It’s a lethargic Thursday across most markets, including bitcoin. Yet, on a longer-term view, the big growth story remains the Ethereum network’s DeFi movement, which continues to help drive ether’s performance in 2020.

Bitcoin (BTC) was trading around $9,395 as of 20:00 UTC (4 p.m. ET), gaining 0.97% over the previous 24 hours.

At 00:00 UTC on Thursday (8:00 p.m. Wednesday ET), bitcoin was changing hands around $9,443 on spot exchanges such as Coinbase. It then dipped to as low as $9,365. While the charts were relatively flat Thursday, the price was below its 10-day and 50-day moving averages - a bearish signal for market technicians who study charts.

Bitcoin trading on Coinbase since June 16

Yet, not everyone sees the daily market action as bearish overall.

“I'm not bearish until sub-$8,500,” said Josh Rager, a cryptocurrency trader and founder of educational platform Blackroots. “I'm not ruling out a pump, but we need to reclaim $9,800!”

Traders like action, and this week has been bereft of it so far. However, it is not stopping some from scooping up $9,400 bitcoin, said Michael Gord, CEO and co-founder of brokerage Global Digital Assets. “There has always been a brief accumulation phase following each halving and each accumulation phase has gotten longer as the market has matured,” he told CoinDesk.

Read More: Bitcoin Halving 2020, Explained

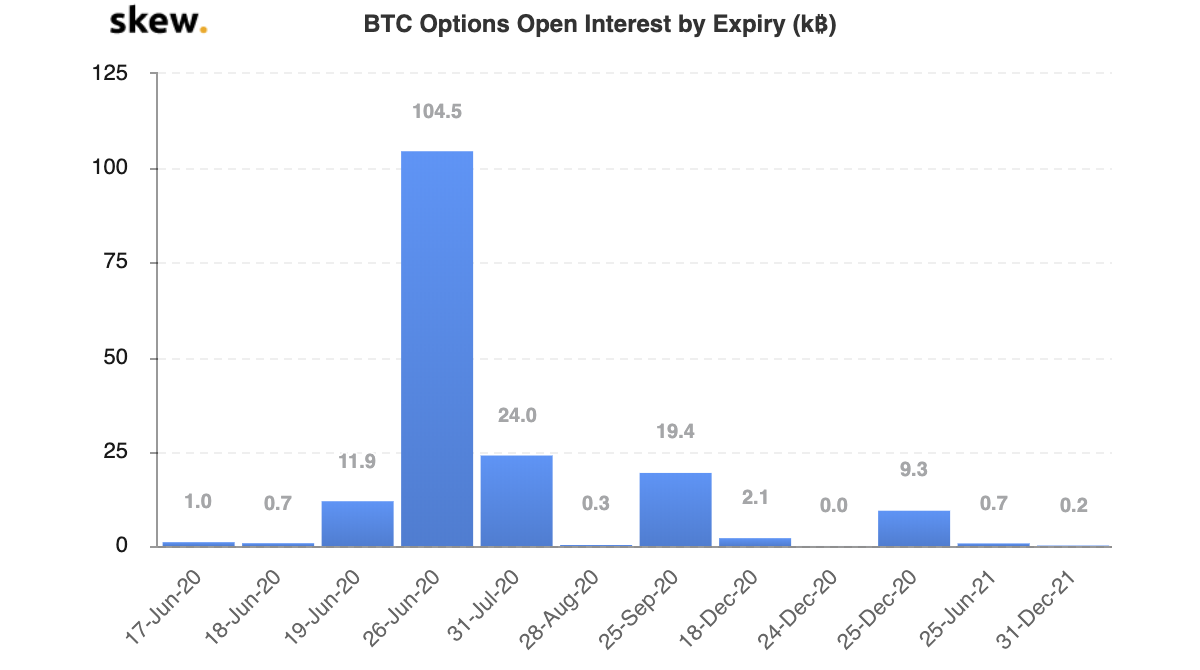

"The market has been very flat over the month of June,” said Denis Vinokourov, head of research for digital asset brokerage Bequant. “But there is room for a break out next week heading into options and futures expiry dates.”

Indeed, there are a number of bitcoin options expiring next week, on June 26, according to data aggregator Skew.

BTC options open interest and expiry dates for 2020

Ether beating bitcoin in 2020

The second-largest cryptocurrency by market capitalization, ether (ETH), is trading around $230, climbing 0.64% in 24 hours as of 20:00 UTC (4:00 p.m. ET). So far in 2020, ether is up 77% while bitcoin has appreciated 30%.

