- More than 20,000 BTC – worth roughly $225 million – are now tokenized and used in Ethereum-based protocols.

- Wrapped bitcoin (WBTC) represents over 76% of the total tokenized bitcoin supply with over 15,500 BTC tokenized.

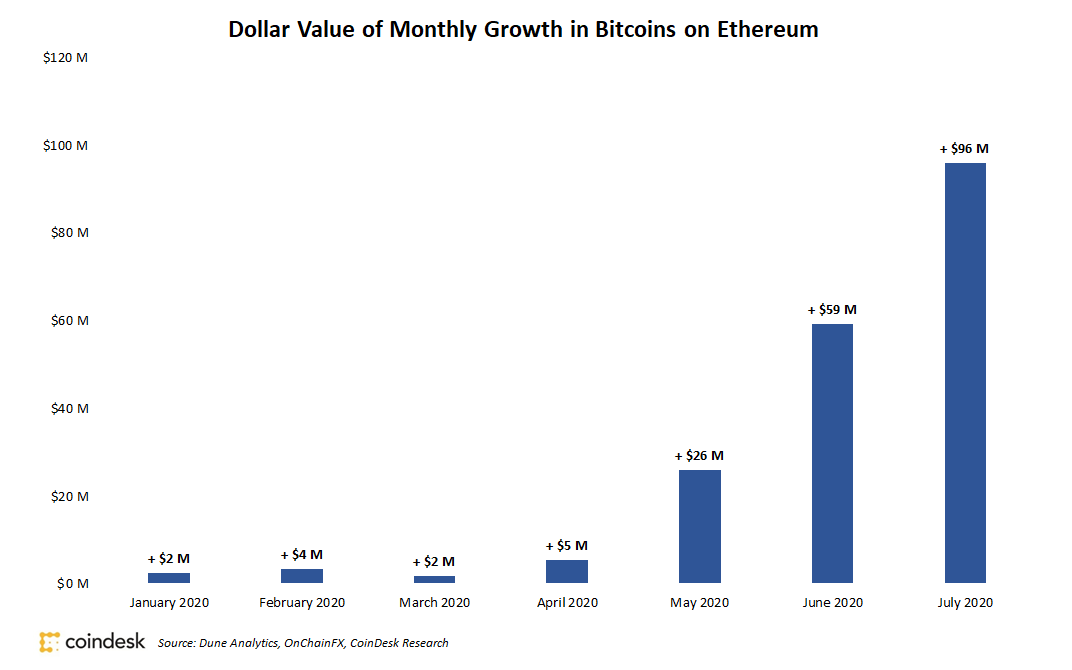

- The total supply grew by roughly $96 million in July, following June’s record growth.

- Tokenized bitcoins allow traders and investors to denominate transactions in bitcoin while using applications built on other blockchains.

- "We experienced a dramatic WBTC growth in July, led by our retail users," said Matthieu Jobbé-Duval, head of financial products at CoinList, a token launch and exchange platform that minted 7,079 WBTC in July.

- renBTC, the second largest supply of tokenized bitcoin, holds approximately 2,068 BTC.

- Tokenizing bitcoins on Ethereum is "the biggest opportunity for decentralized finance's growth today," said Andy Bromberg, president of CoinList in an email to CoinDesk.

Monthly tokenized bitcoin supply growth since January 2020

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EJPAIPARL5HHNOQ3JRLD24TFYE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)