Bitcoin capped the week weaker while DeFi crypto locked dipped.

- Bitcoin (BTC) trading around $13,354 as of 20:00 UTC (4 p.m. ET). Gaining 0.14% over the previous 24 hours.

- Bitcoin’s 24-hour range: $13,191-$13,663

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Bitstamp since Oct. 28.

The price of bitcoin was able to muster a rise to as high as $13,663 Friday, according to CoinDesk 20 data. However, the world’s oldest cryptocurrency subsequently lost some steam and settled to $13,354 as of press time.

Michaeal Gord, chief executive officer for trading firm Global Digital Assets, said he expects the bitcoin market to cool ahead of uncertain fundamentals next week. “I think we’ll probably stay sideways until the [Nov. 3 U.S. presidential] election, with most investors taking a wait-and-see approach,” he said.

However, Gord said he anticipates things will pick up amid coronavirus concerns on the global economy.

“As more countries enter a second lockdown, governments will need to print more fiat currency to keep their economies afloat, which I expect to result in an increasing demand for alternative assets over the next few weeks,” he said.

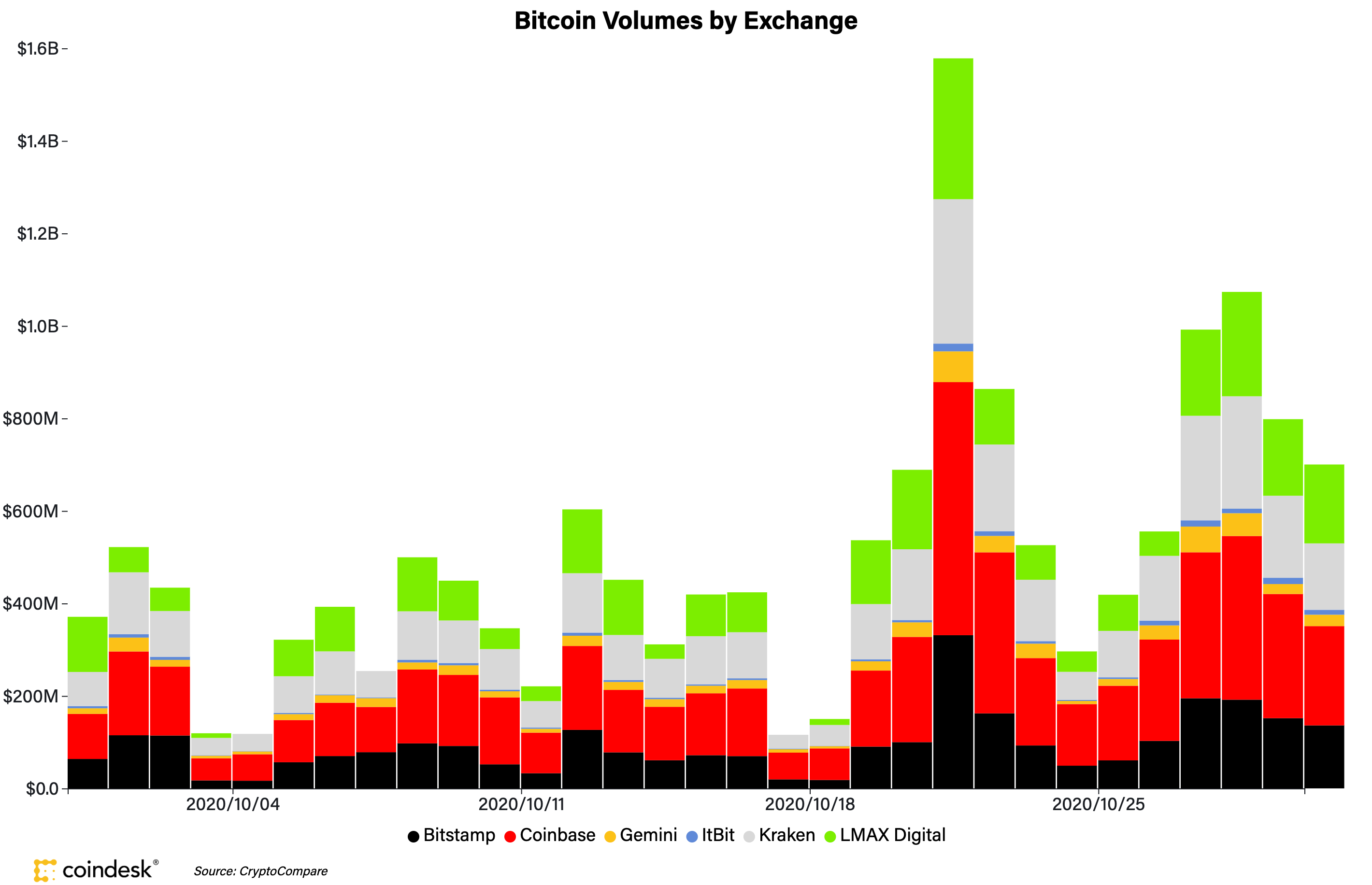

Volumes on major USD/BTC spot exchanges are shaping up to be higher than average the past month Friday. Daily average volume has been $494,925.493 the past 30 days, while Friday was at $700,217,632 as of press time.

USD/BTC volumes on major exchanges the past month.

While higher than average volumes might indicate a potential price move upward, it’s possible equities will be taking the front seat in how bitcoin performs in the near term.

