While adoption of bitcoin as a day-to-day currency still has not reached mass adoption, there are signs that the currency's use is making slow but steady progress.

The numbers of bitcoin wallets has doubled since the close of 2014, with 12,768,681 now in existence, compared with 7,396,772 at the close of the previous year (slide 8).

ATM numbers have also doubled in a year – rising from 342 to 536.

Further, average daily bitcoin transactions increased 50%.

While these adoption rates may not represent the runaway growth, they do indicate that the technology's use as a digital currency might not be as dead as some observers have predicted.

Altcoins have been dying in droves

Crosses in graveyard

2015 saw the demise of a huge number of alternative digital currencies or altcoins (slides 37/38).

While the bigger names among them have shown consistency and occasionally improvement, over 400 altcoins now have no reported market cap – the fundamental 'vital sign' of a digital cryptographic asset.

However, altcoin stalwarts, such as litecoin, Ripple and Ethereum, have all finished the year with a market cap at roughly the level of the previous year, showing continued interest in their use as alternative public blockchains to the bitcoin protocol.

Others, such as dogecoin, peercoin and dash, have actually managed to increase their overall value from one- to three-fold, though it's unclear if this is the work of savvy traders or real-life users.

Notably, bitcoin's market cap finished Q4 2015 flat compared with the close of 2014, at $6,757,260,784.

Big challenges ahead for public blockchains

Private sign

Currently, the bitcoin network can process three to seven transactions per second, which is several orders of magnitude away from mainstream payment systems such as VISA, which handles around 2,000 transactions per second.

As bitcoin usage and other blockchain transactions increase, this will soon likely prove insufficient (slide 111) and the issue has already become the cause of a major debate in the bitcoin industry about the most effective and secure way forward.

Several solutions are vying to resolve the issue, such as Bitcoin Classic, which would raise capacity by increasing bitcoin's block size from 1MB to 2MB, and Segregated Witness, which would rather optimise bitcoin to increase capacity.

The affair has caused much negative press for bitcoin and there is the sentiment that the industry needs to quickly resolve the issue, so as to prepare the digital currency for the future and not to further harm its reputation.

The privacy provided by inherently transparent blockchains (or lack of) will likely also be an issue for the industry going forward, as major institutions move towards implementing distributed ledgers systems to improve their business models.

Many companies or individuals will be unwilling to publish sensitive information onto a public database accessible by government, competitors and family members.

Yet, there is work underway on blockchain solutions that can preserve data privacy alongside the full advantages of the technology that will likely be a topic of conversation in 2016 and beyond.

High volatility boosts trading

stock trading

Depending on which metric you go by, bitcoin has either shown a significant decrease in volatility, or a significant increase (slides 33–33).

A post on the Coinbase blog indicated that in 2015, volatility decreased 21% – a statistic that relied on a trailing 30-day average for the highs and lows of the price.

The bitcoin wallet and exchange said: "Volatility has been on the decline since bitcoin’s inception. In 2015, bitcoin volatility fell by 21%. More specifically, BTC/USD exchange volatility (trailing 30-day average) fell from 3.98% to 3.15% this year."

However, if you look at peak-to-trough percentage, which has a far higher granularity, volatility is up a massive 96% compared with the close of Q4 2014.

While the takeaway from these figures is hard to determine, the increase in volatility at the close of 2015 did see a big hike in trading.

