How do you measure a crypto asset? For years, the easy answer has been to look at its price.

When we launched the CoinDesk Bitcoin Price Index (BPI) — the world’s first index for bitcoin – in September 2013, we were at the forefront of creating an average price using multiple exchanges. The goal was to create a reference rate for a new form of asset, one that would help it be better understood on its way to greater adoption.

Since then, the BPI has established itself as a gold standard for journalists (our own and others), researchers and investors, while bitcoin, the world’s oldest and most valuable crypto asset, has birthed a new economy.

But the market for crypto assets has expanded dramatically and it is no secret this growth has outpaced understanding of what remains a novel technology phenomenon.

As the market has grown in complexity, there’s been no shortage of data providers rushing to market. But how sound were their insights?

Often excluded in available tools are many of the essential elements that we know have propelled the growth of crypto assets — developer interest, social activity, even the use of a crypto asset’s blockchain.

At CoinDesk, we believe we’ve created a more comprehensive way to view cryptocurrency market data, a one-of-a-kind product that, for the first time, let’s anyone visualize a complete picture of a crypto asset market.

Rather than price alone, our tool relies on the full range of data now being assessed in the field of crypto-economics, a word that while perhaps unfamiliar, has come to describe the study of crypto asset economies.

Since its advent, the discipline has been developed and refined by industry leaders. Now for the first time, we’re putting these factors at your fingertips, for your exploration.

