Bitcoin is eking out gains Wednesday while ether’s volatility is up on DeFi drama.

- Bitcoin (BTC) trading around $10,299 as of 20:00 UTC (4 p.m. ET). Gaining 2.7% over the previous 24 hours.

- Bitcoin’s 24-hour range: $9,818- $10,349

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since Sept. 7.

Bitcoin is slowly making gains Wednesday, reaching as high as $10,349 as of press time.

“After the Sept. 2-3 drop, bitcoin has been stuck in a narrow range of $10,100 to $10,500, looking for direction,” said David Lifchitz, chief investment officer for crypto quantitative firm ExoAlpha. “Each drop below $10,000 has been furiously bought, keeping BTC above that,” he added.

Over the past week, traders have come in and scooped up sub-$10,000 bitcoin, with $9,800 being a level tested but retraced.

Bitcoin trading the past week.

While bitcoin is trending upward, the cryptocurrency needs volume to boost it further, Lifchitz added. “This is typical of a wounded asset recovering,” Lifchitz added.” Contrary to traditional assets, there's no federal printing press to artificially prop up digital assets, only good old demand,” he said.

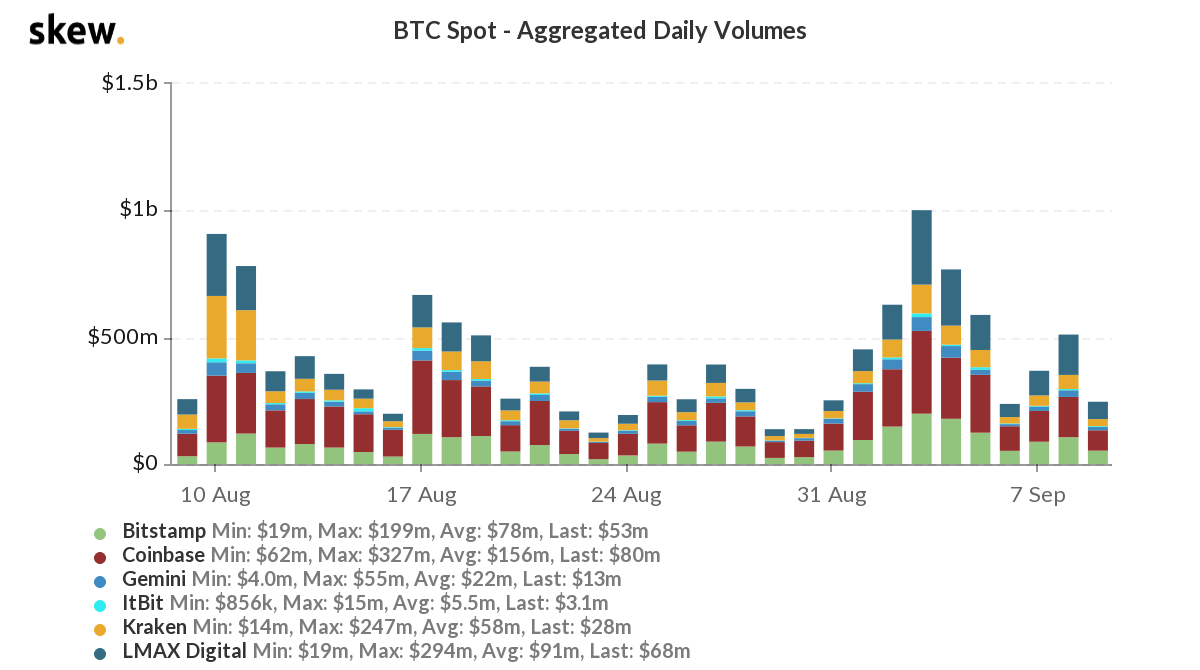

So far Wednesday, demand as measured in volume is relatively flat – a paltry $245 million combined on major spot exchanges according to Skew. This is much lower than a week ago, when spot volumes hit a one-month high of $1 billion.

Bitcoin volumes on major spot exchanges the past month.

John Willock, CEO of digital-asset liquidity firm Tritium, says the ebb and flow in the bitcoin market is simply natural. “This short-term dip down to current levels was a reasonable pullback,” he said. “A steady move upwards in BTC is fully in line with my expectations for the medium-term and through the end of the year.”

According to ExoAlpha’s Lifchitz, “Until bitcoin reaches above $10,600, there’s no hope for a retry toward $12,000 anytime soon.”

Ether volatility up

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Wednesday, trading around $357 and climbing 6% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