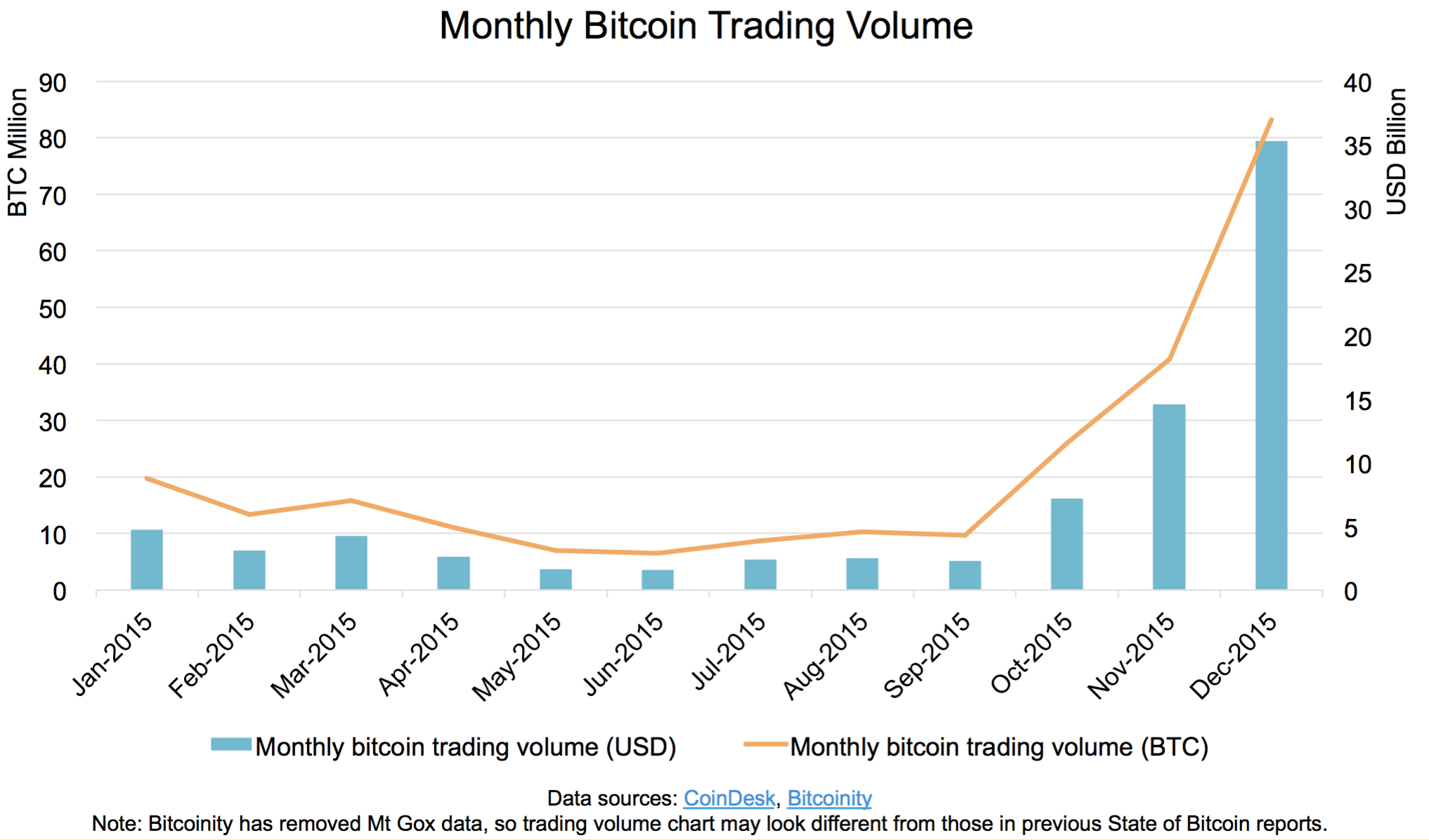

2015 trading volume

Q4 bitcoin trading volumes hit a one-year high, ending up at four times the figure seen at the start of the year.

All that activity also correlated with improvements in the price, which saw a one-year high on 11th December (slide 27).

Mining pools are more concentrated, less secretive

Miners hat and pickaxe

The individuals and firms that use specialist computing equipment to support the bitcoin network by processing transactions – the miners – are a critical section of the industry.