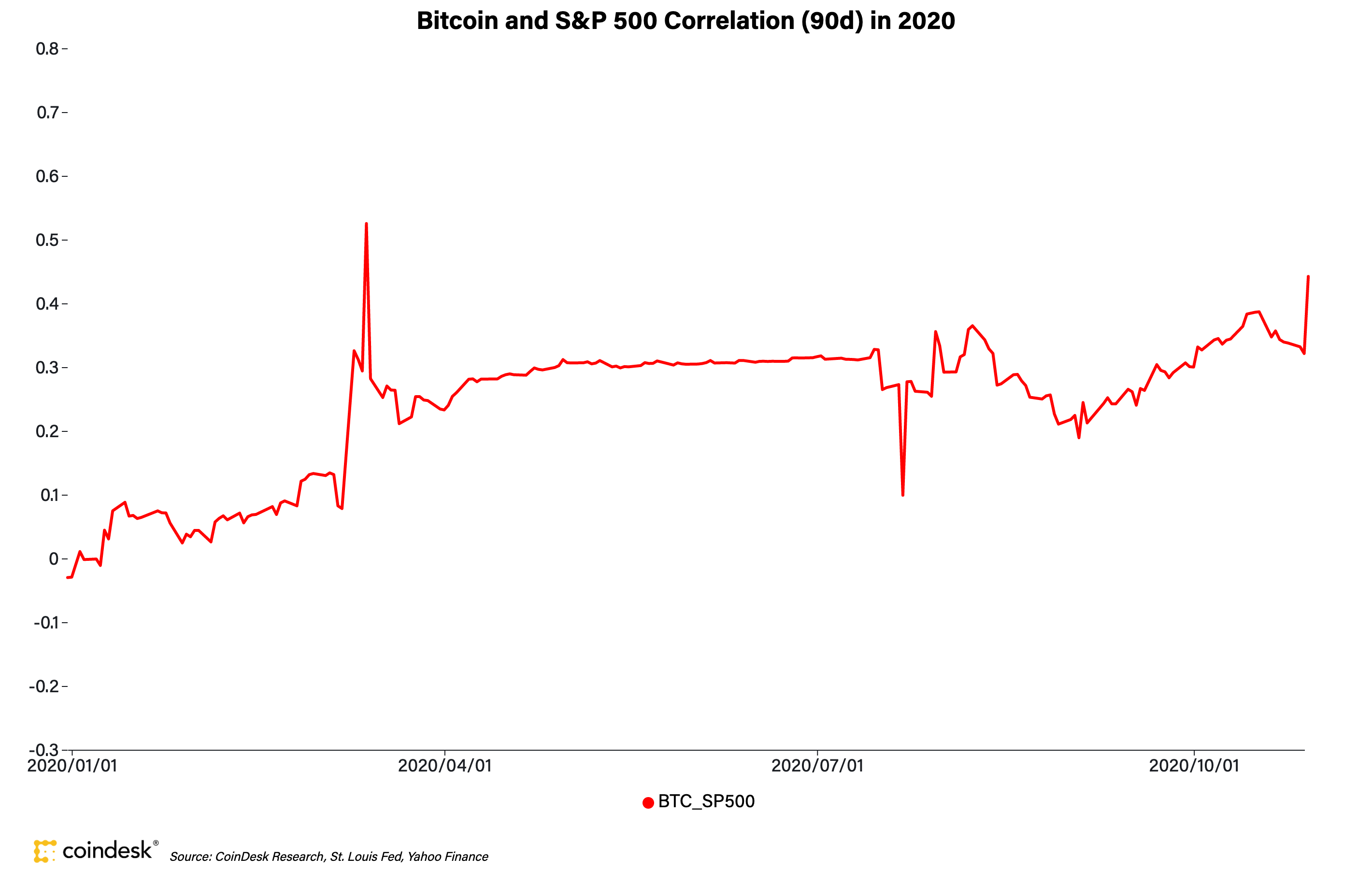

“For most of the pandemic, BTC remained correlated with equities,” noted Andrew Ballinger, an investment analyst at crypto-focused firm Wave Financial. Indeed, correlations between bitcoin and the S&P 500 seem to be rising as stock sell-offs or tepid days had an impact on the cryptocurrency market.

Bitcoin’s 90-day correlation with the S&P 500 index in 2020.

“I wouldn’t be fully honest if I said I didn’t believe a major downturn in equities would have no effect on the still-nascent digital asset economy,” Ballinger added. Major stocks indices are in the red on Friday.

- The Nikkei 225 in Asia slipped 1.5% as coronavirus concerns outweighed the release of positive Japanese industrial output numbers for September.

- The FTSE 100 in Europe ended the day flat, in the red 0.08% as investors signaled uncertainty amid lockdowns and eurozone GDP beating forecasts.

- In the United States the S&P 500 fell 2.1% as increasing concerns about the pandemic combined with stalled talks in Congress on a stimulus package led investors to sell.

Despite the possibly negative influence of stocks on crypto, Ballinger has a bullish forecast. “Short of a significant and swift hit to the equity markets, I still stand by my prediction of bitcoin hitting $14,000 before year end,” Ballinger said. “With continued uncertainty surrounding the economic recovery, investors may turn to digital currencies over equities, and test the ‘digital gold’ thesis of bitcoin further.”

DeFi value locked drops

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Friday trading around $383 and slipping 1.9% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

