Crypto lending startup BlockFi received $18.3 million in a Series A funding round led by Valar Ventures, the company announced Tuesday.

Valar, which was founded in part by PayPal co-founder Peter Thiel, was joined by Winklevoss Capital, Galaxy Digital, ConsenSys, Akuna Capital, Susquehanna, CMT Digital, Morgan Creek, Avon Ventures and PJC. Valar's investment was its first in the cryptocurrency industry following prior investments in other fintech firms like Transferwise, a press release said.

According to a company statement, BlockFi plans on using the capital for additions to its product line up. The firm’s premier product, yield-bearing bitcoin deposits, launched in March. Besides deposits, BlockFi offers cryptocurrency-backed loans.

Speaking on participating in the Series A closure, Valar general partner James Fitzgerald said BlockFi’s product is bringing cryptocurrency mainstream.

“We are excited to help BlockFi build robust 'picks and shovels' for this emerging asset class," he said.

The Series A funding round comes five months after the launch of its bitcoin yield-bearing loans.

Image via BlockFi

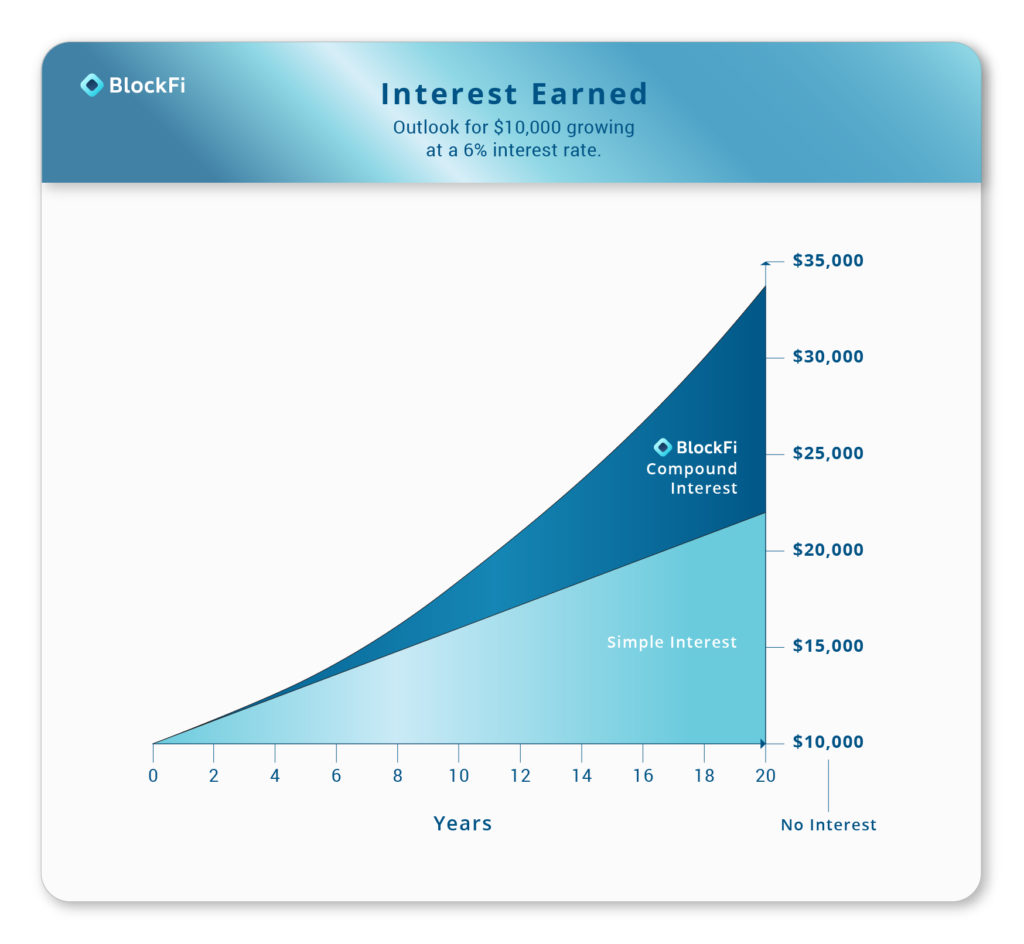

Riding on the backs of a promised 6.2 percent interest rate, the product garnered $25 million in deposits after its March 5 launch. By late April, over $50 million was deposited in BlockFi’s interest-bearing accounts.

The market-topping rate was cut for larger accounts that same month, however. Accounts with deposits over 25 bitcoins or 500 ether had rates reduced to 2 percent annual yield.

BlockFi CEO Zack Prince via CoinDesk archives

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4HUXTQIH6FFVBNDVIVTI3RWQJQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HFTBVAT3OFFFPFYB66C47WRVEI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PCQSVO4EMFGQDFPNV67QYABHEQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5PVVPRTZRNBE5IG6CTHHPWYNVE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LDBUTV6UINESVN2K3WY2F3SYNU.jpg)