Trading NFTs, or non-fungible tokens, on centralized marketplaces like OpenSea or Rarible can be painfully slow and unpredictable. When you want to sell an NFT, there may be no buyers. When you want to buy an NFT, the one you want may not be listed for sale or the offer you place on it may elicit no interest. This is unlike trading fungible decentralized finance (DeFi) tokens on decentralized exchanges like Uniswap, where you can always buy and sell crypto.

Sudoswap, a decentralized NFT marketplace, aims to bring that familiar Uniswap experience to NFTs. It offers a platform where users can create and trade through liquidity pools, which are smart contract containers that consist of NFTs and ether (ETH).

But the whole idea may sound counter-intuitive; after all, each NFT is unique, making them – as the name suggests – non-fungible. How can you throw them all into a liquidity pool, as if they were fungible shiba inu tokens? Well, that’s left up to users to decide whether they want to trade NFTs that way – its popularity so far bodes well for the platform.

What is Sudoswap?

Sudoswap is a decentralized NFT marketplace on the Ethereum network, and it operates in a radically different way compared to other NFT marketplaces.

On OpenSea you trade NFTs with other people through an off-chain order book model. But on Sudoswap you buy and sell NFTs through liquidity pools, which are pieces of code on the blockchain that contain tokens. Users can deposit NFTs or ETH into Sudoswap’s pools and earn fees from trades that take place through these pools.

Read more: What Are Liquidity Pools?

The main advantage of Sudoswap is that there’s always liquidity if there’s a pool for your NFT collection, so you can immediately sell your NFT into a pool and receive ETH. That said, you may not always get the price you’d like, so it may not be an ideal option for super-rare, high-priced NFTs.

The reason behind this is because the price of NFTs changes in proportion to how many NFTs are left in the pool – basically, it’s simple supply and demand calculations. For users experienced with decentralized exchanges, these mechanics should feel familiar, but it is a very different experience for those who are used to NFT marketplaces like OpenSea where you can set the sale price.

Each NFT collection on Sudoswap may have multiple pools with different specifications – all created by users. One specification is “bonding curve,” which is essentially a mathematical formula that determines how the price of NFTs in that pool will change after each sell or buy.

Let’s unpack these mechanics further.

How do Sudoswap’s pools and bonding curves work?

Three types of liquidity pools on Sudoswap:

- Buy-only pools

- Sell-only pools

- Buy-and-sell pools

And these pools may have either of the following bonding curves:

- Linear curve: the price increases or decreases linearly as buys and sells happen

- Exponential curve: the price increases or decreases by X% as buys and sells happen

A buy-only pool structured linearly may buy its first NFT for 3 ETH, then 2 ETH, then 1 ETH

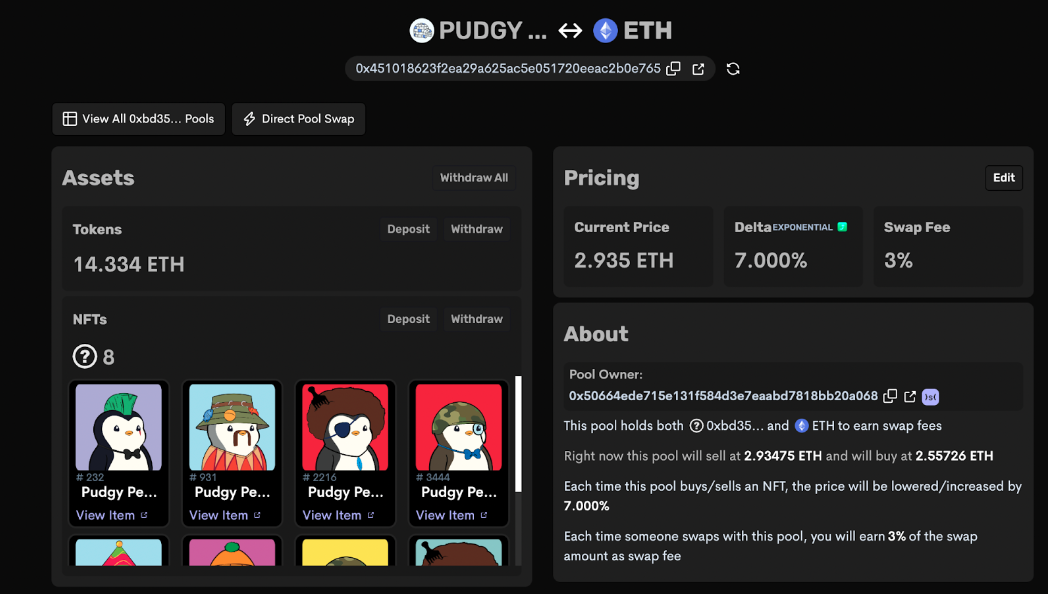

A sell-only pool structured exponentially will sell its NFTs at a certain percentage increase. The example below shows a pool where the price increases exponentially by 7% after each sale.

