Bitcoin hit $12,000 but then fell as long derivatives traders were wiped out. Meanwhile, DeFi lending continues to grow.

- Bitcoin (BTC) trading around $11,884 as of 20:00 UTC (4 p.m. ET). Gaining 1.8% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,468-$12,084

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since Aug. 8.

Bitcoin was able to hit as high as $12,084 on spot exchanges such as Coinbase only to quickly drop 4.5% a few hours later. Leverage may have played a large part in its initial runup and the sudden move down after, according to Denis Vinokourov, head of research for Bequant, a London-based digital assets prime broker.

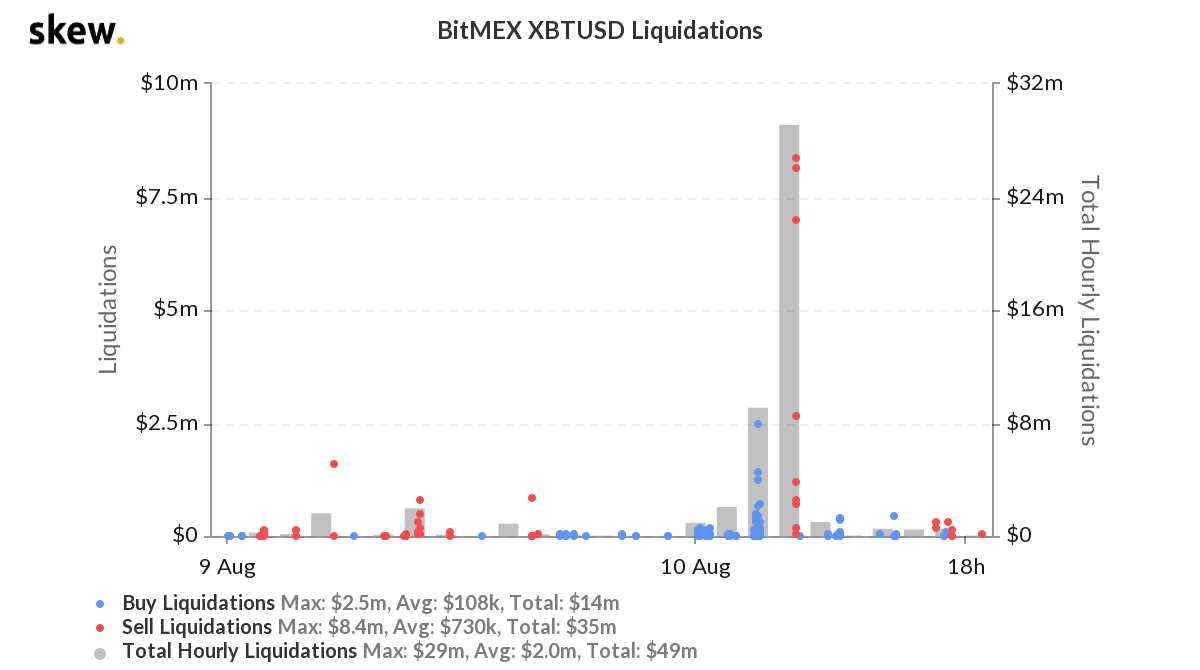

Indeed, leveraged bitcoin traders on derivatives exchange BitMEX were wiped out on the price ride up and back down. As bitcoin’s price increased, short-positioned traders lost over $2.5 million, the crypto equivalent of a margin call. Then, when the bitcoin price decreased, long-positioned traders lost over $8.4 million.

BitMEX liquidations the past 24 hours.

Vinokourov expects more short-term action in the derivatives market to affect bitcoin’s price. That’s because of very low perpetual rates charged to leverage on derivatives platforms such as BitMEX. “With perpetual rates that are flat to slightly positive, leverage flow will likely try its luck again and look to squeeze into the mid-$12,500 zone,” Vinokourov told CoinDesk.

Aaron Suduiko, head of research liquidity provider SFOX, says market volatility is increasing but the way it has been doing so may be a bullish sign.

“What we've seen since the late-July rally are BTC/USD (U.S. dollar) price increases, followed by smaller, relatively quick drops. One pattern with which that's historically been consistent is profit-taking during a broader trend of price increases,” said Suduiko.

Bitcoin trading on Coinbase since 7/1/20.

Bitcoin is up 30% since the start of July, and Suduiko notes an array of factors for being bitcoin bullish. “In the context of sustained trading volume, increased signals of institutional entry and worries about the potential devaluation of the dollar, it's possible that this may represent broader interest in bitcoin's value rather than a fluke run-up in price,” he said.

