SecondMarket

The US Marshals Service (USMS) confirmed today that a bidding syndicate organised by Bitcoin Investment Trust (BIT) and the trading division of SecondMarket took 48,000 BTC in its second bitcoin auction.

The 48,000 BTC (worth roughly $16.9m at press time) is the largest ever won in a USMS bitcoin auction, trumping the nearly 30,000 BTC won by venture capitalist Tim Draper this June. In total, SecondMarket and BIT secured 19 of the 20 bitcoin blocks put up for bid, while the remaining block was claimed by Draper.

Speaking to CoinDesk, SecondMarket managing director Brendan O’Connor expressed his excitement about the news given the work that went in to assembling the 104-person syndicate.

O'Connor said:

SecondMarket itself was not a bidder in its own syndicate, however, he confirmed, meaning none of the 48,000 BTC will be used by the illiquid asset exchange or as part of BIT, its open-ended bitcoin-only trust.

“The bitcoin was won by the participants in the syndicate," O'Connor said. "We were not purchasing any of it.”

The auction winners were notified of the outcome on 5th December. SecondMarket came forward with its announcement earlier today, having distributed all of the 48,000 BTC to the winners in the syndicate over the weekend, O’Connor said.

SecondMarket declined to comment on the price of the takings or the members of the syndicate.

Access to interested bidders

Although SecondMarket won't hold any of the winning bitcoin, O’Connor said the firm’s interest in participating was motivated by the need to provide an outlet for others to participate but skip the tiresome authorization process.

“[It was] for folks out there that wanted to participate in having a chance to win some fairly large blocks of bitcoin that do not come to the market all that frequently without having to go through the trouble of actually going through the approval process with the USMS,” he said.

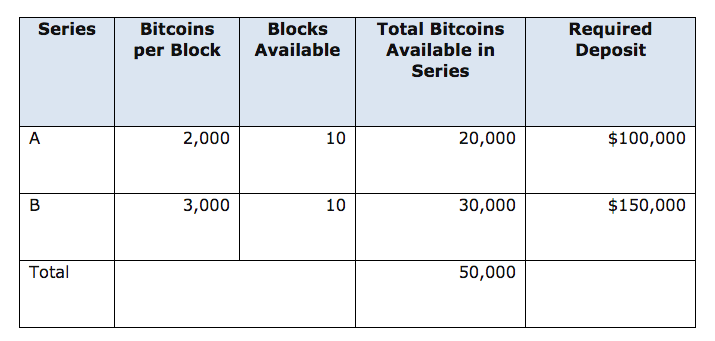

The syndicate model opened the USMS auction to a wider range of foreign and domestic investors, as well as smaller investors who wanted to bid but could not meet the required $100,000 minimum deposit necessary.

USMS, auction

"You have to kind of pass muster from a variety of different perspectives and it requires a lot of time and effort to become an approved bidder in the auction," O'Connor said.

SecondMarket received 104 bids and the BTC quantity bid was 124,127, adding that it was “basically two and a half times the subscription”.

US holiday distractions

When asked about the decline in registered bidders between this auction and the previous one held in July, O’Connor surmised the Thanksgiving holiday in the US might have played a part.

“I’m not 100% sure why they continue to target major holiday times,” he said. “Last time they did this was around the 4th of July and this time it was around Thanksgiving, so its tough to really say.”

A USMS spokesperson has claimed that the timing of the auctions is planned to avoid market disruption. Nevertheless O’Connor said the drop in auction participation is no indication of more bearish attitudes, as bidders needed to place competitive bids to edge out the competition.

He concluded:

Image via SecondMarket

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FQBVFDXP7ZC2LHJD4RRI6DPCBU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HI6IDDOJZVG5BB23XMNWG25B2Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4QH3FLPBL5HLJB3OGTJW4QW5ZY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RAUG3YMJGJHIBJ5R67ZOBANUME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LRHYROYTOVGUFDD3UYF4CHIG5U.jpg)