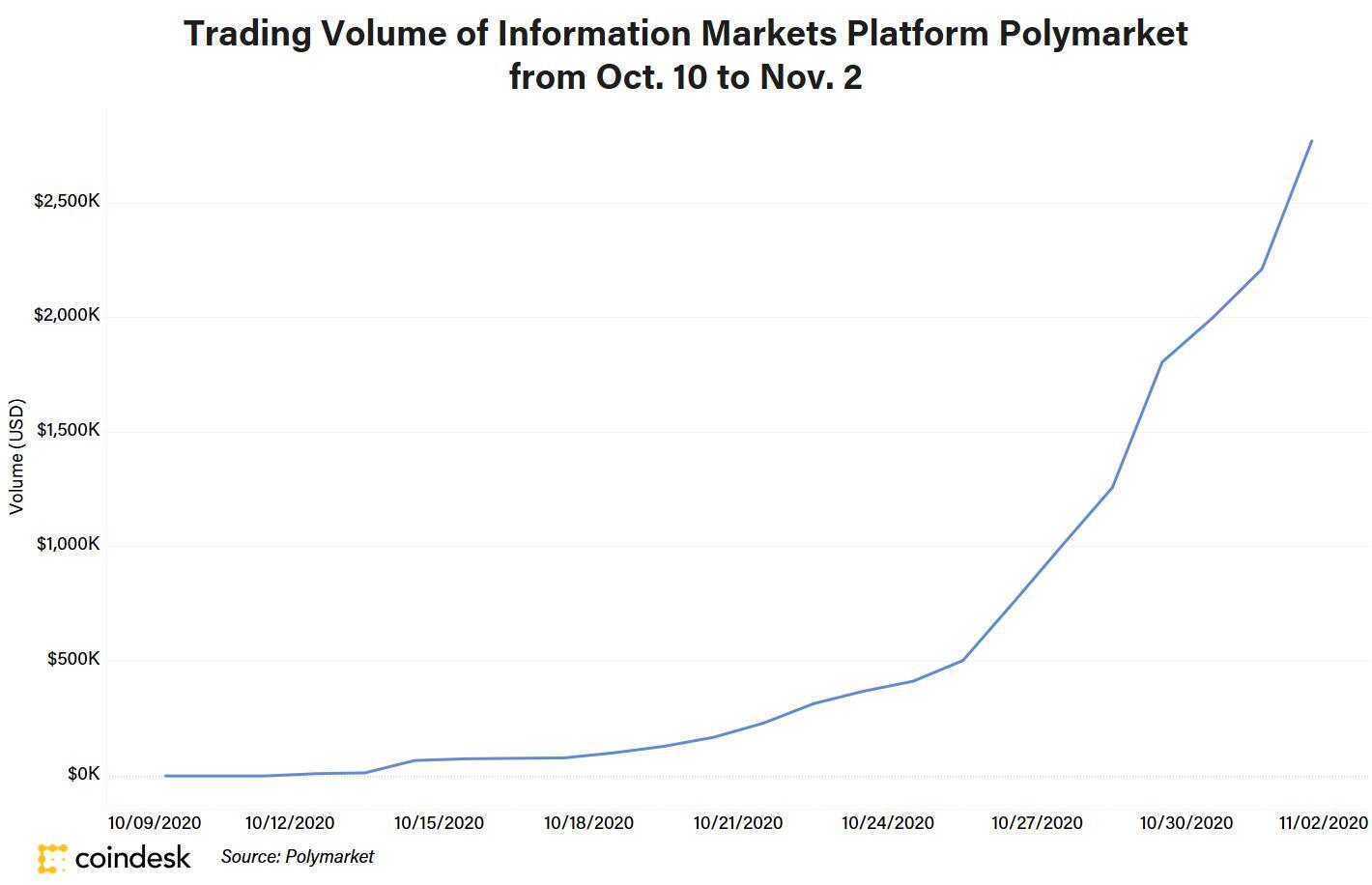

In just over three weeks, the trading volume on decentralized betting platform Polymarket went from zero to almost $3 million.

As of Monday, Polymarket’s “Will Trump win the 2020 U.S. presidential election?” had over $2.8 million worth of bets placed, with each bet (for possible answers “yes” or “no”) costing less than a dollar. The platform allows users to place crypto bets on highly-debated current events and public topics including politics, pop culture, business and health, according to its website.

Polymarket is a non-custodial platform, meaning it does not hold or store user-funds, and bets can be placed in the dollar-backed stablecoin USDC.

Polymarket Trading Volume Growth | Chart by Shuai Hao, CoinDesk Research

Prediction markets, where users can bet on the outcome of future events, are a key application of decentralized finance (DeFi), which allows users to conduct financial transactions on a blockchain without a middleman.

Elections and political debates attract high numbers of traders to these platforms; decentralized prediction platform Augur launched five years ago, but struggled to take off until U.S. midterm election betting gave it a modest push in 2018.

“To me, the presidential election is the Super Bowl for prediction markets. Every single one is experiencing a massive uptick in volume. It’s only natural that crypto follows suit,” David Liebowitz, vice president of business development at decentralized encyclopedia Everipedia, told CoinDesk via Telegram.

Elections also seem to attract new users to crypto betting platforms.

“There are people who are using it, who aren't even crypto native users. They don't even fully understand crypto but they're still using Polymarket,” said Shayne Coplan, founder of Polymarket.

After Elections

Users are looking at a number of betting and prediction markets in the runup to Tuesday’s election. Anonymous crypto betting platform YieldWars launched its election battle last night and has since attracted over $50,000 in bets. Users can stake either the platform’s native $WAR token or ETH.

YieldWars’ co-founder, who goes by Owl, told CoinDesk via Telegram the sudden rise in volume is far from shocking given the scale and importance of the election.

“Crypto-based prediction markets should be flourishing on blockchain right now but have failed to deliver up to this point. The election has breathed life into prediction markets but what is going to happen when it ends? Are people going to be as enthusiastic about them?” Owl said.

Owl also said YieldWars may have found the “secret sauce” to keep people interested in betting, by creating battle royale-style tournaments for betting, ideal for sporting events. The election face-off is a one-time battle, where two pools are running simultaneously, one in each currency.

The platform has partnered with Everipedia to use Associated Press (AP) election data for resolving its election betting market.

In October 2020, the reputed wire-service AP, in a first, partnered with Everipedia to create Oracle, an immutable record of 2020 election results on a blockchain.

“I don’t think there could be a more trusted source than the AP and seeing that the Oracle was built using Chainlink infrastructure, it was only logical to go with this option,” Owl said.

According to Liebowitz, blockchain has long been viewed as the best platform for prediction markets to thrive. But centralized betting platforms like PredictIt are still leading the game.

PredictIt has 214 “markets” or betting scenarios compared to the new-kid-on-the-block Polymarket’s 19 markets. As of Monday, PredictIt’s top event “2020 Presidential Election Winner?” had 116.7 million shares traded.

Coplan declined to say how that compared to Polymarket, calling it a “bizarre metric” adding his platform only tracked dollar trading volumes, and it did not have an equivalent.

Then, there is the expectation that elections will boost betting volumes.

“It’s only going to get bigger from here, especially four years from now when the next election comes around,” Liebowitz said.

According to Coplan, the demand for blockchain-based betting markets has always been there.

“It was just clear that there was a lot of demand for this. I would say, the past week or two, the demand has actually materialized. Still, these are just the very early days,” Coplan said.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2I63ZERWENE6DFS7VAC5KTGKJM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)