Bitcoin is making gains Monday and Ethereum usage is hitting record highs in September.

- Bitcoin (BTC) trading around $10,669 as of 20:00 UTC (4 p.m. ET). Gaining 3.4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,250-$10,759

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since September 12.

The price of bitcoin hit as high as $10,759 on spot exchanges such as Coinbase Monday. That level has not been seen since Sept. 3 and the cryptocurrency is now heading into bullish territory.

“The trend is indeed higher,” said Darius Sit, managing partner of quant firm QCP Capital.

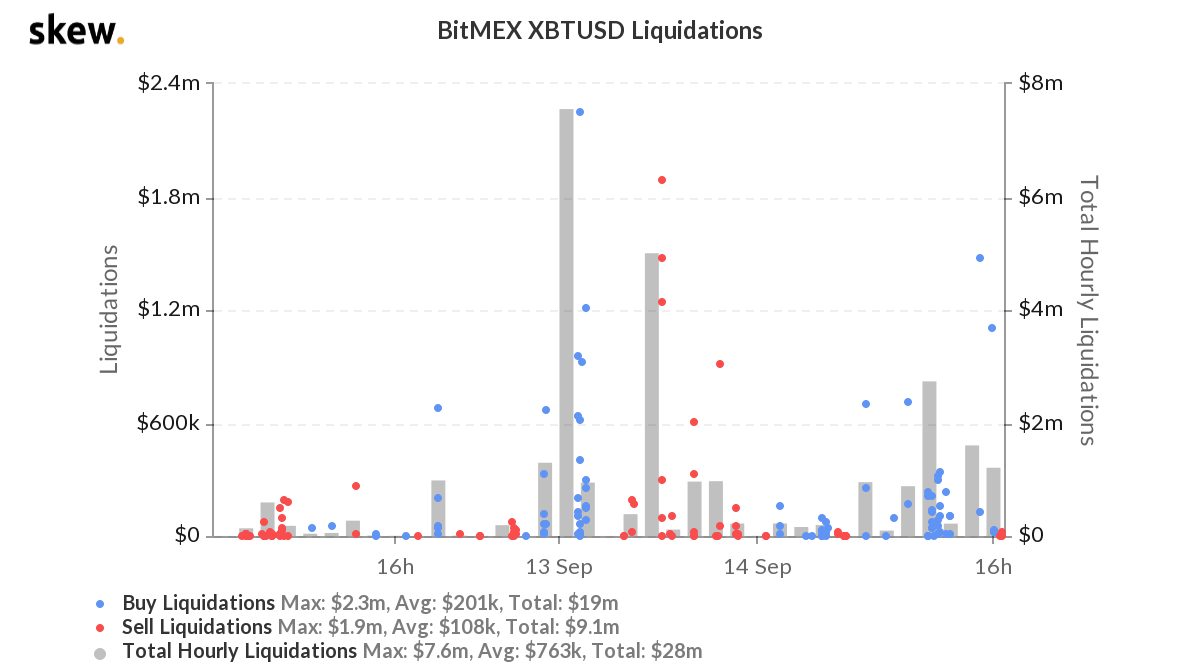

Buy liquidations, the crypto equivalent of a margin call that wipes out short-sellers on derivatives exchanges such as BitMEX seemed to be helping to push bitcoin’s price up. A total of $19 million buy liquidations were more than double the $9.1 million in sell liquidations over the weekend and into Monday on BitMEX, helping fuel the price upswing.

Liquidations on BitMEX the past three days.

