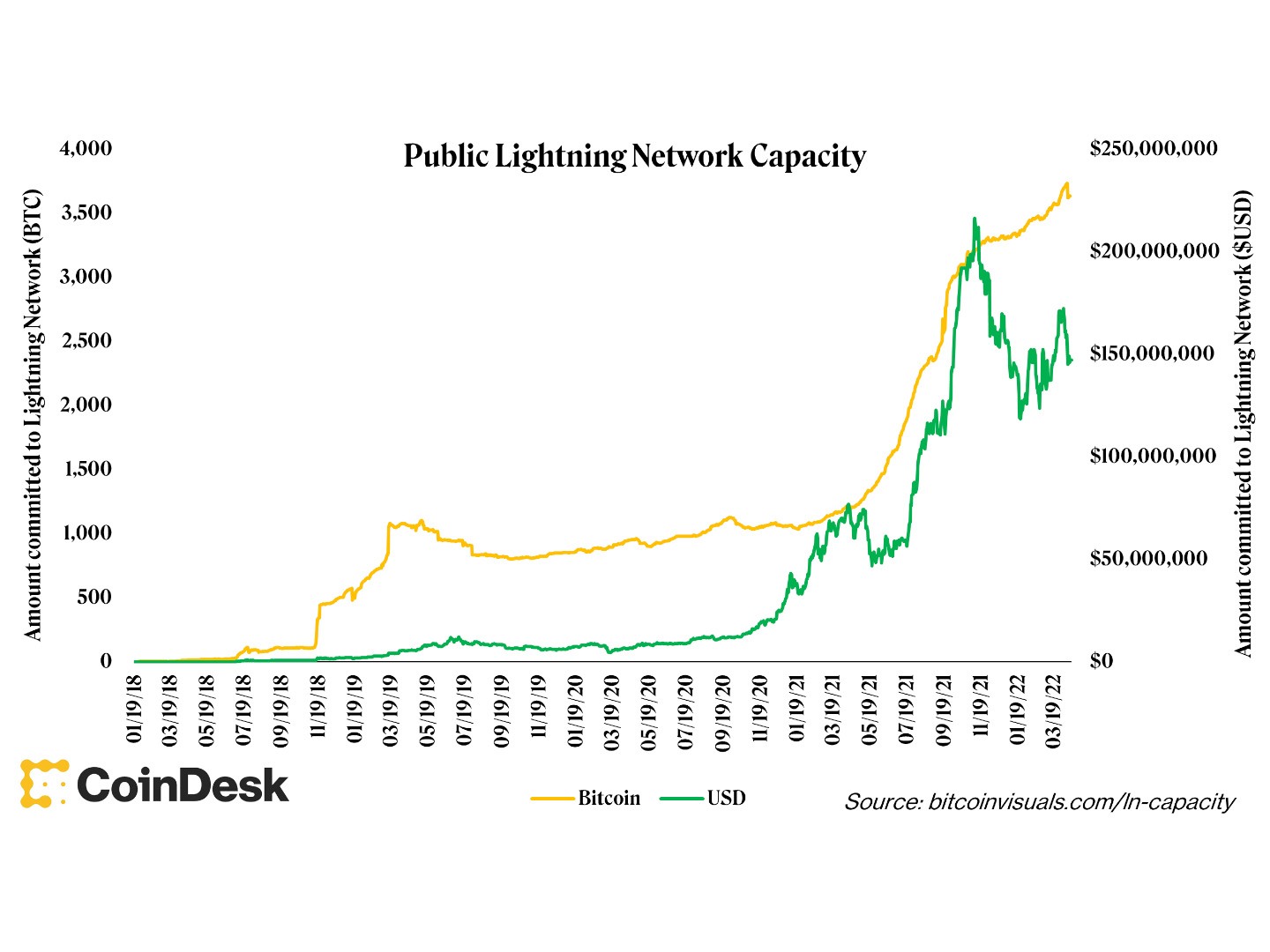

The Lightning Network is an overlay network or “second layer” built on top of the Bitcoin blockchain that uses user-generated micropayment channels to conduct transactions instantaneously. To generate those channels, users commit bitcoin (BTC) for a period of time. The sum of bitcoin committed to Lightning is known as its capacity. The larger the capacity, the more payment volume that can flow through the network.