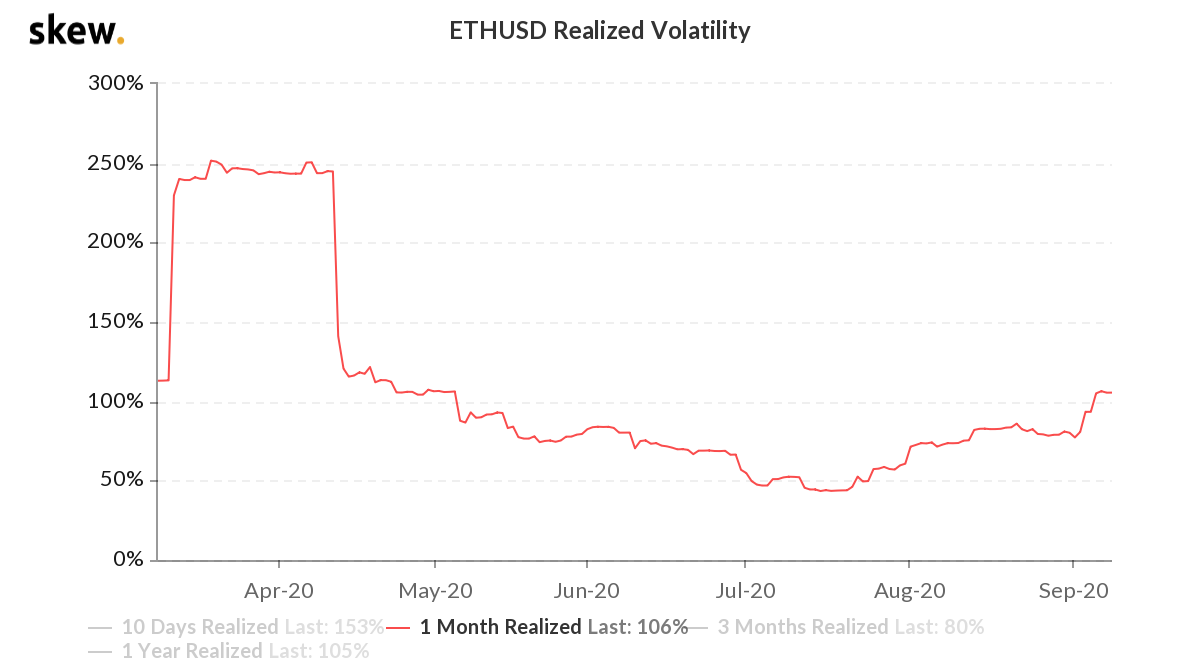

Ether’s one-month realized volatility, a measure of the standard deviation of returns based on historical data, is at 106% on an annualized basis, its highest point since way back on May 6.

Realized volatility for ETH/USD the past six months.

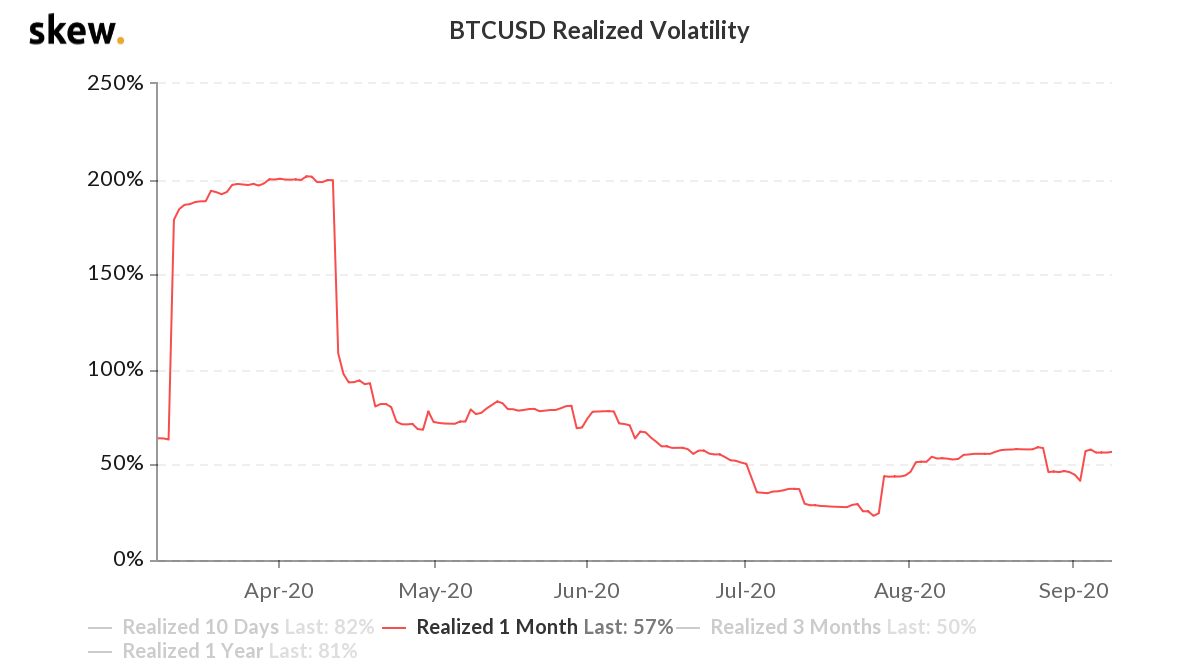

It is clear that ether is more volatile than bitcoin, which, at 57% one-month realized annualized volatility Wednesday, is at a level consistent with its August volatility numbers.

Realized volatility for BTC/USD the past six months.

Vishal Shah, an options trader and founder of derivatives exchange Alpha5, said uncertainty surrounding decentralized finance, or DeFi, is helping drive volatility in ether, and not in the derivatives that are usually the culprit in crypto.

“I don't think much of this volatility is driven by ETH optionality, as the market is relatively small,” Shah said. “Rather, it seems to be a byproduct of pent-up disbelief in gas prices and the large rotations in total value locked in DeFI,” he added.

Other markets

Digital assets on the CoinDesk 20 are all in the green Wednesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Equities:

- In Asia, the Nikkei 225 closed down 1% as a clinical trial pause for a potential coronavirus vaccine damped sentiment in Tokyo.

- In Europe, the FTSE 100 ended the day up 1.3% as a falling pound, which boosts overseas earnings for multinationals in the index, helped sentiment.

- In the United States, the S&P 500 climbed 2% as tech stocks made gains, including Microsoft jumping 4.2%. and Apple up 4%.

Commodities:

- Oil is up 3.3%. Price per barrel of West Texas Intermediate crude: $37.96.

- Gold was in the red 0.90% and at $1,948 as of press time.

Treasurys:

- U.S. Treasury bond yields all climbed Wednesday. Yields, which move in the opposite direction as price, were up most on the two-year, coming in at 4.2%.

The CoinDesk 20: The Assets That Matter Most to the Market

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HIMFWJLWLZGT5MDZNRLVIZY75E.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)