A pool will look like this, with all specifications indicated:

Pudgy Penguins pool (Sudoswap)

Sudoswap fees are generally low. There's a 0.5% fee on trades unlike OpenSea’s 2.5%. But pool creators can set swap fees that will be paid to them (as in the example above).

Controversially, Sudoswap bypasses project royalties, which are fees paid to NFT creators on other marketplaces for secondary sales and beyond. For example, on OpenSea the original creator or artist of an NFT might get 5% of any resales in perpetuity. This allows the original creators to benefit from their work growing in value, unlike in the traditional art market. Sudoswap removes this creator benefit to the gain of the owners and traders.

How do you buy an NFT on Sudowap?

To buy or sell an NFT on Sudoswap, simply go to sudoswap.xyz and click “connect” on the top right to connect your crypto wallet.

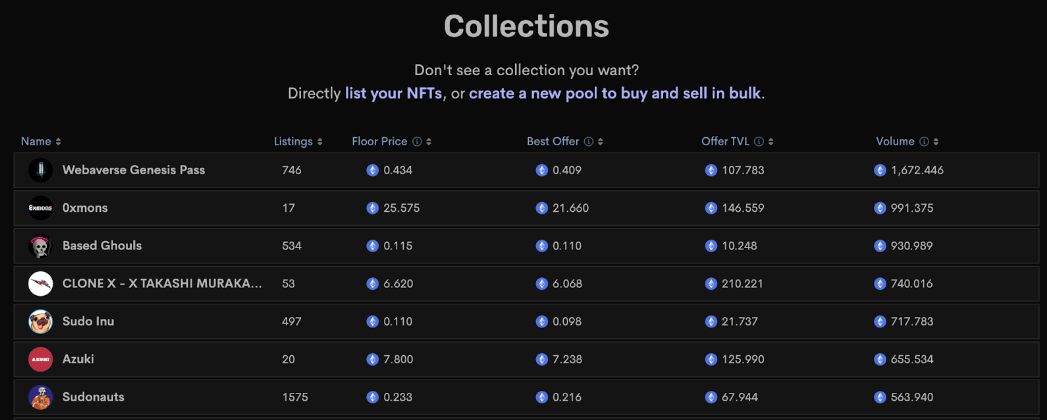

Then scroll down and click “view all collections.”

Collections (Sudoswap)

