While bitcoin prices stay steady, Ethereum transactions are skyrocketing.

- Bitcoin (BTC) trading around $9,184 as of 20:30 UTC (4:30 p.m. EDT). Gaining 0.20% over the previous 24 hours.

- Bitcoin’s 24-hour range: $9,130-$9,244

- BTC above 10-day and 50-day moving average, a bullish signal for market technicians.

Bitcoin trading on Coinbase since July 18. (TradingView)

Holding on to $9,200 after a weekend in the $9,100 range is the best traders could hope for in a weaker-than-normal market for bitcoin. “After a brief consolidation in the region of $9,000, bitcoin began to adjust upward,” said Constantin Kogan, partner at cryptocurrency fund of funds BitBull Capital. “Now it is near the next important level at $9,200. If today's trading session closes above this mark, it is likely to see further growth.”

Any growth would be welcomed by cryptocurrency traders - so far this month, bitcoin’s overall performance in July has been flat.

Spot bitcoin on Coinbase in July.

With bitcoin’s price in a wait-and-see mode, some investors are paying more attention to opportunities in alternative cryptocurrencies, or altcoins, instead. “Altcoins are back in our focus,” said Karl Samsen of Toronto-based brokerage Global Digital Assets.

Digital assets on the CoinDesk 20 are mixed Monday. Notable winners as of 20:30 UTC (4:30 p.m. EDT):

Notable losers as of 20:30 UTC (4:30 p.m. EDT):

- chainlink (LINK) - 5.8%

- dogecoin (DOGE) - 5.4%

- basic attention token (BAT) - 3%

Despite the flurry of altcoin activity, bitcoin investors still believe the oldest cryptocurrency has immense value in an uncertain world. “It is sad but these economic times are setting the stage for a massive wave of new money into bitcoin,” said Henrik Kugelberg, a Sweden-based over-the-counter trader. “The past week, it’s been altcoins but they are only for the initiated. Newbies and wealth storers will go for bitcoin.”

However, Michael Gord, CEO of Global Digital Assets, believes altcoins aren’t going anywhere. “Alt season is in session,” he said. “Expect it to only get crazier as the mainstream wakes up to the very substantial returns being generated again with digital assets.”

Ethereum transaction frenzy

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday trading around $236 and climbing 0.50% in 24 hours as of 20:30 UTC (4:30 p.m. EDT). “If ETH manages to hang around $262 for more than a couple hours, it would be quite positive,” said Jack Tan, of Taiwan-based quantitative firm Kronos Research. “I’m looking at the $500 level for ether before year end.”

