DeFi trading protocol SushiSwap, which threatened to sap the life out of rival Uniswap just two weeks ago, is still losing crucial liquidity.

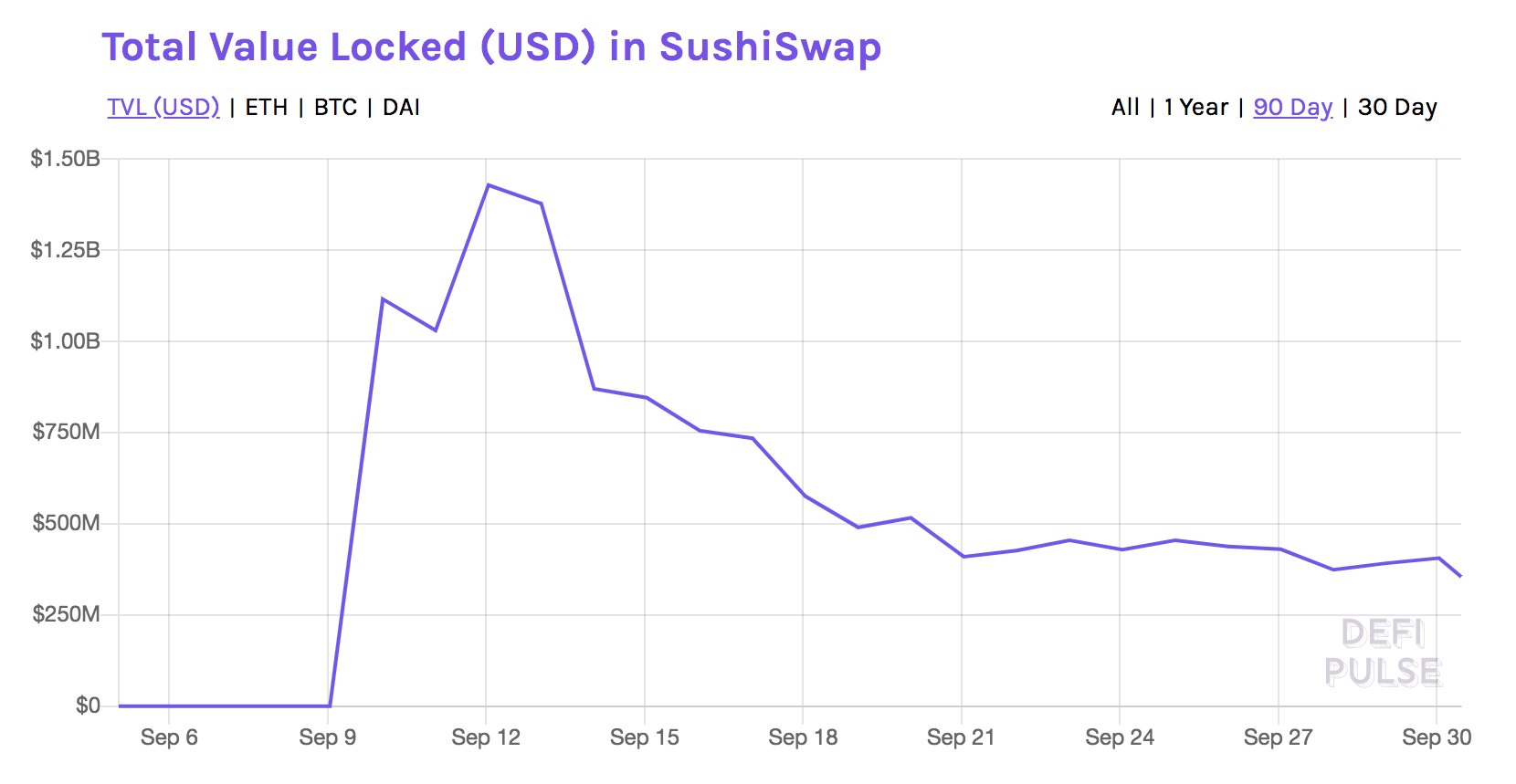

- Data from DeFi Pulse shows total value locked (TVL) in SushiSwap has dropped nearly 8% in the past 24 hours.

- TVL represents the dollar value of the tokens locked into a protocol's smart contracts. While not universally accepted, it's generally considered a key success metric for decentralized finance (DeFi) projects.

- This is particularly true for automated market maker (AMM) exchanges, such as SushiSwap and Uniswap, which rely on users depositing tokens in order to provide liquidity and create the trading experience.

- As such, Wednesday's figures don't make for good reading; SushiSwap has been on a near-uninterrupted decline since mid-September when its creator made off with, and then returned, the dev fund.

- After hitting an all-time high of $1.4 billion on Sept. 12, Sushi's TVL fell by two-thirds to nearly $490 million just a week later.

- While that rate of decline has shallowed, TVL has still fallen a further $130 million to $354 million in the past nine days.

- Wednesday's drop of nearly $50 million is the biggest since TVL fell by $100 million on Sept. 21.

SushiSwap TVL has fallen roughly 75% since its all-time high.

- This marks a significant change in SushiSwap's fortunes, which just weeks ago looked to supersede Uniswap after it took $830 million in vital liquidity.

- However, a $500 million UNI airdrop and concerns over SushiSwap's founder saw most of that liquidity bounce back to Uniswap.

- Indeed, from just $430 million in TVL in mid-September, Uniswap has made a dramatic snapback, becoming the first protocol to break the $2 billion milestone this week.

- In the past 24 hours, Uniswap's TVL has risen by approximately 2%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IDC3T7NRTFEBXLBKHOX5WNX5QY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NLAQNN5WM5GRFDBV23KH3WYMBM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WWJMA7GZLNGTFENGAM55VIK4CU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VAPG2GNB7VCZ3HVBESBII5LKNE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2T5ZEDYTFJF37HXO5YUQHFSNIA.jpg)