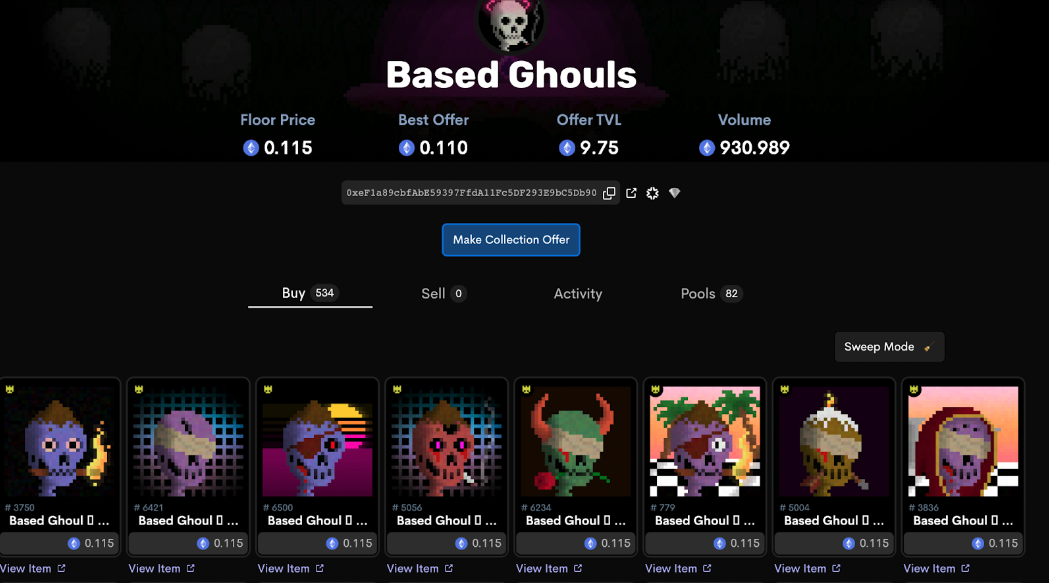

Select the NFT collection you want to trade, and you’ll be taken to the collection’s page:

Based Ghouls collection (Sudoswap)

There are two ways to buy. The simplest way is just to buy directly at listed prices. Let’s cover that one first.

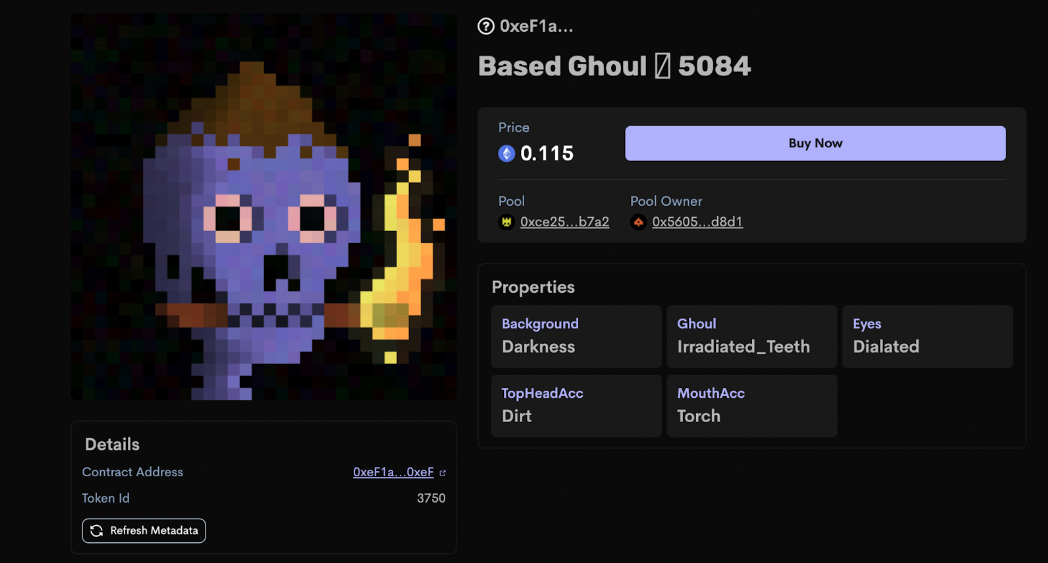

Click “view item” for the NFT you like, and it’ll take you to the individual NFT page.

Based Ghoul 5084 (Sudoswap)

Just click to “buy now” and confirm the transaction on the MetaMask pop-up that will appear. That's the whole easy process.