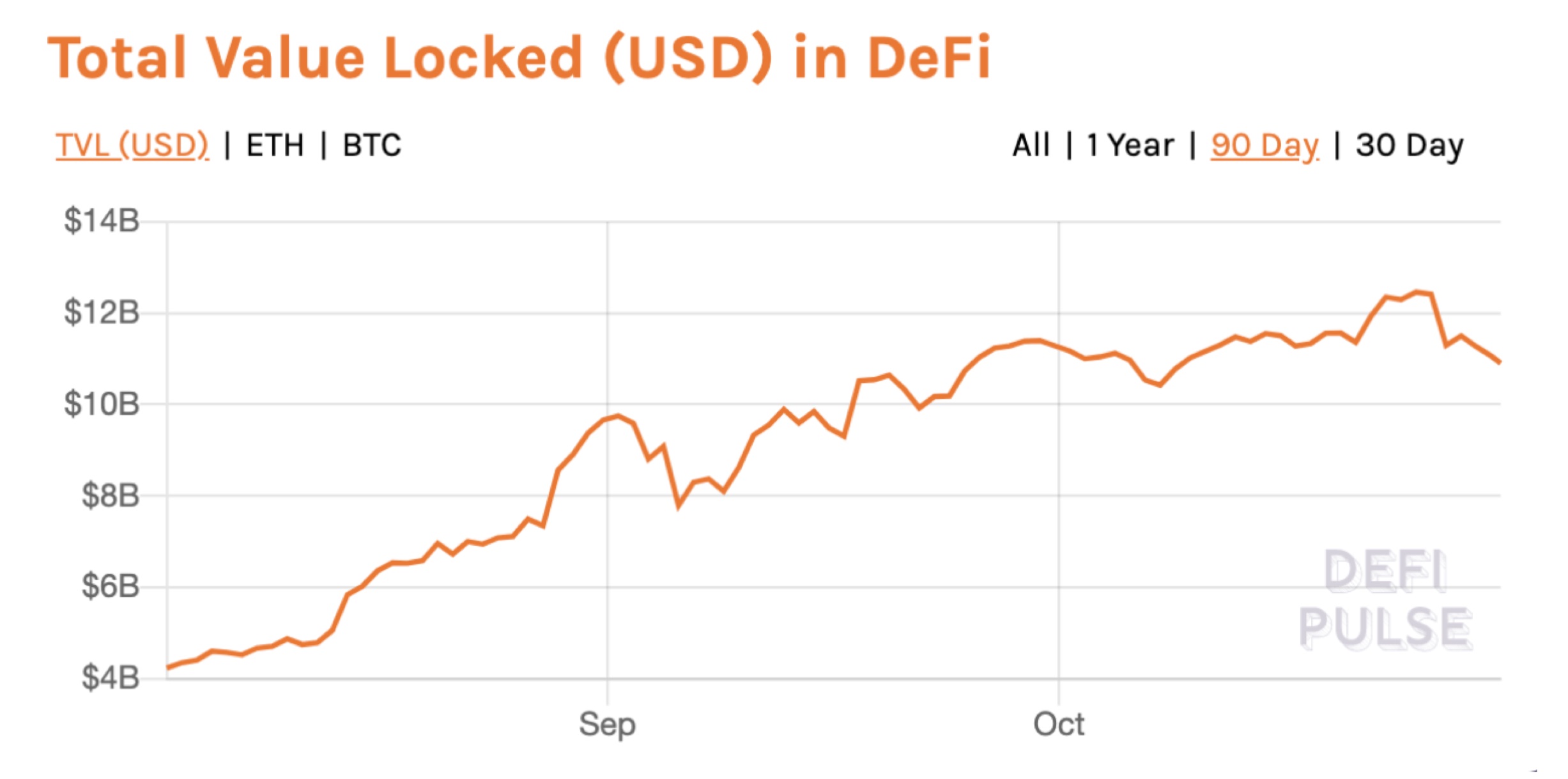

The amount of cryptocurrency “locked” in decentralized finance (DeFi), known as total value locked, or TVL, is trending downward. On Friday, the amount of crypto TVL dipped below $11 billion. The last time TVL was at this level was back on Oct. 8.

Total value locked in DeFi the past three months.

Over-the-counter crypto trader Alessandro Andreotti said the DeFi TVL decline is only temporary because of bitcoin’s price closing in on 2020 highs. “I think it's only a momentary downtrend since bitcoin is on the spotlight for now. We're gonna see new highs for DeFi and crypto in general after the U.S. election,” he said.

Other markets

Digital assets on the CoinDesk 20 are mixed, mostly red Friday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers:

Commodities:

- Oil was down 1.4%. Price per barrel of West Texas Intermediate crude: $38.58.

- Gold was in the green 0.57% and at $1,878 as of press time.

Treasurys:

- U.S. Treasury bond yields all climbed Friday. Yields, which move in the opposite direction as price, were up most on the two-year bond, jumping to 0.156 and in the green 6.6%.

The CoinDesk 20: The Assets That Matter Most to the Market

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/AQIQI26PEFFCTGW24BFETS3STY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)