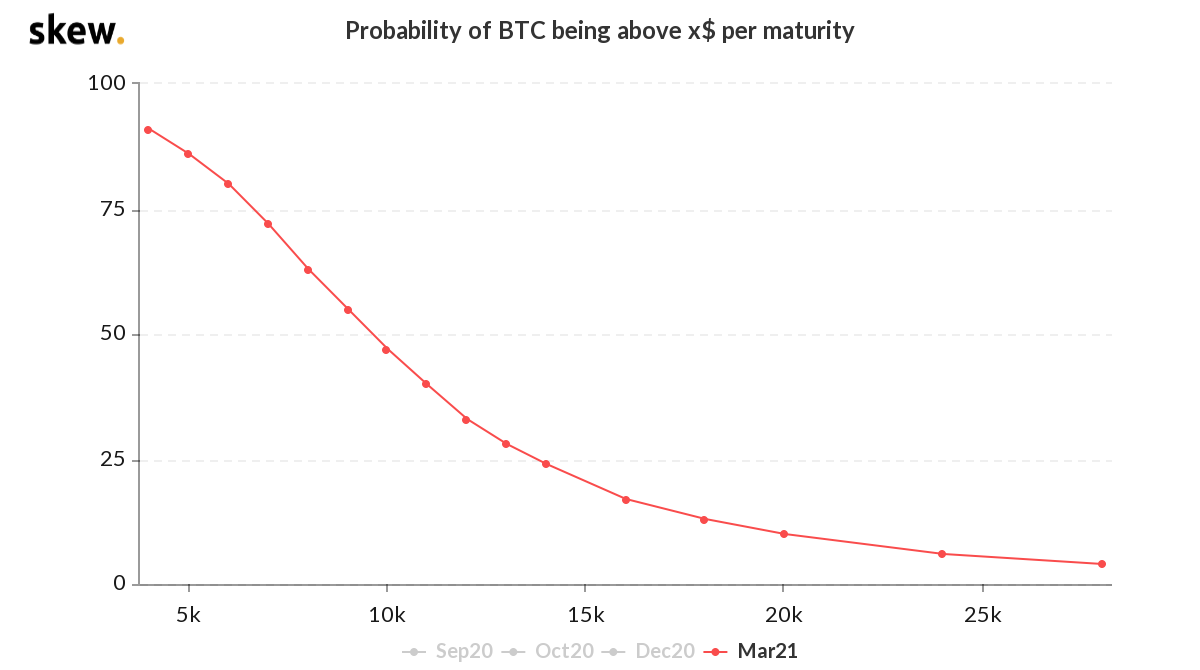

In the options market, some traders remained highly bullish that bitcoin can hit new highs.

“While bitcoin price dabbles around $10,000 now, traders have still priced in a chance that bitcoin will trade at $20,000 by March 2021,” said William Purdy, an options trader and founder of analysis firm PurdyAlerts.

Indeed, based on how options are currently trading in the market, it appears as if options traders are estimating a 10% chance that bitcoin will be at $20,000 by the March 2021 expiration date.

Bitcoin price probabilities at March 2021 maturity.