A measuring tool

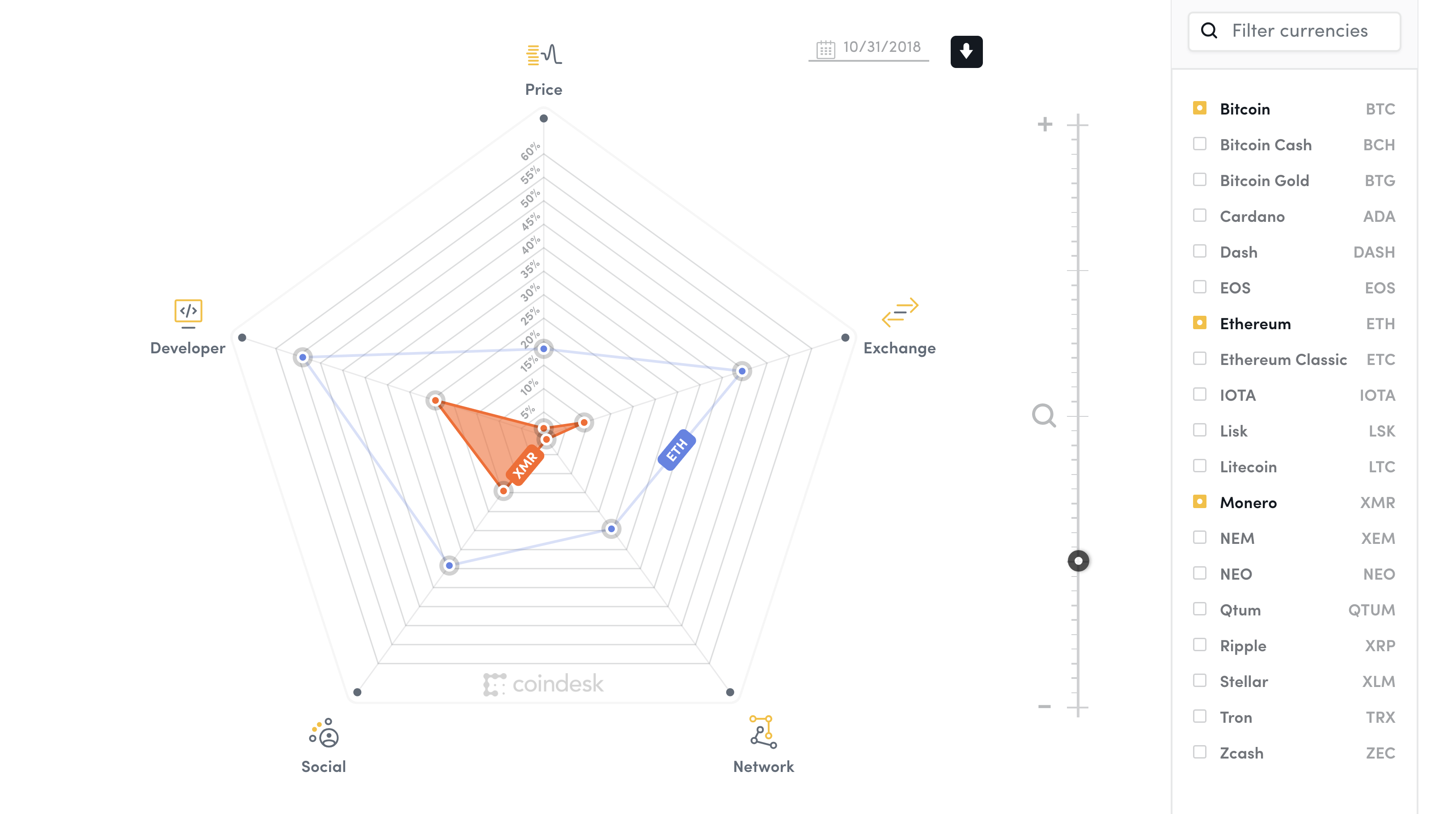

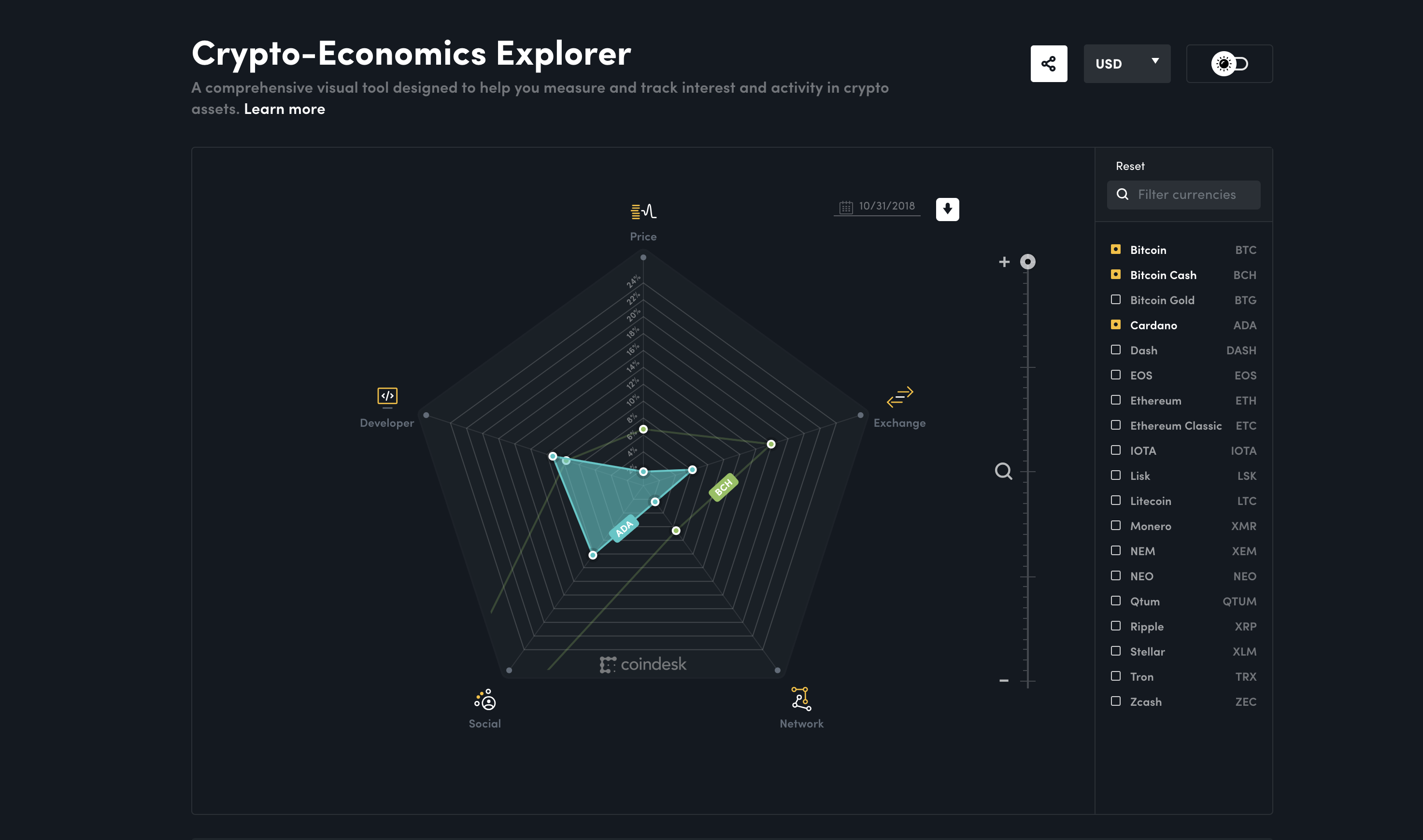

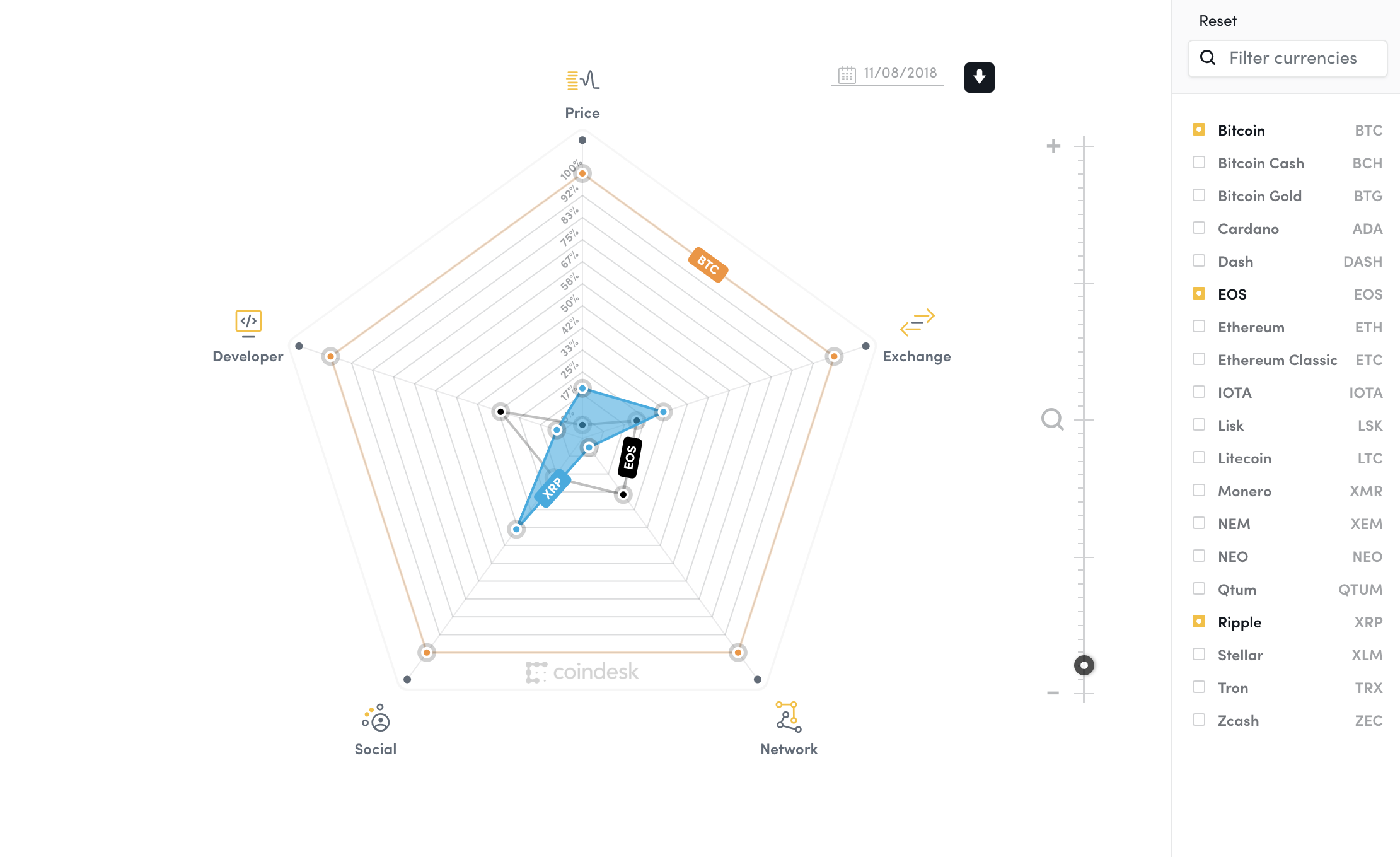

The CoinDesk Crypto-Economics Explorer is a tool designed to offer a more complete picture of the economic activity for crypto assets. With our new data insight product, you can explore the extent to which exchanges are supporting their economics and if developers are actively working to improve their core code.

The result of our work is a suite of 28 factors related to price, exchange, network effect, developer base and social data that allows you to measure crypto assets against each other and against bitcoin.

To normalize our data, we created the Bitcoin Benchmark, which makes it easier to compare bitcoin and other crypto assets.

You can read the full breakdown of the Crypto-Economics Explorer here.

The benchmark is a proprietary volume-weighted price index that draws from market prices across 16 different exchanges. We take these prices, as well as the market cap, and compress that information into a single data point.

This takes the form of a percentage that can be used to compare the price activity of any asset relative to bitcoin.

Beyond prices

But as we’ve said, looking at the price is just one way to measure a network’s health – one that doesn’t exactly indicate if a crypto asset is actually being used.

