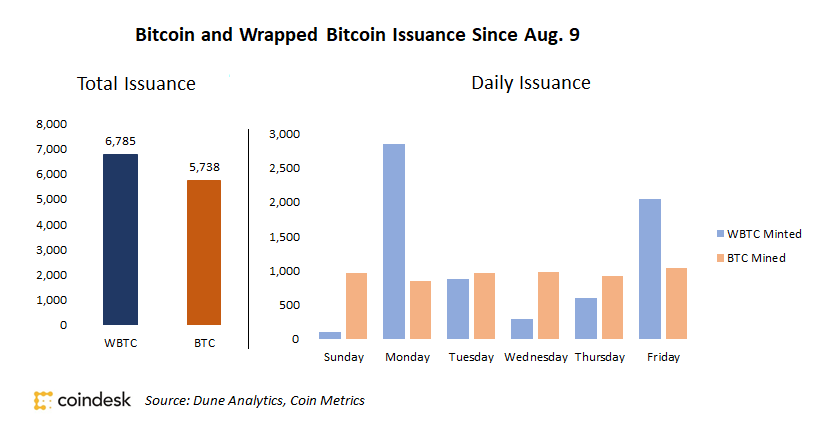

Since Sunday, 1,043 more bitcoins were tokenized through wrapped bitcoin than were actually created by bitcoin miners as the Ethereum-based decentralized finance (DeFi) boom shows no signs of abating.

- About 900 bitcoins are mined per day, given the current issuance rate of 6.25 bitcoins minted per block and the target 10-minute block time.

- At last check, nearly 31,000 bitcoins have been tokenized on Ethereum, according to Dune Analytics, 75% of which were minted by wrapped bitcoin (WBTC).

- Ethereum’s supply of tokenized bitcoins hovered below 3,000 until mid-May, when the rate of new tokens shot up.

- The rate of bitcoin tokenization signals the surging demand to use bitcoin in the burgeoning network of Ethereum-based DeFi applications.

- “WBTC continues to exhibit strong growth as demand for bitcoin in DeFi has exploded,” said Kyle Davies, co-founder of Three Arrows Capital, in a private message with CoinDesk. “I expect this trend to continue,” he added.

WBTC and BTC issuance since August 9

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CFI2E3JMPRGWTCZ5HJRNO5BREA.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)