Decentralized finance (DeFi), which is a term for crypto-based financial services and products like lending and borrowing, is a major use case for Ethereum, the largest smart contract-focused blockchain.

But the problem with Ethereum, according to its critics, is that its transactions are slow and fees are too steep for average users, leading some to call it “the blockchain for the bankers.”

In response, a wave of contenders has tried to usurp Ethereum’s success by solving its problems with a rival blockchain. One of the main rivals is Avalanche, which bills itself as “blazingly fast, low-cost and eco-friendly.”

Avalanche’s development is led by New York-based Ava Labs, which was co-founded by Emin Gün Sirer, a computer science professor at Cornell University, Kevin Sekniqi, a Ph.D. student, and Maofan “Ted” Yin, who wrote the protocol used in Facebook’s ill-fated digital currency project Libra.

What is Avalanche?

Avalanche is a blockchain that promises to combine scaling capabilities and quick confirmation times through its Avalanche Consensus Protocol. It can process 4,500 TPS (transactions per second). For Ethereum, that number is 14 TPS.

Avalanche’s native token, AVAX, is the 10th-largest with a market cap of $33 billion as of this writing in March 2022, according to data from CoinDesk.

Avalanche went live in September 2020 and has since become one of the largest blockchains. It has over $11 billion total value locked in its protocol, according to data from Defi Llama, making it the fourth-largest DeFi-supporting blockchain after Terra and Binance Smart Chain.

Avalanche’s thriving DeFi ecosystem contains some of the protocols from Ethereum, such as the lending protocol Aave and decentralized exchange protocol SushiSwap.

Trader Joe (no relation to the American supermarket chain Trader Joe’s) is Avalanche’s main decentralized exchange, with $1.47 billion locked into its liquidity pools. Benqi, with $1.26 billion locked into its smart contracts, is a popular lending platform that fulfills similar functions to Aave.

Avalanche isn’t only for DeFi, though. Ava Labs financially supports metaverse investments in the network, too, with the idea being that a fast and cheap network could effortlessly support blockchain-based games and virtual worlds.

How does Avalanche work?

A blockchain, as a decentralized system, needs a way to reach decisions among its globally distributed participants (validators) who maintain the public ledger – a way to reach consensus governed by a protocol. In Avalanche, that role is fulfilled by the Avalanche Consensus Protocol, which was first proposed in 2018 by a pseudonymous group called Team Rocket – a precursor to Ava Labs.

