Bitcoin's (BTC) price drop since Friday has pushed the oldest and largest cryptocurrency back into the red for 2020.

But guess what bitcoin is still beating? Big U.S. bank stocks, which are suffering as coronavirus-related business disruptions, household lockdowns and rising unemployment eviscerate the economy, pushing up loan losses.

You're reading First Mover, CoinDesk's daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

JPMorgan, the biggest U.S. bank, is down 26 percent this year, while Bank of America has fallen 29 percent, Wells Fargo has tumbled 38 percent and Citigroup has plunged 40 percent.

Bitcoin is down a comparatively paltry 6.4 percent on the year.

Bitcoin prices year to date. Source: CoinDesk

With governments and central banks around the world pledging trillions of dollars of emergency aid packages and money injections, bitcoin has garnered heightened investor attention lately as a potential hedge against inflation, a digital form of gold. The Federal Reserve's balance sheet last week surged past $6 trillion for the first time in its 107-year history.

Yet, when bitcoin was envisioned in a 2008 white paper by the pseudonymous Satoshi Nakamoto, the original intended purpose was as a peer-to-peer electronic payment system that could bypass financial institutions.

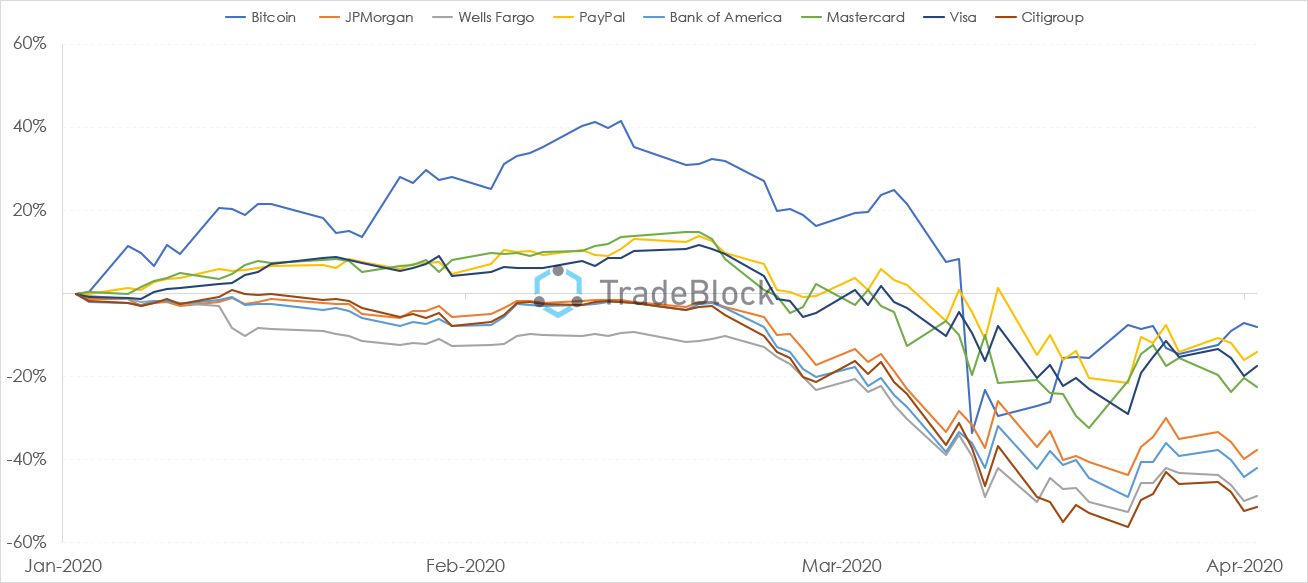

And it's that original use case that prompted TradeBlock, a cryptocurrency research firm, to take a look last week at how the cryptocurrency is performing versus bank stocks. The topic could come under heightened focus this week as JPMorgan reports earnings for the first quarter.

"Interestingly, while market prices of the large banks and even payment processors saw a lack of investor confidence during the past several weeks, investor confidence in bitcoin has fared surprisingly well," John Todaro, director of currency research at the crypto-focused firm TradeBlock, wrote in an email.

Bitcoin's price charted against big U.S. bank stock prices. Source: TradeBlock

In fact, Citigroup's share price has been hit so hard its market capitalization has shrunk to about $100 billion, according to FactSet – well below the $122.8 billion outstanding market value of bitcoin. If the trend continues, bitcoin could next overtake Wells Fargo, whose market value currently sits at $135 billion.

