Bitcoin was little changed at around $11,000 with lower spot volumes as traders eye growth in the market for ether futures.

- Bitcoin (BTC) trading around $11,142 as of 20:00 UTC (4 p.m. ET). Slipping 0.90% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,811-$11,348

- BTC above 10-day and 50-day moving averages, a bullish signal for market technicians.

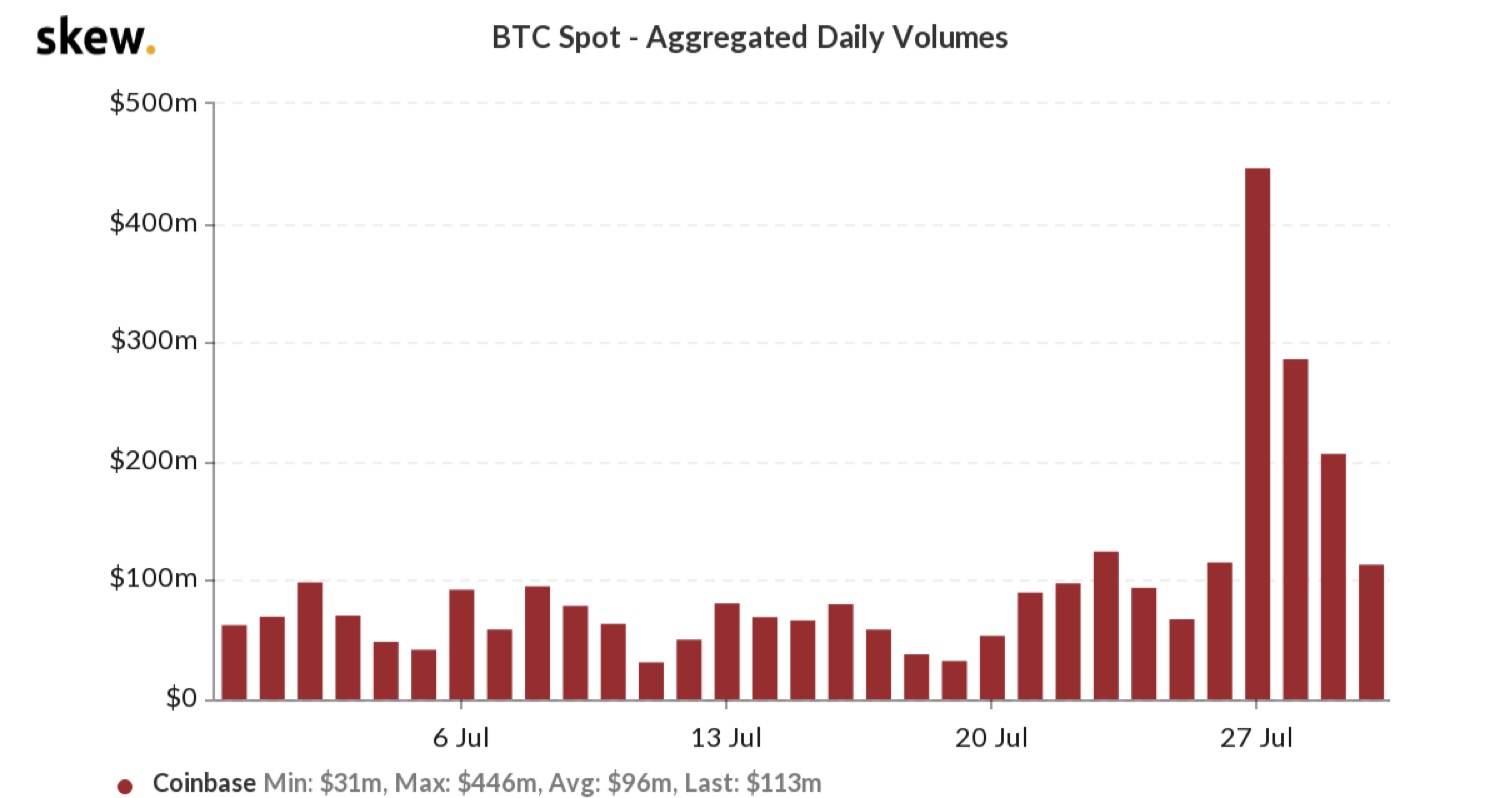

Bitcoin trading on Coinbase since July 27.

Bitcoin was little changed at around $11,000 Thursday as traders digested reports the U.S. economy shrank during the second quarter at the fastest pace on record, and that President Donald Trump is wondering if the Constitutionally mandated November presidential election could be delayed.

Trading was light, with volume of about $113 million on the Coinbase exchange, after a price rally earlier this week led to a surge in volumes.

Spot volumes on Coinbase the past month.

