Non-fungible tokens (NFTs) are a red-hot asset class in crypto, with billions of dollars in value traded each month. But NFTs aren’t only for buying, selling and holding. Just like other assets, they can be part of more complex and lucrative financial arrangements.

The need for financial instruments in the NFT market stems from a significant problem. While you can sell bitcoin pretty much instantly, the NFT market is far more illiquid. It could take months until someone buys your NFT.

And when you sell your NFT, you have to sell the whole thing. Lots of people don’t want to part with their NFTs forever – not even parts of it, as would be the case with NFT fractionalization.

These problems explain why NFT lending has become the latest sector to emerge. It solves the problem of low liquidity in NFTs while encouraging more people to invest in the NFT market by lowering the cost of entry.

The sector is structured around four models:

- Peer-to-peer NFT lending.

- Peer-to-protocol NFT lending.

- Non-fungible debt positions.

- NFT rentals.

Remember that financial investment in NFTs and decentralized finance (DeFi) – or the intersection of both as in this case – presents a myriad of risks, including sudden downturns in the cryptocurrency market, smart contract exploits and regulatory crackdowns. Although many of these platforms are audited, an audit doesn’t guarantee safety, it only points out the errors in a platform’s code as far as the auditor can spot.

Read More: The Risks of DeFi Lending

Peer-to-peer NFT lending

The first kind of NFT lending replicates the classic model of a lending marketplace: matching lenders with borrowers.

NFTfi is a popular peer-to-peer NFT lending platform. When you list your NFT as collateral on the platform, you receive loan offers from others. If you like any of the offers, you can accept one and immediately receive wrapper ether (WETH) or DAI (a stablecoin) from the lending user’s wallet. As part of the loan agreement, the platform automatically transfers your NFT into a digital vault – an escrow smart contract – for the duration of the loan.

You get your NFT back into your wallet when you repay the loan before the expiration date. If you default on your loan, the lender will receive your NFT at a huge discount. Drastic changes in an NFT collection’s floor price don’t affect the loan terms; it’s a peer-to-peer deal with its own terms.

Here’s an actual example of an NFTfi loan. Someone who bought Bored Ape Yacht Club #8646 for 0.55 ETH a year ago has collateralized the NFT for 90 days. The lender provided a loan of 45 WETH to the NFT owner on May 7. And by Aug. 5, the lender received either 48.328767 wETH (that’s a 30% annual percentage rate) or if the NFT owner had defaulted, the collateralized NFT. At the time of writing, NFT appraisal platform Upshot values the collateralized Bored Ape NFT at 123.63564 ETH, and another appraisal platform NFTBank values it at 147.29025 ETH.

NFTfi charges lenders 5% on the interest earned on successful loans (no fee in case of a loan default). Borrowers use the platform with no service fee.

Arcade allows users to wrap multiple NFTs – such as several CryptoPunks – into one wrapped NFT that can be collateralized as a single asset. The platform offers more flexibility in borrowing terms than NFTfi does. You can indicate with ERC-20 tokens what you would be willing to accept, for example.

Peer-to-protocol NFT lending

While peer-to-peer NFT lending allows for customizable loan terms, peer-to-protocol NFT lending platforms allow you to borrow directly from the protocol.

Similar to DeFi lending protocols, these NFT lending platforms rely on liquidity providers adding crypto funds to a protocol pool. Borrowers can access liquidity immediately after collateralizing their NFTs and locking them up in the protocol’s smart contract-powered digital vaults.

BendDAO screenshot

BendDAO is a popular platform that functions under the peer-to-protocol model. The protocol had around 1,000 NFTs collateralized as of May 2022, including 273 Bored Ape Yacht Club NFTs.

The platform uses Chainlink oracles – which are bridges connecting blockchains to data streams – to get the floor price information from OpenSea, the most popular NFT trading platform. BendDAO liquidates collateralized NFTs when the floor price in the collection falls below a certain health factor, which takes into account the market value of the NFT collateral and the borrowed amount. But there’s a 48-hour wait period before any liquidation happens, giving the NFT owner a chance to rescue their beloved NFT from slipping away from their hands.

Read More: What Are Blockchain Bridges?

Pine.loans app screenshot

With the platform's current form, users will lose their NFT only if they don't repay by the expiration date. But in the next version of Pine, users will face liquidation because of poor "health" factors, similar to how BendDAO operates. The platform also promises a “thorough borrower protection plan” in the future.

Non-fungible debt position

MakerDAO, which is one of the oldest platforms in DeFi, is famous for its collateralized debt position (CDP) structure, which lets borrowers take out the stablecoin DAI when they collateralize ETH.

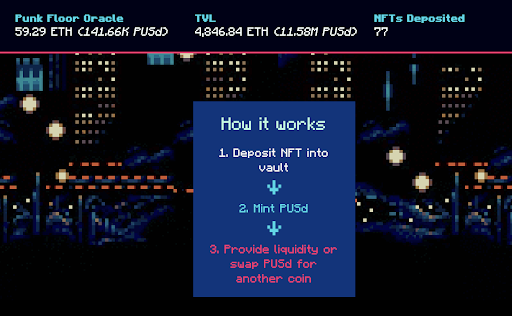

Following a similar model, JPEG’d offers non-fungible debt positions. The platform, which had a total value locked (TVL) of 4,846 ETH in its smart contracts as of May 2022, lets users collateralize whitelisted blue-chip NFTs like CryptoPunks and borrow a synthetic stablecoin, $PUSd, which is pegged to the U.S. dollar on a 1:1 basis.

JPEG’d screenshot

As a borrower, you can use $PUSd to provide liquidity on the protocol and earn interest or you can swap it for other cryptocurrencies to seek opportunities elsewhere. And when you repay the loan, you can take back control of your NFT.

Similar to peer-to-pool lending platforms like BendDAO, JPEG’d uses Chainlink oracles to keep tabs on the market price of its NFT collaterals.

Renting out NFTs

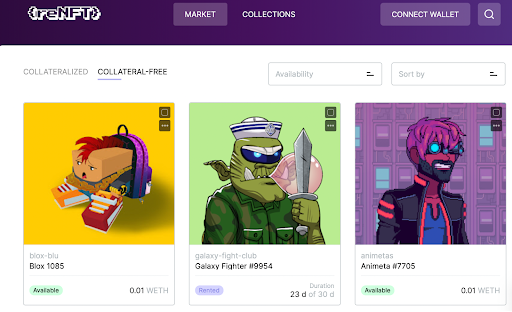

A final category is NFT rentals, where reNFT is a popular platform. It’s a permissionless market for potential renters and tenants with varying rental terms and conditions.

reNFT screenshot

Instead of locking up NFT collaterals in a digital vault, the protocol facilitates peer-to-peer NFT rentals where the asset transfers from one wallet to another wallet for the duration of “tenancy.” As a tenant of a rented NFT, you receive full access to token-gated perks like Discord servers or whitelist giveaways made available to the holders of certain NFTs.

Although for NFT owners the protocol allows access to liquidity, the motives aren’t necessarily about earning yields for those who buy a "tenancy" – in fact, they pay for the privilege of access and crypto credibility. In one case of a three-month CryptoPunk rental last year, for example, the tenant saw his “[social-media] engagement skyrocket and has made a full name for himself in the space.”

Read More: 5 Ways to Earn Passive Income With NFTs

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CCGX227NURBN7KLH4ZIKS3IWPU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FBKUMHO4CJFYPNW2J7ZSXYCBU4.png)