After the collapse of Terra’s USD in the middle of 2022, algorithmic stablecoins earned a bad rap. It looked like the value of these coins was dependent on little more than hot air. But one of the oldest and most stable decentralized stablecoins, MakerDAO’s DAI, managed to sail through the pandemonium.

DAI’s advocates would argue that it shows that decentralized stablecoins can work when they are designed properly. Its critics would say that DAI isn’t that decentralized of a stablecoin at all. Although it is backed by cryptocurrencies, it is backed in no small part by centralized stablecoins, especially USDC.

So what to make of MakerDAO? Is it really the central bank of crypto or a shining beacon in truly decentralized governance? Read on to find out more.

What is MakerDAO and how does it work?

MakerDAO is a lending platform that was launched in 2017 on the Ethereum blockchain. It powers a decentralized stablecoin called DAI. DAI is pegged to the U.S. dollar, which is useful when crypto’s financers want to exchange more volatile cryptocurrencies for a coin that’s worth something relatively stable.

The protocol works by allowing anyone to take out loans in DAI using other cryptocurrencies as collateral. Crucially, these loans are overcollateralized, meaning that you will have to deposit more cryptocurrency than you put in. As of August 2022, the minimum collateralization rate of a “vault” of ETH is 170%, meaning that you would have to collateralize $170,000 worth of ETH to receive $100,000 worth of DAI.

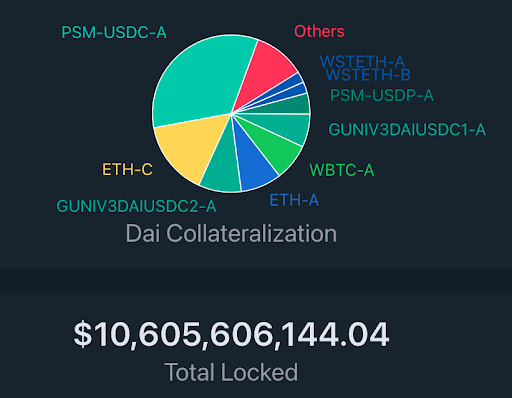

As of this writing in August 2022, DAI is backed by $10.6 billion worth of crypto assets and a smattering of real-world assets, such as $100 million from Huntington Valley Bank. It is overcollateralized at a ratio of 141%, according to data from Daistats.com.

Dai's collateralization (daistats.com)

The greater the collateral, the more these cryptocurrencies would have to fall in value before DAI loses parity with the U.S. dollar.

What motivates users to lock up more than they borrow?

The lender-borrower structure seems to be great for MakerDAO, but why would anyone want to borrow less than they lock up? The main reason is that by borrowing DAI (as opposed to buying it), an investor would be able to access a U.S. dollar stablecoin without having to sell his or her ETH. This is useful because many yield farms and lending platforms offer higher returns for U.S. dollar stablecoins than for ETH itself. DAI can be converted back to ETH at any time.

There’s also another token within MakerDAO’s network, which is MakerDAO’s governance token, Maker (MKR). The token is used primarily to vote on protocol updates within the platform. As of August 2022, MKR had a market capitalization of about $1.1 billion.

Then there’s the Dai Savings Rate (DSR), which is a savings protocol that issues returns to those who lock up DAI in the DSR’s smart contract. This lets those within Maker’s governance module influence the demand for DAI by changing the levers of the protocol’s monetary policy, just like a centralized bank.

So far, DAI’s done remarkably well, rising from a market capitalization of $100 million in early 2020 to a peak of $10 billion in February 2022, before falling to $6.4 billion in May 2022 after the crypto market crashed. As of August 2022, DAI’s market cap was $7.5 billion.

MakerDAO’s governance

Part of MakerDAO’s success isn't in its algorithmic design, but in its decentralized governance. Those with lots of MKR all but saved DAI from collapse in March 2020 after the pandemic shook the token to its core.

To prevent it from falling below $1, the decentralized autonomous organization voted to back the stablecoin with USDC, a centralized stablecoin maintained by Centre, a consortium led by payment company Circle and crypto exchange Coinbase. Since then, DAI has also added USDP to the mix. These stablecoins are distinctly centralized as they are run by companies and backed by USD and equivalents held in banks.

More generally, the governance protocol works to update the protocol through a series of time-based polls. These votes take place directly on the blockchain, and MKR tokens are the currency of the ballot. If a resolution passes, it’s binding.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/A6M3OIU2KVGN3B2OZ3OMTK5YSE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FBKUMHO4CJFYPNW2J7ZSXYCBU4.png)