DeFi debt hits record

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday trading around $395 and climbing 1.2% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

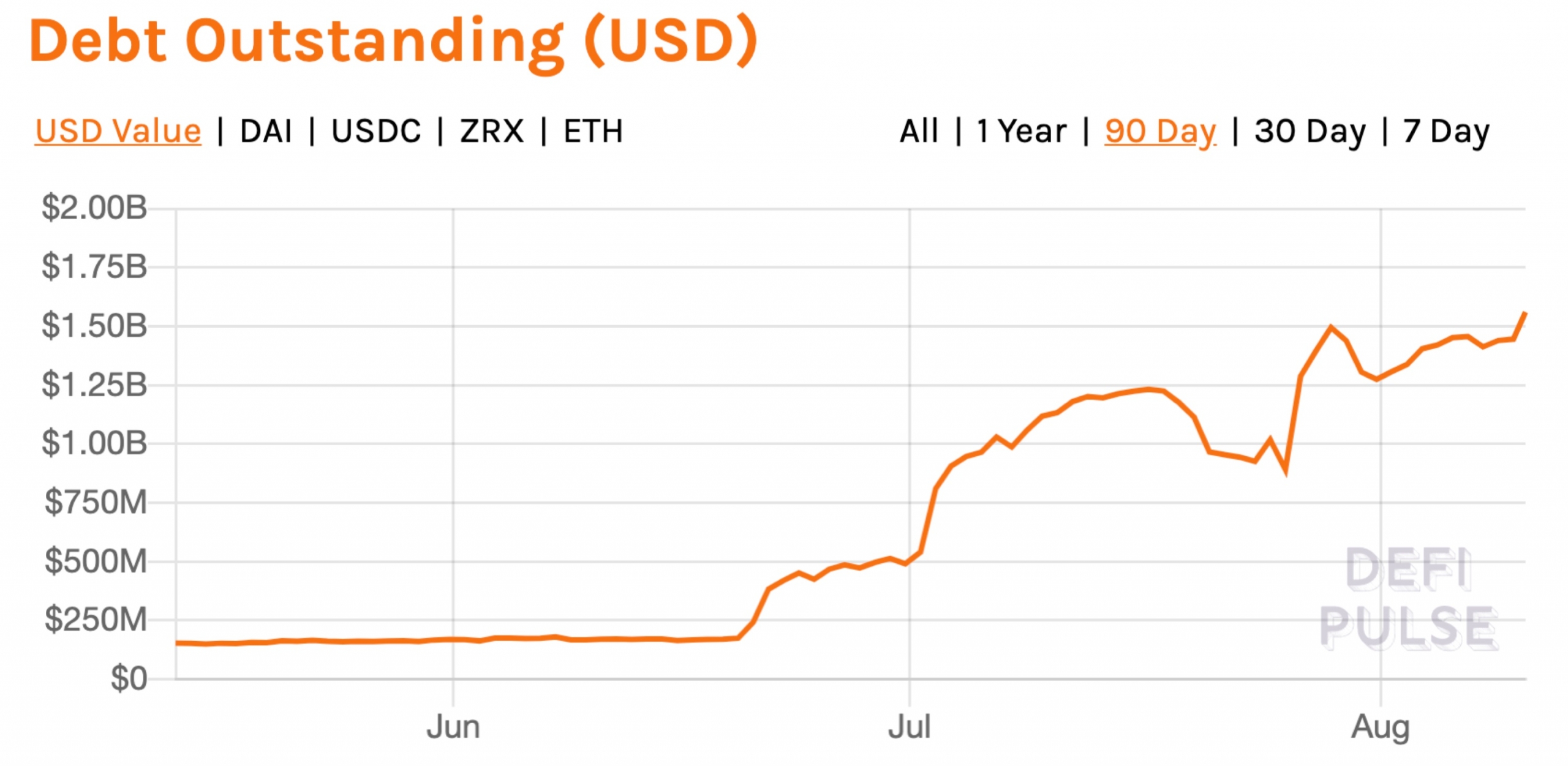

Ethereum-powered decentralized finance (DeFi) debt outstanding has hit a record Monday, crossing $1.56 billion, according to data aggregator DeFi pulse.

Debt outstanding in USD for DeFi platforms.

John Wu, president at AVA Labs, an upcoming DeFi blockchain with an active testnet for developers, says old-school financial institutions can’t compete with the rates provided by DeFi, which is helping fuel interest in the space.

“As returns from traditional investment vehicles reach record lows, crypto-savvy investors are finding yield in DeFi protocols,” he said. “They are willing to trade off the systemic risks they see in traditional finance for the product risks of this maturing ecosystem,” he added.

Other markets

Digital assets on the CoinDesk 20 are mostly in the green Monday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

Equities:

- Japan’s Nikkei 225 is closed for a holiday. Hong Kong’s Hang Seng index ended the day in the red 0.63%, dragged down by tech stocks such as Tencent.

- Europe’s FTSE 100 closed in the green 0.31% as gains were limited due to concerns about economic prospects in the U.S.

- The United States’ S&P 500 gained 0.25%, boosted by gains in the industrial and energy sectors, which collectively were up 2.4% Monday.

Commodities:

- Oil is up 1.1%. Price per barrel of West Texas Intermediate crude: $42.03

- Gold is down 0.56% and at $2,024 as of press time.

Treasurys:

- U.S. Treasury bonds were mixed Monday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 4.2%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GXCFFSATJ5D23B2AS2SRQXBOJA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)