Following muted growth between 2019 and mid-2021, Lightning’s capacity has increased rapidly in the last 12 months adding ~2,400 BTC, a growth rate of 195%. Of note, this data is representative only of the capacity in publicly announced channels – unannounced, and therefore private, channels do exist. As a result, this data is an understatement of the total Lightning Network capacity.

Public Lightning Network capacity (Bitcoin Visuals) (George Kaloudis)

Lightning Network growth

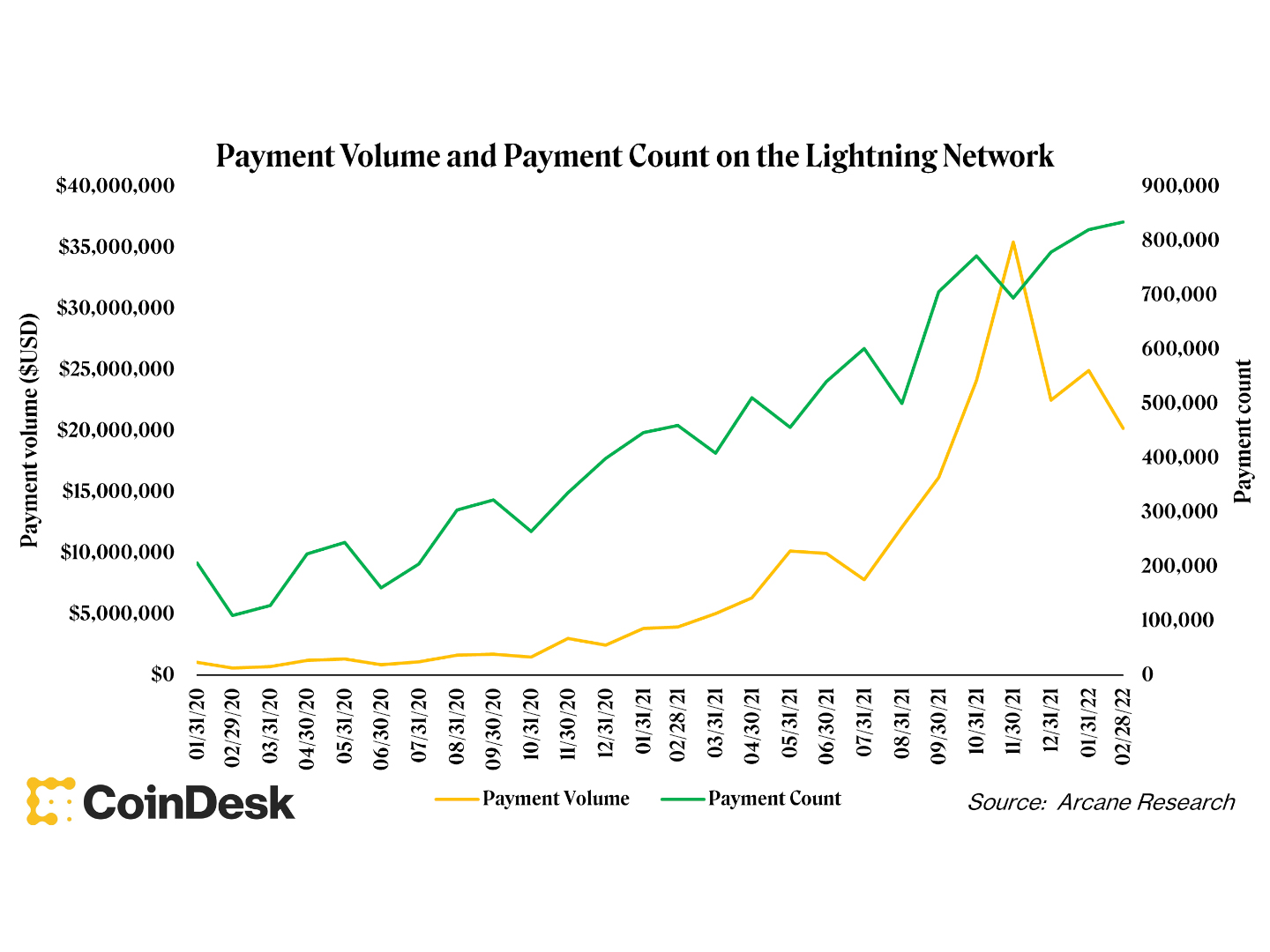

Transactions over the Lightning Network are not announced publicly as they are on the regular Bitcoin blockchain; therefore, the actual usage rate of the Lightning Network is unknown. However, public data can be used to estimate payment volume and payment count.

