Swipe (SXP) futures volumes – $45 million at last check – equal 42% of its total market capitalization, a possible sign the market is overextended.

- SXP futures is the second-largest futures market on FTX, the only cryptocurrency exchange with SXP futures.

- SXP volumes signal cryptocurrency traders’ increasing interest in cryptocurrencies with low market capitalizations as bitcoin continues to trade in a tight range above $9,000.

- FTX launched SXP futures on July 13 shortly after Binance acquired the crypto wallet company behind the token.

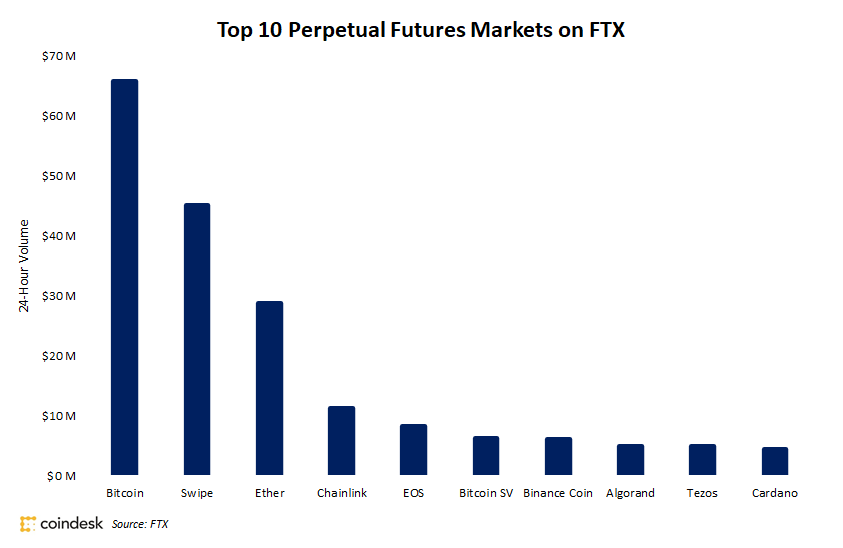

Top FTX perpetual futures markets ranked by 24-hour trading volume

- FTX is the sixth-largest cryptocurrency exchange by open interest, according to CoinGecko.

- Swipe futures volume relative to its market capitalization could well be a sign that the market is overextended, said Sam Bankman-Fried, CEO of FTX. Or it could be the market capitalization is just too low, he added.

- Swipe's market capitalization is currently $108 million, nearly $300 million smaller than dogecoin's, according to CoinGecko.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FKMJ4445QFDFNK6ZLIY4TNZODY.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)