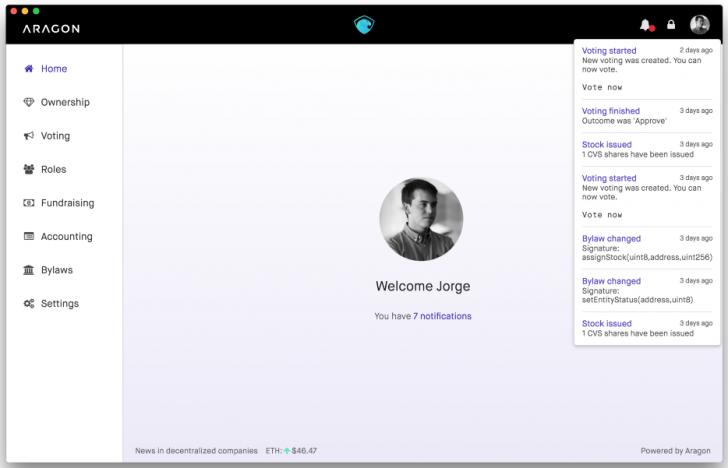

Aragon, a administrative platform for decentralized organizations built on ethereum, has released a new alpha client for testing.

Unveiled in February, Aragon aims to provide a means for establishing governance mechanisms for decentralized autonomous corporations, or DACs, with support for voting, budgeting and the creation of bylaws, among other features.

In recent weeks, the team behind the project has been quietly bug-testing an early version of the platform with members of the ethereum community, setting the stage for today's publication.

Project lead Luis Cuende, who co-founded blockchain startup Stampery, wrote of the release:

Though not live on the public network, Aragon is available for experimentation on the Kovan testnet, which was launched earlier this month and is backed by a number of startups working with ethereum. The alpha software has been released for MacOS, Linux and Windows.

The software publication also builds on past work. According to Aragon, more than 130 DACs have been established on the platform, while also drawing over 300 participants to its developer Slack channel.

Images via Aragon; Shutterstock

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XABPDC3OZDQNAW7452QXGTFHU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)