Bitcoin's market value is still less than half of JPMorgan's, which is around $313 billion.

In a report last week, CoinDesk Research noted developers are actively working on technologies that would improve bitcoin's usefulness as a payment system. And that's to say little of the fast-growing arena of decentralized finance, or DeFi, which aims squarely at displacing big banks and so far has largely been built around Ethereum, the second-biggest blockchain network after Bitcoin.

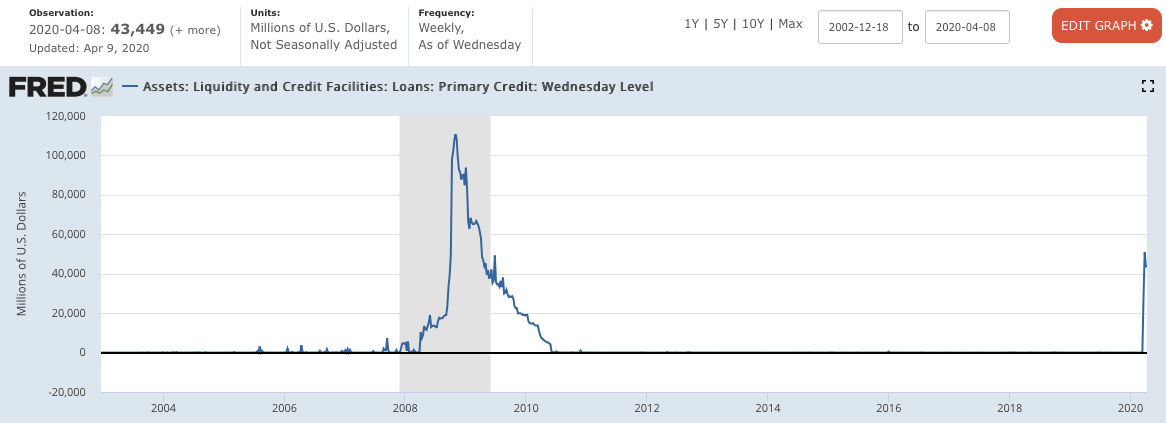

Just as they were in the 2008 crisis, banks are big beneficiaries of the Federal Reserve's new emergency lending programs.

As of April 8, banks were borrowing some $43.5 billion from the central bank's so-called discount window, which is usually reserved for emergencies. (The Fed in late March encouraged banks to use it as a way of trying to assure coronavirus-roiled markets had plenty of liquidity.) Wall Street dealers had pulled down another $33 billion, money-market mutual funds were backstopped by $54 billion and collateralized loans known as "repurchase agreements" totaled some $227.6 billion.

Chart of banks' discount-window borrowings from the Federal Reserve. Source: St. Louis Fed.

Bitcoin, which saw a big sell-off in March along with just about everything else as investors sought safety in U.S. dollars, may have benefited from the stabilization in markets that followed the Fed's aggressive response.

But the banks' year-to-date stock returns reveal just how worried shareholders remain.

According to a Morgan Stanley report last week, cash-strapped companies have been drawing down credit lines at a record pace, with a total of $223 billion drawn so far in 2020. There's a big risk some of those loans could go bad if the economy sours further.

There are also concerns banks might face losses stemming from the past decade's explosion in corporate debt, especially "leveraged loans" made to companies with junk-grade credit ratings. Many of those loans were packaged into bonds known as collateralized loan obligations, sponsored by non-bank financial firms such as Blackstone. But Fitch, the credit-rating firm, has warned some of those losses could reverberate back onto banks.

"Overall, credit risk is rising as the global economy slows, and leveraged lending is a key concern given the higher risk associated with the loans," wrote Brian Kleinhanzl, a bank analyst at the brokerage firm KBW.