According to data from Arcane Research, we’ve seen payment volume and payment count grow consistently since the beginning of 2020. This continued growth highlights how Bitcoin is gaining ground on its original stated use case as a viable peer-to-peer digital cash through the use of the Lightning Network. The dip in payment volume in November 2021 coincides with the price of bitcoin tumbling from over $66,000 to $46,000 in December. All the while, payment count on Lightning ticked up even as bitcoin’s price dipped.

Payment volume and count on the Lightning Network (Arcane Research) (George Kaloudis)

Transaction values across coins vary widely

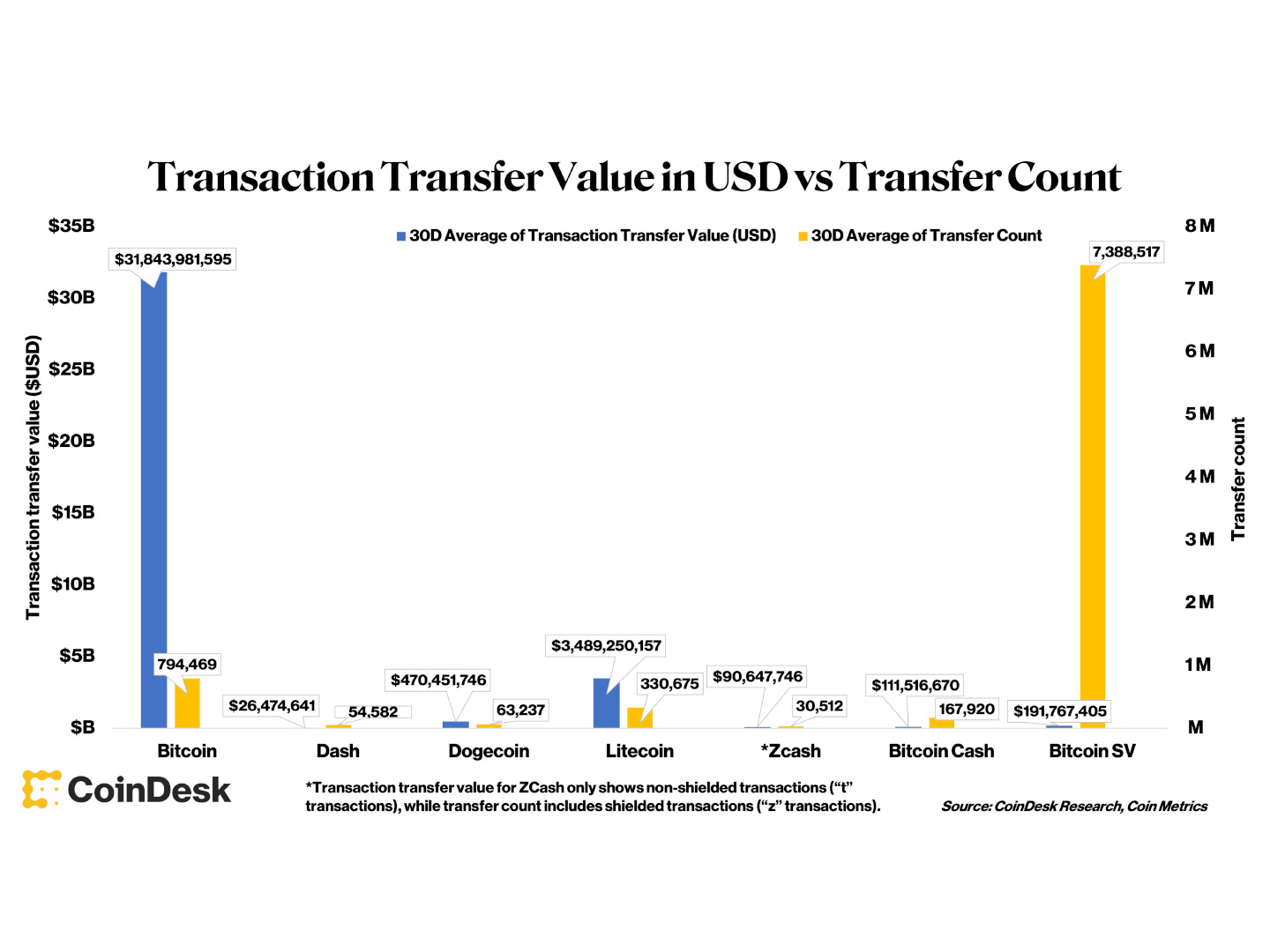

The seven coins included in this chart are defined by CoinDesk Indices' Digital Asset Classification Standard as part of the Currency Sector. Their primary function is to act as currency and make payments.

Transaction transfer value for various cryptocurrencies (Coin Metrics) (Sage D. Young)

Looking at the transaction transfer value (the U.S. dollar amount of the asset value transferred) of these coins in combination with the total amount of transfers or transactions allows us to glean insight into each cryptocurrency’s usage.

A cryptocurrency blockchain could have many transactions, suggesting high levels of activity, but if the USD value of that activity is quite small it might suggest something else. This is the case with bitcoin SV (BSV). BSV has several million more transfers than other cryptocurrencies, yet the individual value of these transfers tends to be comparatively small. On average, BTC transfers $40,000 per transaction while BSV transfers $25.95 per transaction. After bitcoin, the next lowest value per transaction of the coins included in the data set is dash with $485 of value transferred per transaction.

Read more: What Is Going On With Bitcoin SV?

