Similar to buying bitcoin, there are several options when it comes to selling bitcoin.

You can buy bitcoin directly on crypto exchanges, bitcoin ATMs, P2P marketplaces or traditional brokers. Likewise, you can also sell bitcoin via any of these channels, with the exception of some bitcoin ATMs.

You can sell bitcoin on the same exchange or brokerage where it was purchased by placing a sell order. As the name suggests, a sell order is an instruction to a broker (crypto exchange) to sell an asset, in this case bitcoin, at a particular price.

Bitcoin can also be exchanged or swapped for other cryptocurrencies or stablecoins, such as ether or tether (respectively). This is useful if you wish to take profit on your bitcoin investment or prevent the value of your portfolio from declining.

If you plan on withdrawing the fiat (government-issued currency) equivalent of your bitcoin, you would need to first place a sell order involving your preferred fiat currency, such as the U.S. dollar. Once the order is fulfilled, most exchanges will allow you to withdraw your funds directly to your bank account. Note, most exchanges have a minimum withdrawal amount, which means if you leave small balances in your exchange account you might have to deposit more in order to get the remaining amount out.

Learn More: Bitcoin 101 Crash Course

Overall, Binance, Coinbase, Huobi, FTX and Kraken are examples of some high-volume exchanges where you can buy and sell bitcoin. Volume refers to the amount of money or digital assets being traded on the exchange at any given time. High volumes mean it’s more likely you’ll be able to successfully complete your sale of bitcoin at any given time.

It is also worth mentioning that depending on the volume of your order and how much you wish to withdraw, you may be required to go through some form of identity verification. “Know Your Customer" (KYC) procedures are now mandatory for many crypto exchanges, just as they are for traditional financial institutions. Therefore, you may be required to submit information such as a valid identification card, utility bills with your house address or a Social Security number before you can buy and sell bitcoin.

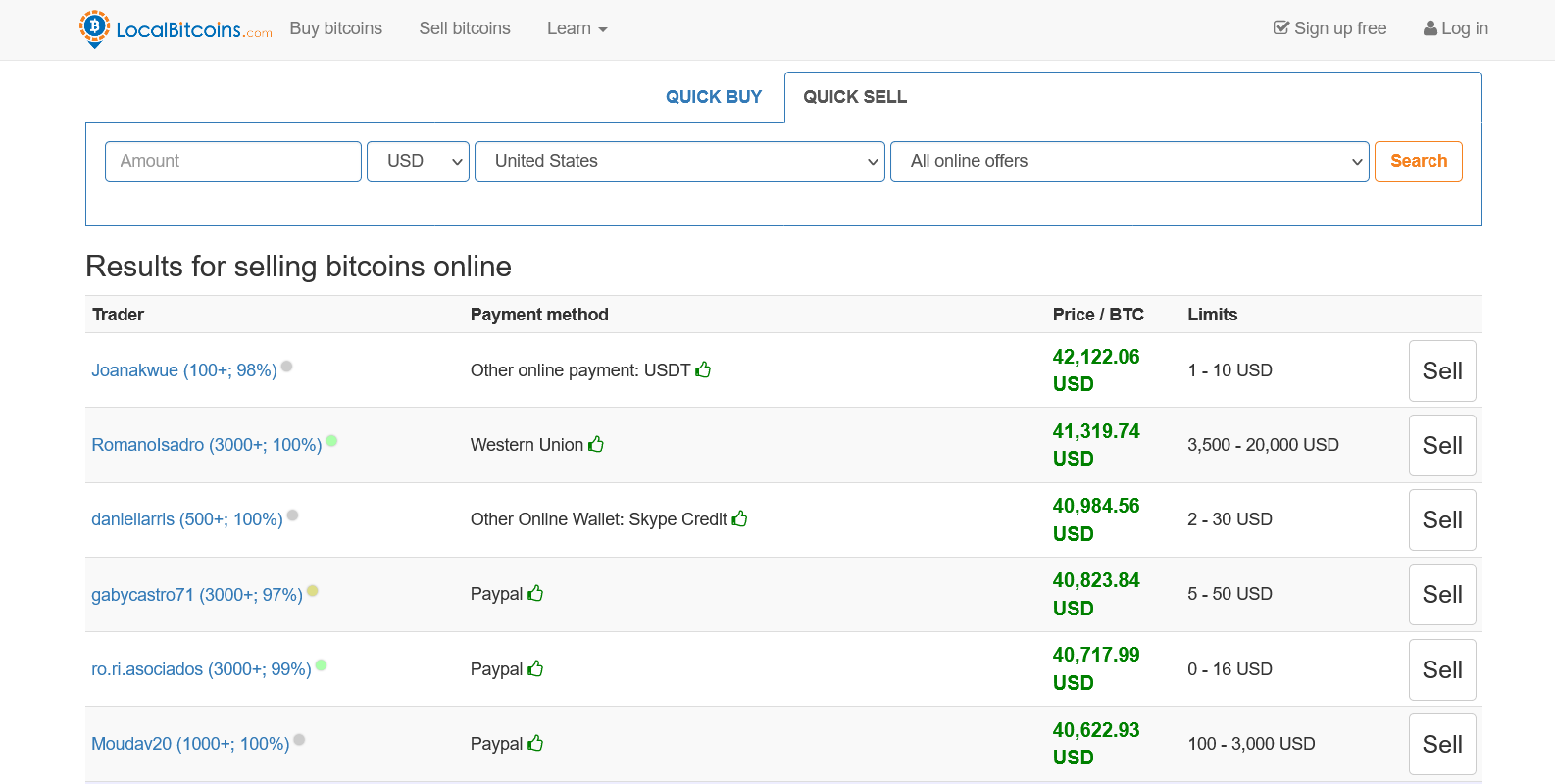

Apart from crypto exchanges and bitcoin ATMs, another way to sell bitcoin is through peer-to-peer markets. In this case, the transaction happens directly between you and the buyer. You can register as a seller on platforms such as LocalBitcoins, Paxful and BitQuick.

Localbitcoins screenshot

Although each platform handles payments a little differently, the process is essentially the same. First, you need to register as a seller on any of these platforms and then set up your sell order. You will be notified when someone shows an interest in your offer to sell bitcoin. Some platforms such as Localbitcoins have a built-in escrow service to ensure transactions run smoothly. You can receive payment for your sold bitcoin via Moneygram, Paypal, cash in the mail, gift cards, bank deposits and even cash in person, depending on your preferred option. If you decide to make in-person trades, make sure you transact in a public setting and be aware of the major risks involved.

Learn More: CoinDesk Price Pages 101

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CJOO7TPEIVHB5OTYJ3FCQNQJWM)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FBKUMHO4CJFYPNW2J7ZSXYCBU4.png)