Our Exchange Benchmark looks to expand on what is currently tracked by including factors such as the total value transacted at crypto exchanges and trading volumes.

However, we ask a variety of other questions. How many exchanges list the crypto asset? How many trading pairs does that asset have across exchanges? And what volume of fiat currency is it exchanged for — a good indicator of the amount of liquidity moving in and out of crypto exchanges.

Our Network Benchmark looks at data points specific to the blockchain in question like the number of on-chain transactions, mining profitability and how many nodes are running the software. The combination of these data points can show us how the network attracts miners, merchants and other key economic actors.

Our Developer Benchmark looks to measure how active the developer base of an asset is, answering questions such as, How many developers are working on the protocol? How much code is being proposed, tested and committed on GitHub?

Our Social Benchmark demonstrates a unique phenomena in crypto: that discussion, debate and even governance predominantly take place on social networks. This data point measures how many followers and subscribers a project has across several platforms and seeks to indicate how much interest there is in the network.

These five scores, when combined, provide the first Crypto-Economics Explorer rankings benchmarked to bitcoin.

To be clear, an asset can have benchmark scores that are higher than bitcoin’s and we fully expect to see this as we observe their growth and development in the years to come.

Getting involved

What you’re seeing today is just the first version of what we hope will become the industry standard for visualizing the health and growth of the world’s major crypto assets.

Already, we’re developing new ways to examine and explore the vast amount of data produced by cryptocurrency networks – and we’ll be shipping those features as part of our broader developmental roadmap for the Crypto-Economics Explorer.

Simply put, the tool you see today will change, evolve and grow along with the ecosystem itself – and we’re hoping that you, our users, can be a part of that process.

If you work with a project that is not represented in the Crypto-Economics Explorer and want to see your data represented, we’re excited to work with you to collect this data and add it to the Crypto-Economics Explorer.

to share more information.

We encourage you to use the tool, compare various assets and tell us what you think.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HRKCUV5THJDRDLMPLSJW5GKSQM.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CLSJWMCI6ZC4DKI3S3XDUDGIAI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HI6IDDOJZVG5BB23XMNWG25B2Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4QH3FLPBL5HLJB3OGTJW4QW5ZY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RAUG3YMJGJHIBJ5R67ZOBANUME.jpg)