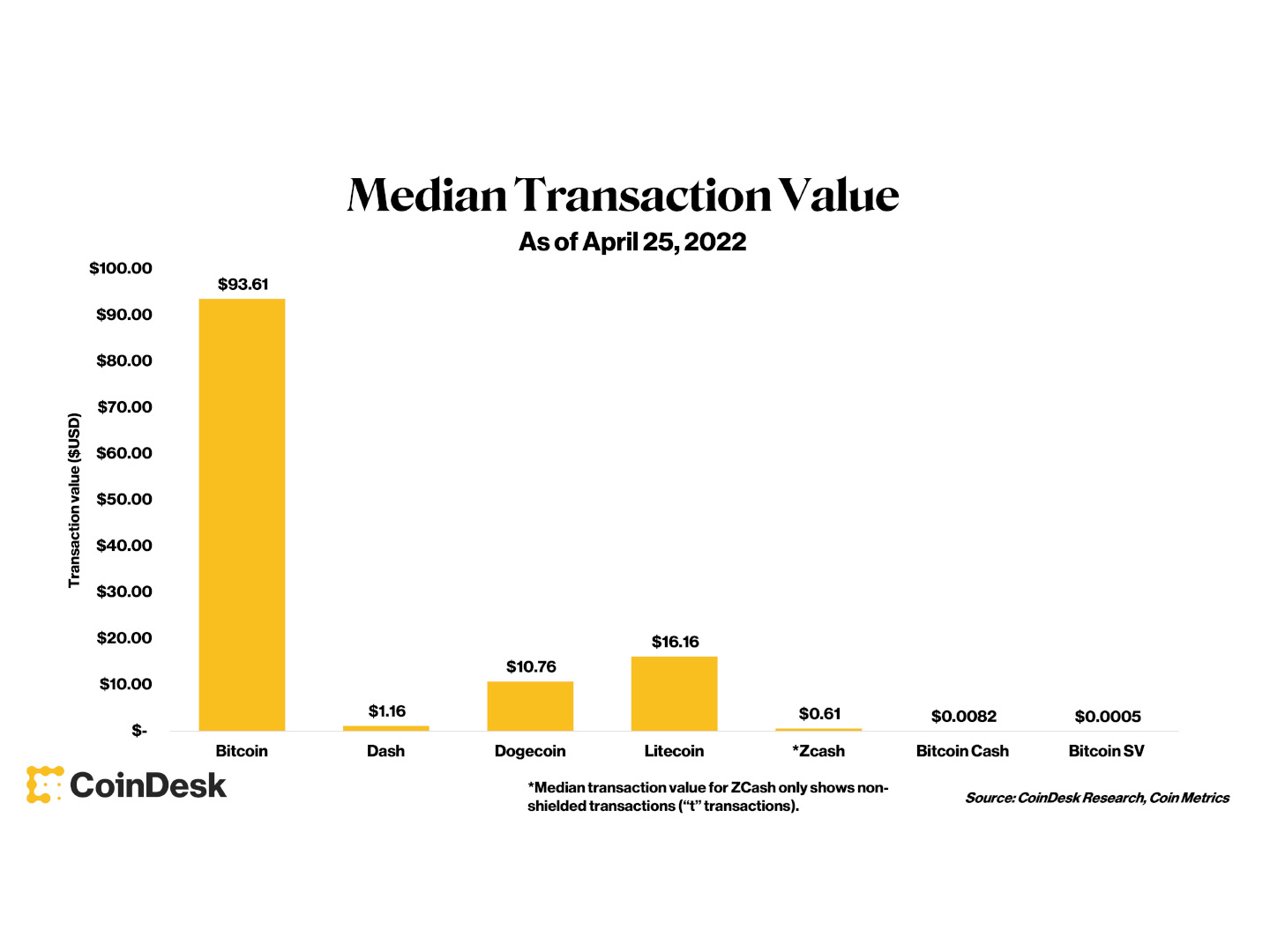

However, averages are skewed by large transactions, so looking at median transactions in USD can be quite useful in determining the actual usage of these cryptocurrencies for payments.

The 30-day trailing average for the median value transferred using bitcoin is $94 and $0.0005 for BSV. Both of these values skew to the high and low end value for casual commerce, so it might be the case that smaller casual crypto payments are being carried out using dogecoin (DOGE) or litecoin (LTC), which have median transaction values of $11 and $16, respectively.

Also worth a caveat is zcash and its relatively low median transaction value. Zcash is a privacy coin, but in order to use its privacy features, users must opt in. A regular zcash transaction is “unshielded” and is called a “t” transaction. A user can choose to “shield” their transactions in a “z” transaction, where all information is not publicized. As such, our data is only able to include unshielded transactions. Given roughly one third of zcash transactions are shielded, the resultant data is likely skewed.

Median transaction value for various cryptocurrencies (Coin Metrics) (Sage D. Young)