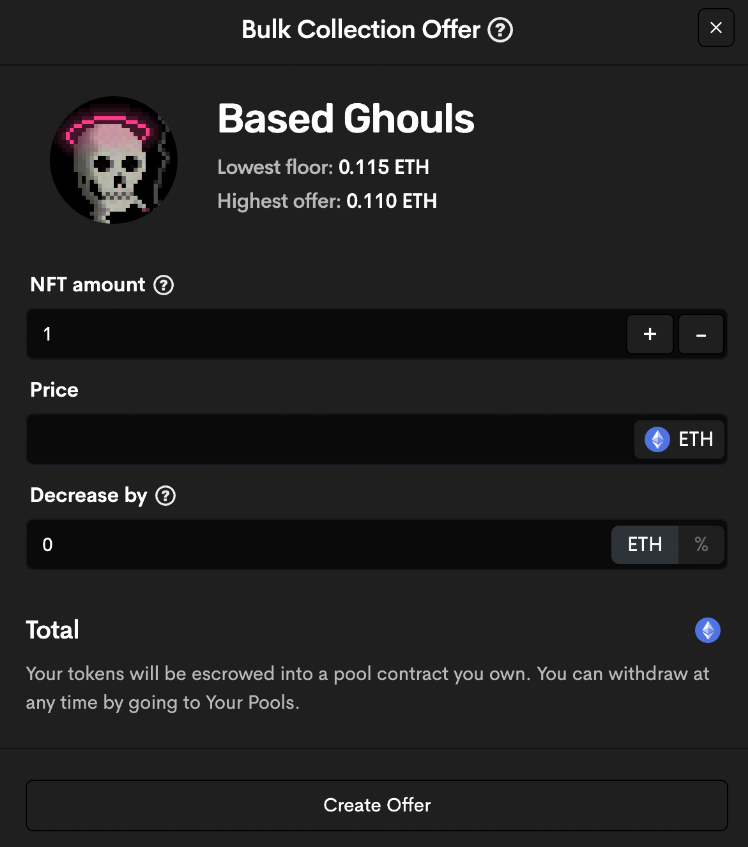

Alternatively, you can make a collection offer, which would require you to create a pool with the specifications you indicate, as seen below. Click “make collection offer” on the main collection page.

Bulk collection offer page (Sudoswap)

With a collection offer, you can buy multiple NFTs and indicate by what percentage your price should indicate after someone sells you an NFT.

How do you create a liquidity pool on SudoSwap?

More experienced DeFi users may want to create a liquidity pool on Sudoswap and earn trading fees, similar to liquidity pools on decentralized exchanges like Sushiswap.

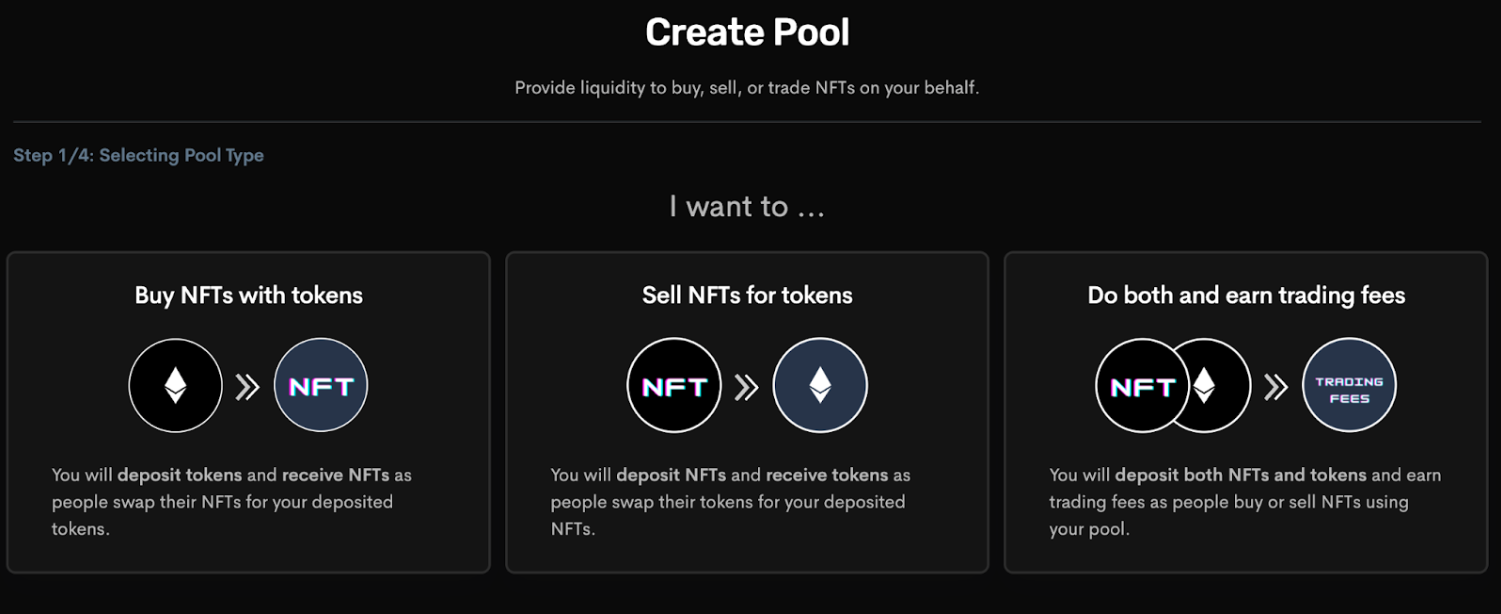

Click “your pools” on the top right of the screen. You will have three options, as explained earlier.