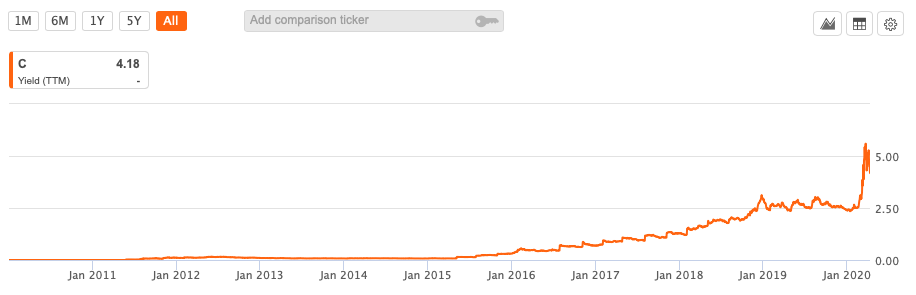

So far the biggest U.S. banks have managed to keep paying dividends, but former Fed Chair Janet Yellen said last week regulators should ask banks to consider suspending the shareholder payouts – to preserve capital that could be used to support additional lending. Such a move also would help to avoid a repeat of the 2008 crisis, when losses grew so steep the big banks had to get emergency capital injections (bailouts) from the U.S. Treasury Department. Citigroup and Bank of America each needed $45 billion.

Citigroup's stock-price plunge has been so swift the New York-based bank's dividend now equates to a yield above 4 percent, a level not seen since 2009.

Citigroup's dividend yield. Source: SeekingAlpha.

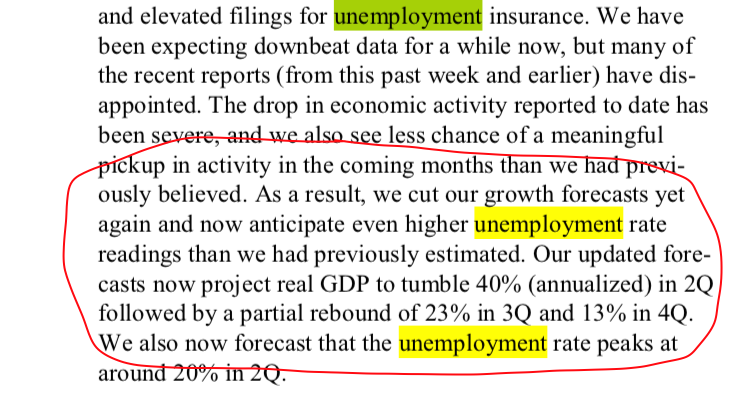

JPMorgan CEO Jamie Dimon, who in 2017 called bitcoin a "fraud" before saying the following year he regretted the comment, wrote last week in his annual letter to shareholders that his board of directors "would likely consider suspending the dividend" if an "extremely adverse" economic scenario came to pass. That was defined as a situation where gross domestic product, or GDP, tumbled by 35 percent in the second quarter, with U.S. unemployment surging to 14 percent later in the year.

Dimon published his letter just days before JPMorgan's own economists predicted in a report that GDP would fall at a rate of 40 percent in the second quarter, and that the unemployment rate would jump to 20 percent:

Source: JPMorgan Economic Research

If investors haven't already written off big-bank dividends, a wave of suspensions could push the stocks lower.

That could widen the performance gap with bitcoin, which doesn't have a dividend to cut.

Tweet of the day

Bitcoin watch

Trend: Bitcoin fell to 13-day low of $6,600 early on Monday, having fallen out of a rising wedge pattern three days ago, as noted by macro economist Henrik Zeberg.

The converging nature of the trendlines forming the wedge pattern indicates bull fatigue. Hence, a breakdown is considered confirmation of a bullish-to-bearish trend change.

An asset usually ends up erasing a major chunk of a recent rally following a wedge breakdown. Hence, Zeberg expects bitcoin to drop to levels below $5,000 and suggests the breakdown in the top cryptocurrency could be an advance warning of another liquidity crisis in the global markets.

Global equities took a beating in March amid a scare over the economic affects of the coronavirus pandemic, triggering a global dash for U.S. dollar cash, which saw investors sell everything from gold to U.S. Treasurys.

S&P 500 futures are signaling risk aversion at press time with a 1.2 percent decline. The drop comes as the number of coronavirus cases in China and Singapore surged over the weekend. However, European markets are closed Monday, an Easter bank holiday. It remains to be seen if investors resume liquidating assets for USD during the week ahead.

From a technical perspective, bitcoin is now operating in bearish territory and only a daily (UTC) close above the 50-day average at $7,145 would neutralize the outlook.

First Mover is CoinDesk's daily markets newsletter. You can subscribe here.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FS2VZ7GQ6VC3PHVRPNC2I3AUHI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)