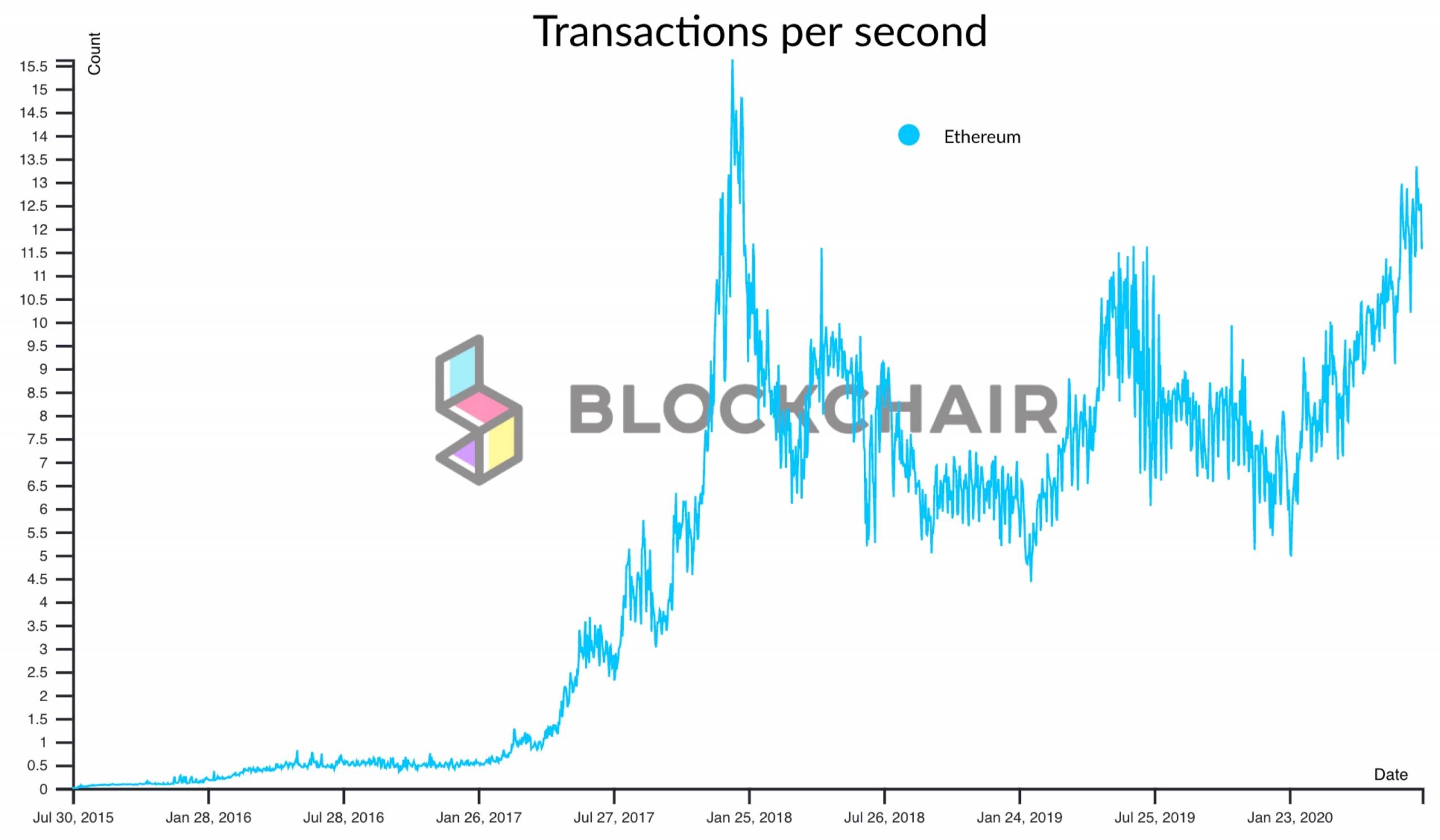

The average transactions per second on Ethereum is hitting highs not seen in years. On July 13, the network processed over 13 transactions per second, the highest since January 15, 2018 according to data aggregator Blockchair.

Transactions per second during the life of the Ethereum network. (Blockchair)

Peter Chen of Hong Kong-based trading firmOneBit Quant says the current situation reminds him of Ethereum’s 2017-2018 fundraising craze via initial coin offerings, or ICOs.

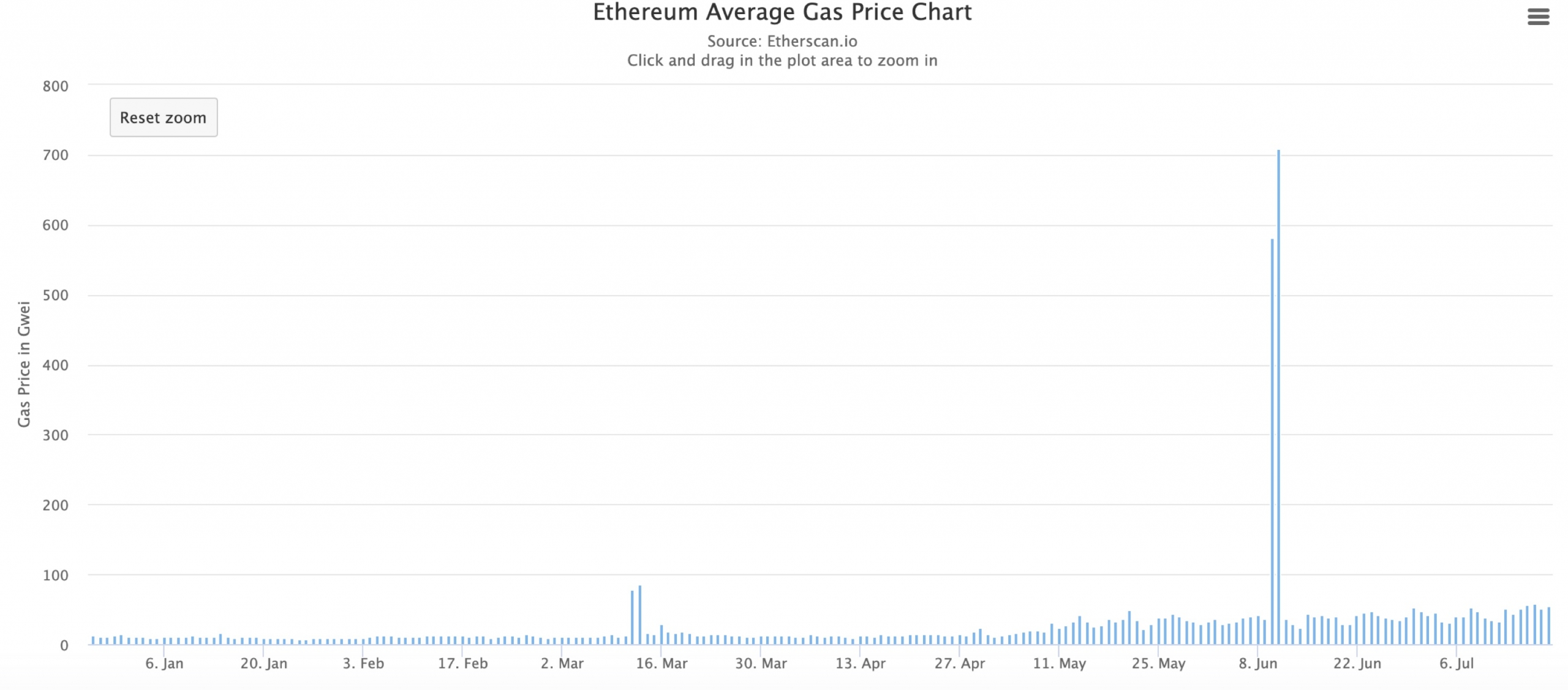

Average Ethereum gas prices in 2020.

“ETH gas is also in the sky right now,” said Chen. “It’s probably because of the DeFi tokens hype. Maybe we are seeing a second wave of ICOs on the Ethereum blockchain?”

Other markets

Equities:

- In Asia, the Nikkei 225 ended the day flat, in the green 0.09% with concerns about the coronavirus dampening positive economic sentiment.

- In Europe, the FTSE 100 in London closed in the red 0.49% as policymakers in the EU plot a €750 billion coronavirus stimulus package.

- The U.S. S&P 500 index gained 0.70% as tech stocks closed higher - Amazon climbed 7.1%, its largest jump since March.

Commodities:

- Oil is up 0.36%. Price per barrel of West Texas Intermediate crude: $40.72

- Gold is up 0.50% Monday, at $1,817 per ounce

Treasurys:

- U.S. Treasury bonds all slipped Monday. Yields, which move in the opposite direction as price, were down most on the 10-year, in the red 3.5%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLQXWASDDFFRLPZZNTXCQ2TDRM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)