Creating a pool (Sudoswap)

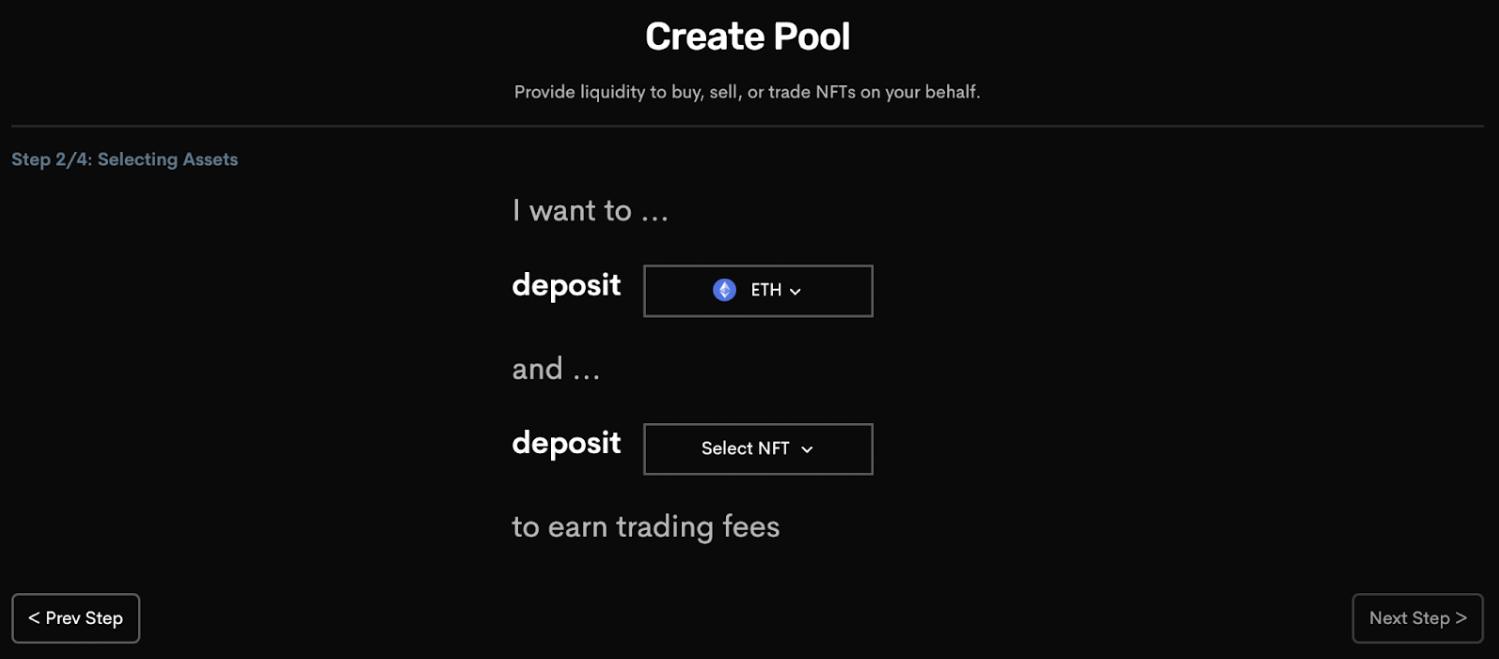

After you select the pool you want to create, Sudoswap will walk you through the process, asking you to indicate how much ETH and how many NFTs you want to deposit.

Creating a pool (Sudoswap)

In the next screen, you’ll select a bonding curve – exponential or linear – and indicate what you’re depositing to set up the pool, for example 6 ETH and two Pudgy Penguin NFTs.

The SUDO token

Sudoswap has plans to decentralize governance through tokenization. In December 2021, project co-founder 0xmons confirmed Sudoswap would have a token called SUDO, and in September 2022 the project announced it would release its token via airdrop, primarily to holders of XMON, which is the native token behind the 0xmon NFT collection that was also created by the founders of Sudoswap.

The project’s document states the token would be non-transferable until the launch of on-chain governance.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VE7MU44HD5G5VI6E2P34NUHRHM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FBKUMHO4CJFYPNW2J7ZSXYCBU4.png)