Bitcoin (gold) versus ether (blue) in 2020

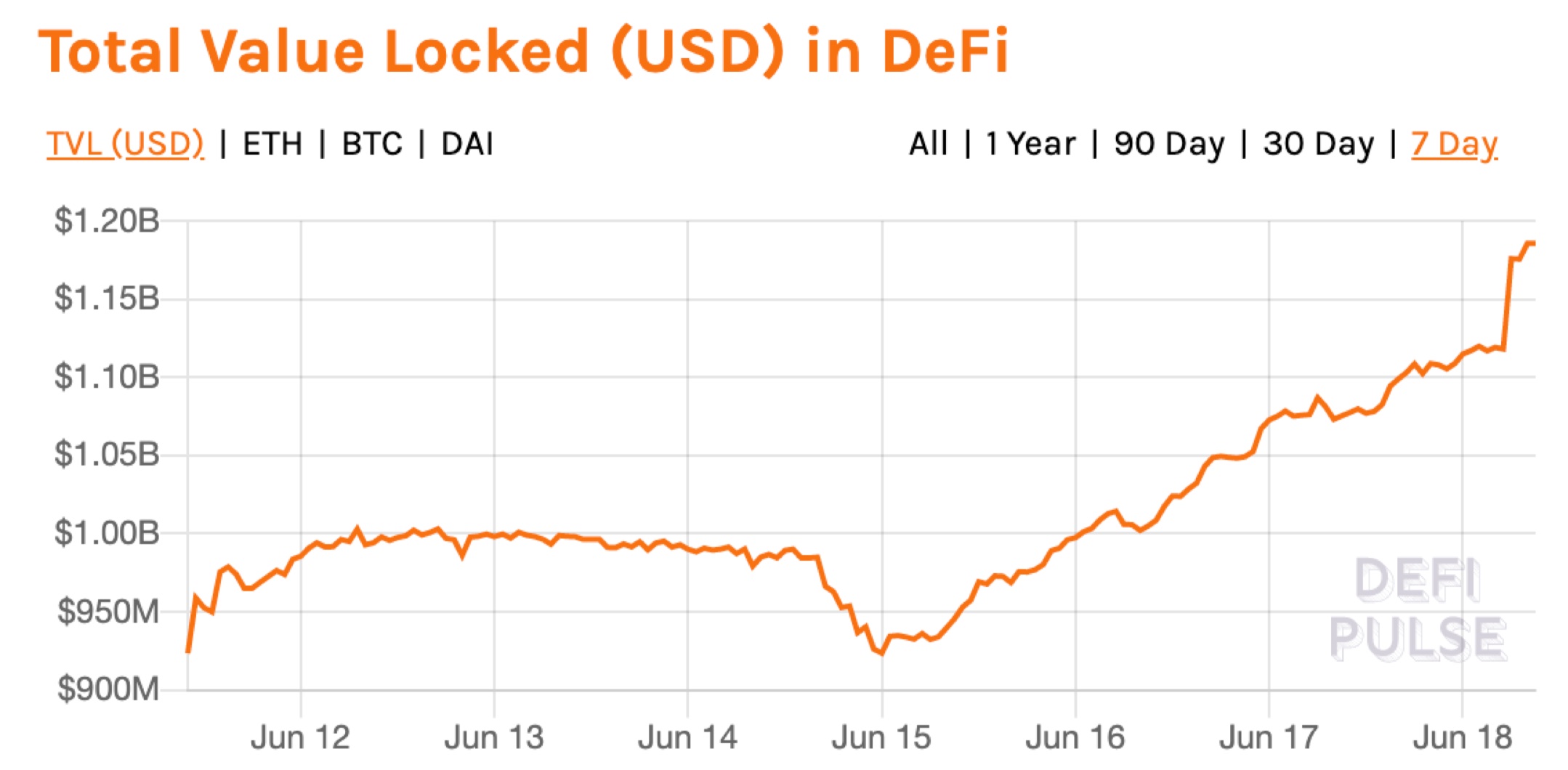

Traders point to the growth of decentralized finance (DeFi) applications being constructed on the Ethereum network as fundamental drivers of more people buying ether, causing the price to go up.

Over the past week, total value locked in DeFi has jumped 28%, closing in on $1.2 billion.

USD value locked in decentralized finance the past week

However, Michael Arrington, founder of Arrington XRP Capital, a fund that currently is using 80% of its assets for trading various cryptocurrencies, says narratives can change quickly in this market. “This year the story so far has been ether. But it might end up being bitcoin again,” he said.

Other markets

Digital assets on CoinDesk’s big board are mixed Thursday.

In commodities, oil is the lone asset making gains Thursday, jumping 3%. A barrel of crude was priced at $38.84 as of press time.

Contracts-for-difference on oil since June 16

Gold is trading flat as the yellow metal slipped 0.08%, trading around $2,724 for the day.

In Asia, the Nikkei 225 of publicly traded companies in Japan closed in the red 0.45%, as stocks in the industrial and real estate sectors dragged the index lower.

In Europe, the FTSE 100 index in Europe slipped 0.73% despite fresh stimulus from the Bank of England to the tune of £100 billion.

The U.S. S&P 500 index was flat, up just 0.06%, as fresh jobless claims stayed above the one million mark.

U.S. Treasury bonds all slipped Thursday. Yields, which move in the opposite direction as price, were down most on the 10-year, in the red 5.6%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/7SSD6AP7BFGWXGW2YAAQEUKXGY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TPIELPTEOFCFBMZMK37FF3FBA4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2K6KHE7MI5E77JNGFZR2PHPKPE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ASBYAI7RH5D7DLS3IM6FCSR7EA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BIYJNJIUNZCSLPQIMFT76Z57XE.png)