“Bitcoin’s push has been fueled by the drive towards safe-haven assets,” said Micah Erstling, trader at digital-asset trading firm GSR. “Markets are being driven by ongoing coronavirus concerns as well as U.S.-China trade tensions, which also helps to explain gold’s meteoric rise.”

Gold is up 28% for the year, while bitcoin has gained 53%.

Bitcoin (orange) versus gold (yellow) in 2020.

“In the last couple of weeks, the majority of assets are up – stocks, commodities, crypto – so despite fundamental weaknesses, there’s a seemingly positive risk environment,” said Matt Ficke, head of capital markets for cryptocurrency exchange OKCoin.

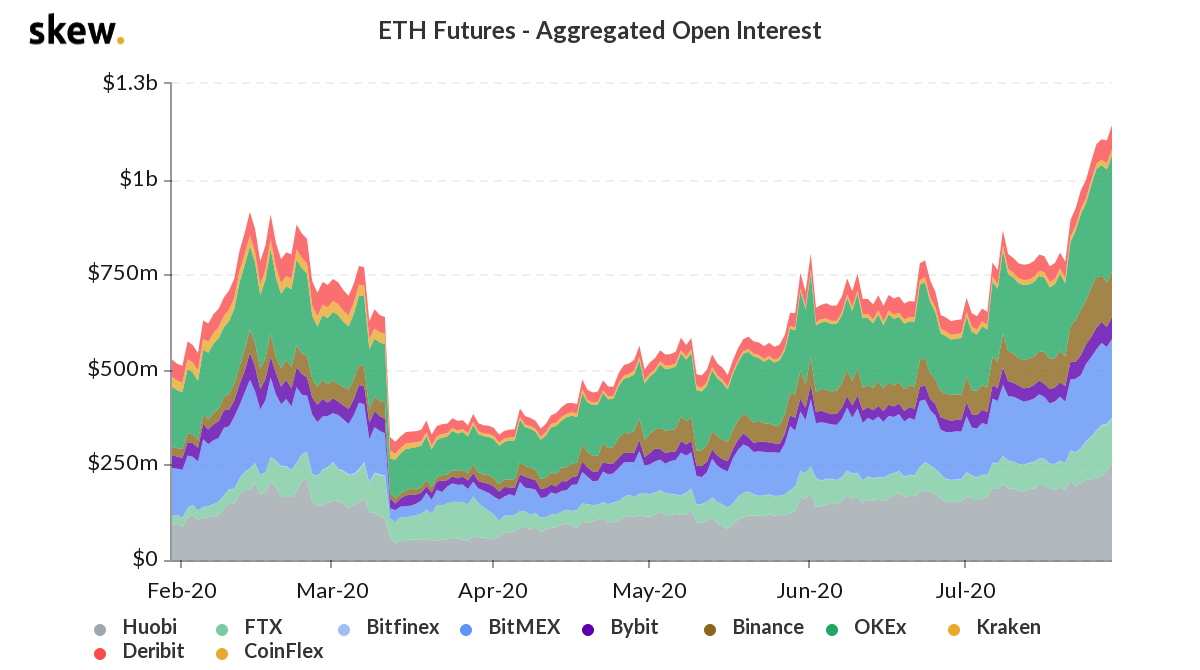

Ether futures open interest over $1 billion

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Thursday, trading around $334 after climbing 3.5% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

“Ethereum has been propelled by a new wave of DeFi and stablecoin activity,” said GSR’s Erstling. “The bullish sentiment has been great for market involvement but it has come at a cost as ETH fees are at an all-time high, highlighting how scalability issues are still present,” he added.

Open interest, or the number of outstanding contracts, in ether futures is at a 2020 high, at over $1.1 billion, according to data aggregator Skew.

The cryptocurrency exchange OKEx is the top ether futures platform, with $307 million in open interest, followed by Huobi at $253 million, BitMEX at $208 million, Binance at $118 million and FTX at $117 million.

Ether futures open interest the past six months.

Other markets

Digital assets on the CoinDesk 20 are mixed Thursday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

Equities:

- Asia’s Nikkei 225 closed in the red 0.26% as new coronavirus infections passed 1,000 in Tokyo and the government cut back operating hours for bars and restaurants.

- Europe’s FTSE 100 ended the day down 2.31% as the German economy reported a double-digit drop amid rising coronavirus cases.

- The United States’ S&P 500 slipped 0.40% as gross domestic product dropped a record 32.9%. in the second quarter.

Commodities:

- Gold is in the red 0.75% at $1,955 as of press time.

- Oil is down 2.8%. Price per barrel of West Texas Intermediate crude: $40.17

Treasurys:

- U.S. Treasury bonds all slipped Thursday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 12.5%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2IT4AQ6EHRHRBCNEUMBGZI36BQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)