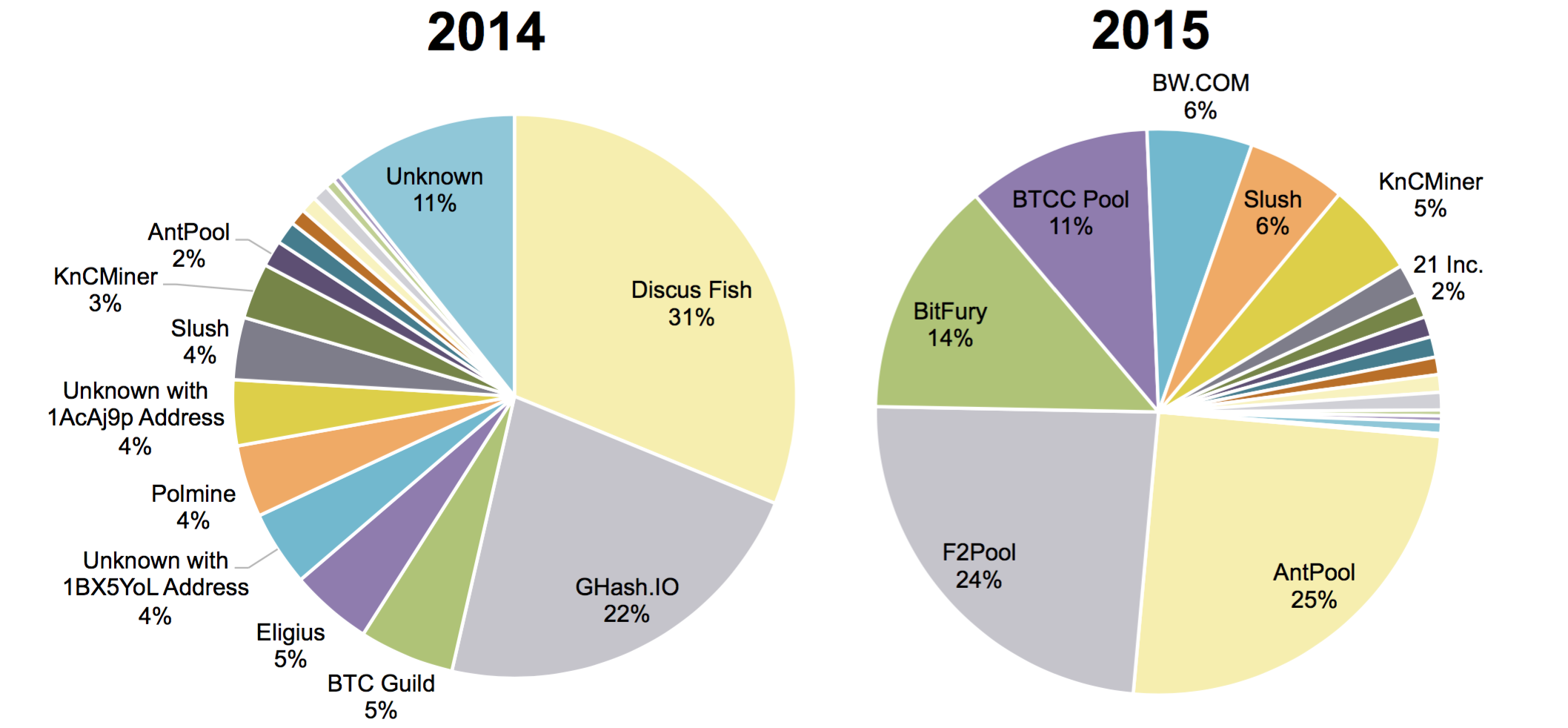

The figures have revealed that, over the last year, mining pool (groups of miners) have consolidated and there are less pools doing more of the processing, or hashing.

A glance at the graphs below reveals that Antpool and F2Pool have both grown significantly, from 2% to 50% in 2015, and both now maintain around a 25% share each of bitcoin’s hashing power. Other pools, such as GHash.IO, disappeared following low bitcoin prices last year.

Consolidation within the mining industry may be of concern to some in the bitcoin space, since decentralisation is part of the core philosophy of bitcoin, and some already feel that mining by increasingly big firms effectively centralises power in the network.

Furthermore, the hashing share of anonymous mining pools has dropped significantly, from 11% to 1% (slide 22).

Why is this an issue? Since there is a certain amount of trust involved regarding miners, if an anonymous pool had developed to take a large share of the network (51% being a key point), it could pose a risk to the security of the network should they turn out to be bad actors.

Note: Pools with a <1% share are not shown

View the full State of Bitcoin and Blockchain 2016 report by subscribing to our research newsletter.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DTHQC4TNTBD2LHRJQ7A4YWSI6E.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)