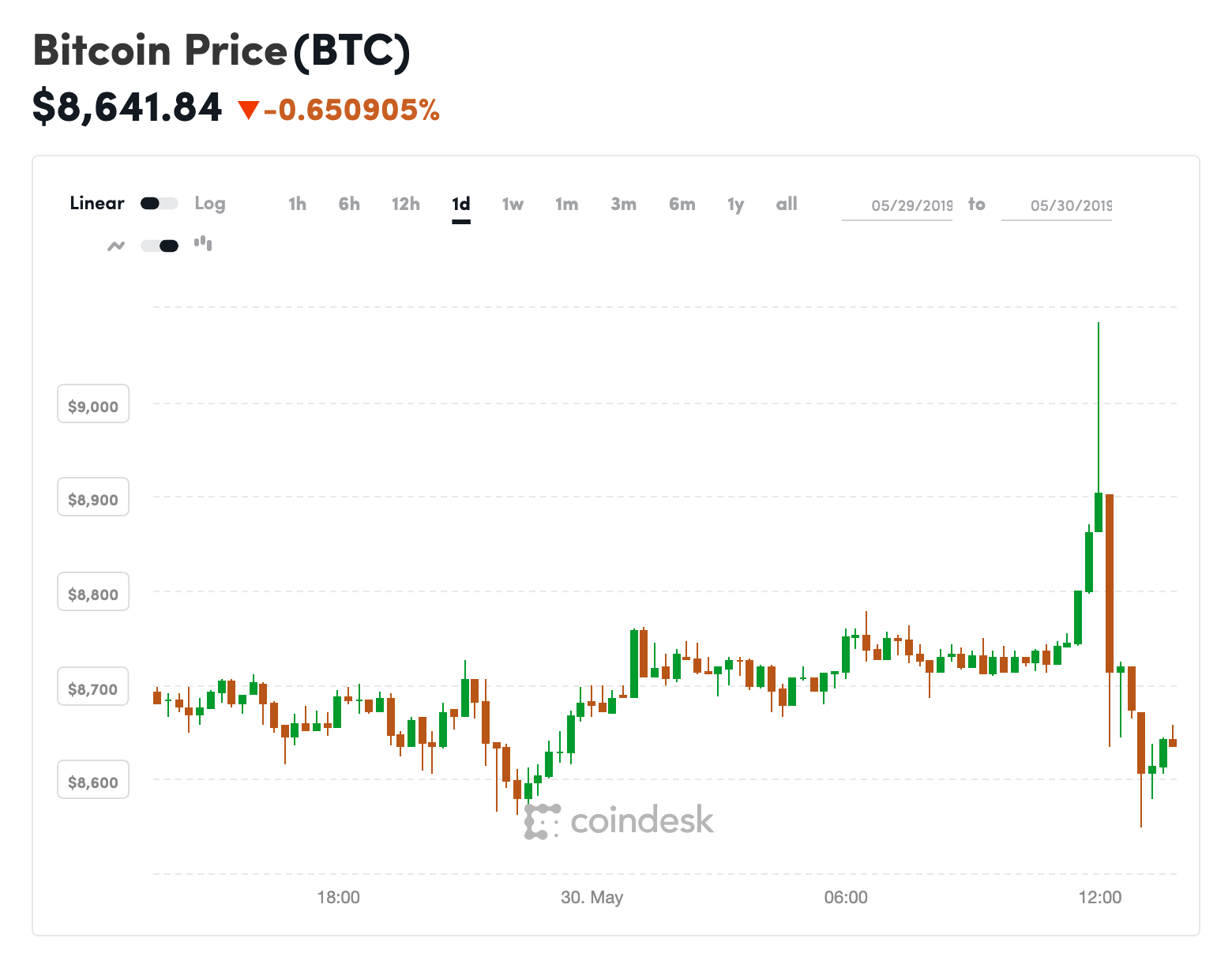

Bitcoin’s price peaked above $9,000 for the first time in over a year earlier today, but the rally was short lived as its price returned below $8,600 just minutes later.

At 16:00 UTC, the world’s largest cryptocurrency jumped 4.6 percent from today's UTC opening price of $8,681 and climbed as high as $9,084 – its highest price since May 10, 2018, according to CoinDesk pricing data.

However, sellers quickly halted the rally, causing the price of bitcoin to drop more than $500 to $8,548 in just 30 minutes after reaching today’s high.

In all, Messari data reveals $26.3 billion in reported bitcoin volume has traded hands so far today.

What's more, today's pullback has hardly put a dent in an impressive performance from crypto bulls this month, with bitcoin still reporting month-to-date gains of roughly 63 percent at the time of writing.

Disclosure: The author holds several cryptocurrencies. Please see his author bio for more information.

Roller coaster image via Shutterstock

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2QNASUBLYVCNLJL7K7GIPUL7II.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)