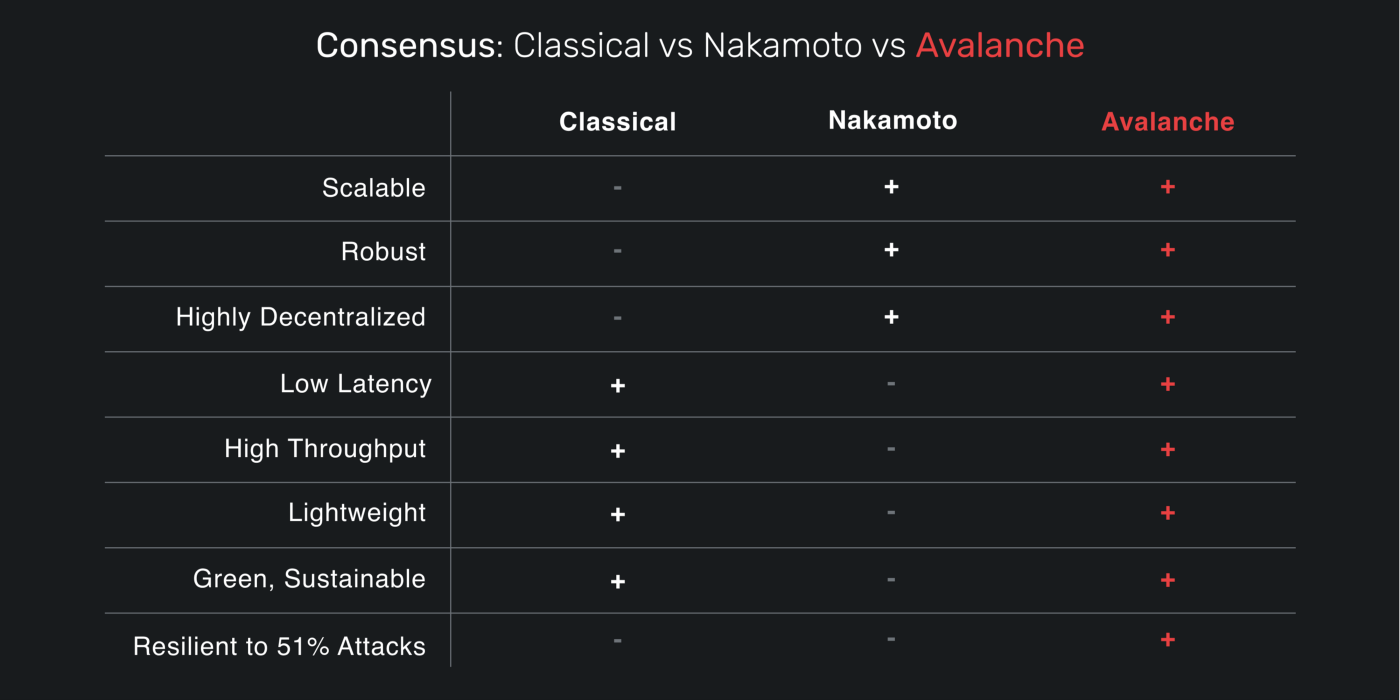

The Avalanche Consensus Protocol claims to combine the benefits of two other sets of consensus protocols known as Classical and Nakamoto.

- Classical protocols: These are fast, green and low-maintenance, but aren’t typically decentralized or scalable. HotStuff, a Classical protocol, was famously used in Meta Platforms' (formerly Facebook) stablecoin project, Diem (formerly Libra).

- Nakamoto protocols: A breakthrough technology by Bitcoin’s pseudonymous inventor Satoshi Nakamoto, this kind of protocol offers decentralized, robust and scalable blockchains – as is the case with Bitcoin. But the network is costly to run, and transactions aren’t swift.

AVAX's consensus protocol (Avalanche)

Avalanche is built across three chains:

- The C-chain.

- The X-chain.

- The P-chain.

They stand for contract, exchange and platform. The C-chain hosts Avalanche's DeFi ecosystem, which is where most users conduct a majority of their transactions. The C-chain is powered by the Snowman Protocol, a specific application of the Avalanche Consensus Protocol. (Many things on Avalanche are winter-themed.)

How does AVAX token work?

Affectionately called the “red coin” by its holders, AVAX is the native token of Avalanche, with a maximum supply capped at 720 million tokens.

AVAX has at least three use cases on the network.

Avalanche users need AVAX to pay for transaction fees on the network. That’s similar to how ETH is used to pay for gas fees on Ethereum. In fact, Avalanche’s fee algorithms are based on Ethereum’s dynamic gas fee model, which is known as EIP-1559.

While Ethereum’s gas fee is partly burned and partly paid to miners, Avalanche’s fee is entirely burned. According to tracker site BurnedAvax, more than 1 million AVAX have been burned as of this writing, or close to $1 billion.

Second, AVAX is used in staking, which is a term for pledging crypto, in this case AVAX, to participate in the validation process and help secure the blockchain.

Proof-of-work networks like Bitcoin rely on validators running powerful computers known as mining rigs to secure the network. For proof-of-stake networks like Avalanche, the economic resource required to be given the right to validate isn't running powerful computers, but locking up crypto assets. Users who stake at least 2,000 AVAX can run their validator nodes and receive AVAX rewards. Those with less AVAX can join staking pools and combine their assets together with others in the network to become a single validator.

The third use of AVAX is more technical and less of an interest to regular users. It’s used as a basic unit of account between the multiple subnets deployed on Avalanche. A subnet is a set of validators working to achieve consensus.

Read more: Top 6 Cryptocurrencies You Can Stake

And of course, like all cryptocurrencies on the market, AVAX is also a speculative, volatile crypto asset investors can buy and sell in the hopes of making a profit.

How to use Avalanche

To get on the Avalanche network and try its DeFi protocols, you will need to buy AVAX on a centralized crypto exchange like Binance or Kraken. Then you will need to select “withdraw” on your exchange and transfer your AVAX tokes to a DeFi wallet, such as MetaMask.

Remember to choose C-chain, as otherwise your funds may be irreversibly lost on the wrong chain.

The user experience on Avalanche is similar to Ethereum’s interface because the C-chain runs on the Ethereum Virtual Machine (EVM). If you have used Ethereum before, your Ethereum public crypto wallet address that starts with 0x will also be your Avalanche address.

It’s also easy to bridge crypto from other chains into Avalanche, simply by connecting your DeFi wallet to a bridge protocol like Hop Exchange and following the instructions. Bridges are used to transfer tokens from one blockchain, or sidechain, to another – even if the two chains are directly interoperable.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C4QANEBHCZEMBOH6ZYZYGZMU3Q.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FBKUMHO4CJFYPNW2J7ZSXYCBU4.png)