Brooklyn-based startup Kadena will launch a public blockchain this October, the company announced Monday at CoinDesk's Consensus 2019 conference in New York.

Founded in 2016, Kadena raised over $14 million last year to develop a new proof-of-work (PoW) blockchain network called Chainweb that would seek to offer users high transaction volumes without slowing down network speed and ramping up network cost for users.

Speaking to CoinDesk, CEO of Kadena Will Martino, said:

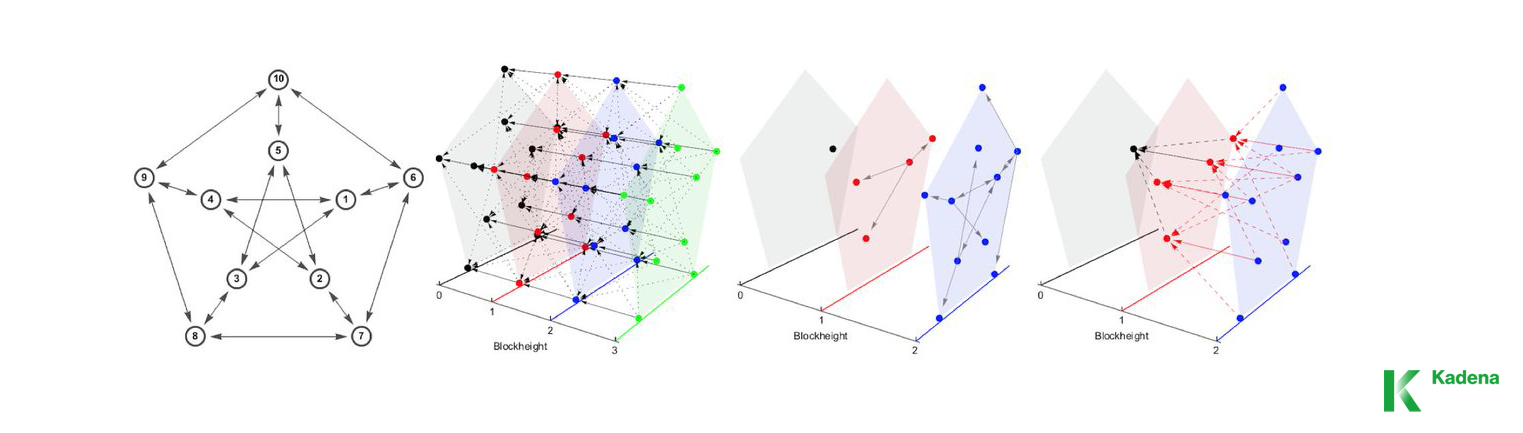

Chainweb's protocol, the company said, links multiple blockchain networks to run concurrently and split up large computation loads. As previously reported, these different chains share information through Merkle roots to achieve cross-chain consensus.

The envisioned goal of Chainweb is to produce roughly 1,000 different blockchains and reach networks speed of up to 10,000 transactions per second.

According to Kadena CEO Will Martino, Chainweb has been running on a test network since March. Later this summer in May, the test network will be opened up to preliminary users.

"We have a mining queue that we will slowly begin on-boarding to test the user experience and the process of hooking up to the network," said Martino to CoinDesk.

Martino stressed that miners would not be earning tokens ahead of their market release by engaging in the preliminary test network. Today's press release notes that miners will strictly "get to learn how Chainweb works and collaborate with our team to scale the network."

Along with today's announcement, the team at Kadena further revealed a partnership with commodities and alternative investment products provider USCF Investments, a manager of approximately $3 billion in assets.

John Love, president and CEO of USCF, told CoinDesk:

As Martino put, the two will be working together to build "the next generation of fintech" by leveraging Kadena products like Chainweb.

"The key is that USCF brings this history of innovating in financial markets and a vision for how a new technology [like blockchain] could fundamentally advance how these systems and these products are built [in fintech]," said Martino to CoinDesk.

Kadena's @_wjmartino_ & @SirLensALot join #CoinDeskLIVE at #Consensus2019 Send in your questions! https://t.co/dK5K2MTI3A

— CoinDesk (@coindesk) May 13, 2019

Team photo courtesy of Kadena

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Q6HWC4DM4NELXBY5HQJI7ZMQFI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)