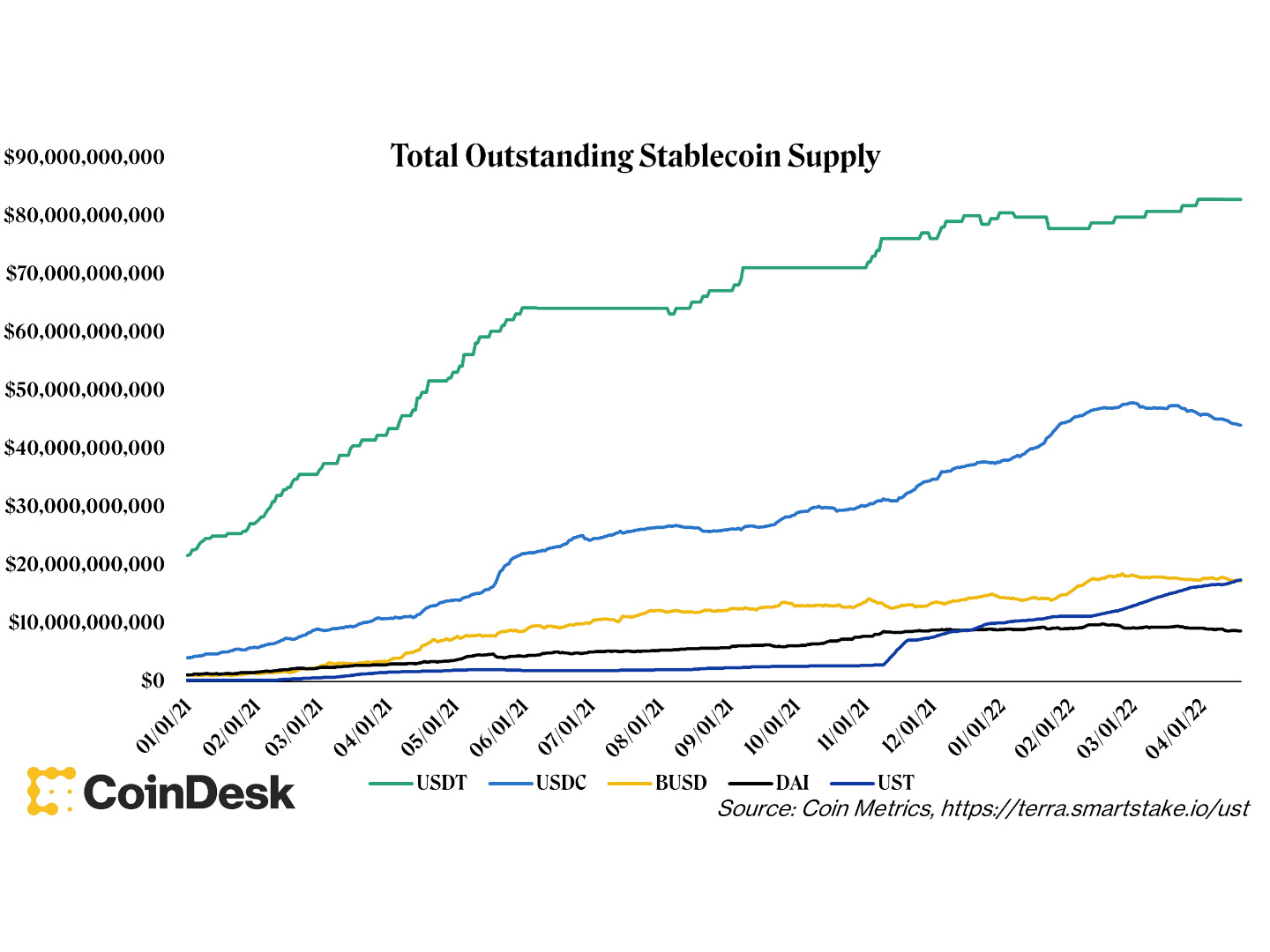

Stablecoin supply

Stablecoins are pegged to the price of a sovereign currency, usually the U.S. dollar. U.S.-pegged stablecoins play a vital role in payments, given their perceived lack of volatility and the dollar’s status as a globally accepted unit of account.

Tether (USDT), the first stablecoin, has long been the dominant stablecoin since inception, and there is now more than $80 billion of tether in circulation. Given its popularity, other stablecoins like USD coin (USDC) and terraUSD (UST) have popped up. In total, U.S.-pegged stablecoins now have more than $180 billion of market value.

While impressive, it is important to note that a sizable portion of stablecoins is used in crypto trading and decentralized finance (DeFi) versus peer-to-peer payments to buy things.

Stablecoin supply has grown meaningfully in the last year. (Coin Metrics, terra.smartake.io/ust) (George Kaloudis)

Read more: What Is a Stablecoin?

Payments are a killer use case for coins for institutions

Improving payments represents one of the killer use cases for crypto assets, evidenced by the fact that there are so many different projects out there trying to do payments. In fact, money is one of humanity’s oldest technologies, and transacting with that money is a critical component of a successful money. Be it through cutting out third-party rent seekers or focusing on speed or perceived unit of account volatility risk, there is no shortage of options consumers have to make digital payments through crypto.

As with any network, it is important to understand the usage and pertinent metrics when determining the level of trust you want to put into these projects. Due to the transparency of blockchains, this type of insight can be gleaned with as little as an internet connection. That said, the main takeaway from the current data is that we have a long way to go.

More from Payments Week:

Blockchains offer unique advantages, but these must be combined with a user experience that feels similar to the one consumers know today, writes Senior Vice President Jose Fernandez da Ponte.

Financial censorship has gone from an abstract idea to a harsh reality for Russians who suddenly found themselves unbanked by the West and their own government.

Down The Silk Road: Where Crypto Has Always Been Used for Payments

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VJGVA56SW5DQVK3SMLYDZUHWRE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)