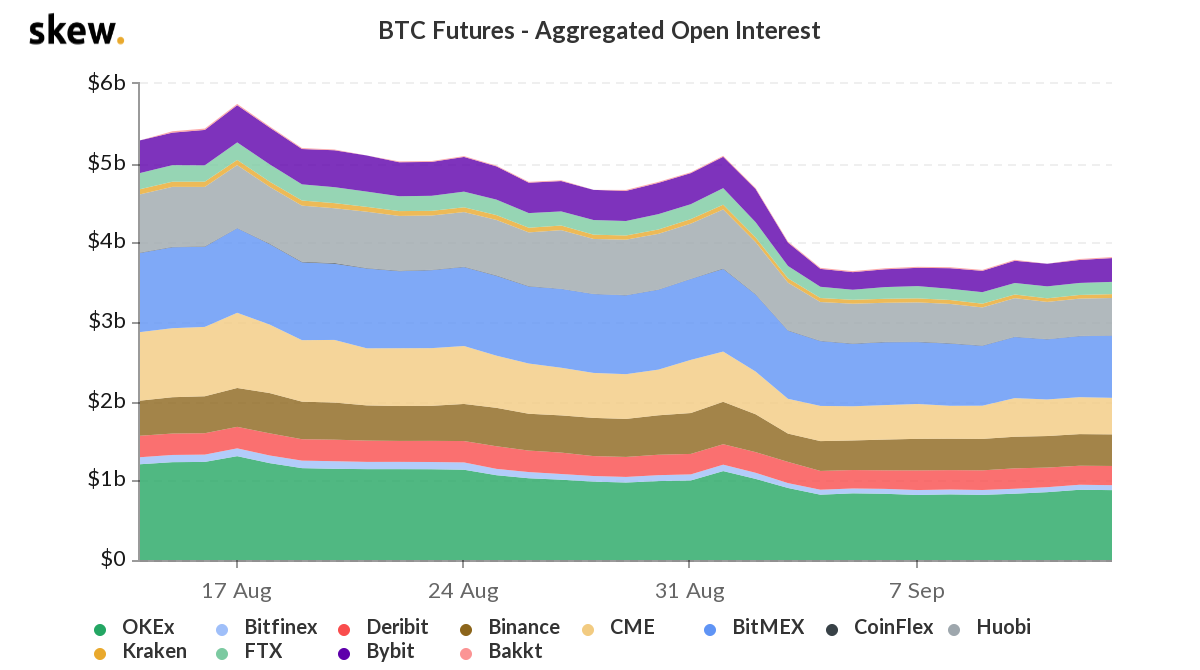

Over in the futures market, investor interest seems to have waned somewhat.

"Bitcoin futures aggregate open interest has dropped $1 billion, or 20%, since the start of September,” noted Jason Lau, chief operating officer for cryptocurrency exchange OKCoin.

Open interest in bitcoin futures the past month.

However, Lau said a higher bitcoin price could mean an increase in futures interest. “It seems traders are in a holding pattern,” Lau added. “U.S. markets have had a strong opening this morning, which pushed BTC up 5%, so it will be interesting to see what impact that has on open interest in the coming days."

Ethereum record gas usage

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday, trading around $375 and climbing 3.2% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The total amount of “gas” (or costs) used on the Ethereum network to send transactions and interact with decentralized finance (DeFi) protocols hit new highs in September. On Sept. 6, a record 80 billion units of gas was used on the network, and Friday (Sept. 11) was the second-highest usage day ever, at 79,743,954,147 units used.

Total gas used per day all-time for the Ethereum network.

“I have short-term concerns about Ethereum network congestion but it’s a positive for the long term because it shows demand,” said Brian Mosoff, chief executive officer of Eth Capital, which invests in the Ethereum ecosystem.

The short-term issues could cause pain from a usability standpoint, Mosoff added. “Realistically, until the second and third phases roll out in ETH 2.0, high gas costs or requiring the use of a supporting or competing network are going to be the reality.”

Read More: The Virtual CoinDesk Invest: Ethereum Economy Event October 14

Other markets

Digital assets on the CoinDesk 20 are all in the green Monday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

- neo (NEO) + 9.9%

- lisk (LSK) + 7.5%

- ethereum classic (ETC) + 3%

Read More: How Bitcoin Correlations Drive the Narrative

Equities:

- Asia’s Nikkei 225 ended the day up 0.65% as investors digested signals that easy money policies would continue in Japan.

- Europe’s FTSE 100 closed flat, in the red 0.10% amid reports industrial production numbers have not returned to pre-coronavirus levels.

- In the United States, the S&P 500 climbed 1.6% with tech leading the way, boosted by Nvidia's $40 billion deal to buy chip designer Arm Holdings from Softbank.

Commodities:

- Oil is flat, in the red 0.01%. Price per barrel of West Texas Intermediate crude: $37.29.

- Gold was in the green 1% and at $1,958 as of press time.

Treasurys:

- U.S. Treasury bond yields climbed Monday. Yields, which move in the opposite direction as price, were up most on the two-year bond, in the green 3%.

The CoinDesk 20: The Assets That Matter Most to the Market

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HPGD3XKVDJFOPB6533HR3DCUQ4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)