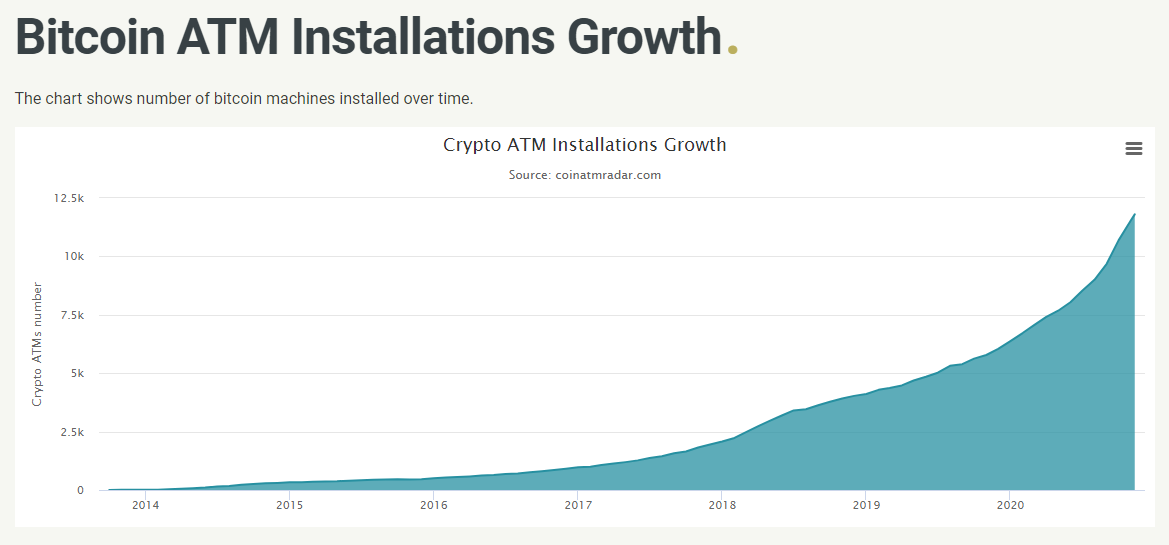

The number of bitcoin automated teller machines (ATMs) across the globe has surged this year amid the coronavirus-induced shift toward contactless payments.

Bitcoin ATM installations have increased by 85% to 11,798, outpacing the previous year's near 50% rise by a significant margin, according to data source Coin ATM Radar.

The spike demonstrates the rising popularity of bitcoin as a payment mode. The fear of getting a coronavirus infection has accelerated the growth in the broader contactless payment market this year, according to Global Trade Magazine.

Bitcoin's borderless network facilitates a seamless transfer of money in any amount from anywhere across the globe, through any mobile or computer, and at relatively lower fees than traditional banking channels.

A bitcoin ATM allows a person to purchase the cryptocurrency by using cash or debit card. Some machines facilitate the purchase of bitcoin and the sale of cryptocurrency for cash.

Bitcoin ATM installations growth

The U.S. added over 800 ATMs in October alone and is leading cryptocurrency adoption, followed by Canada and Germany, as noted by Coin ATM Radar.

With several public companies investing in bitcoin and online payments giant PayPal adding support to the cryptocurrency, mainstream adoption could continue to grow.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CD6NS2LLZJCDPEN2PDEES4BSSI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z46FU4UPONEOPG3WNCZGMXDVPQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RY642ORET5GYFOW5HKCWX3D4AQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FU36HQ5QQZEI7FCZNR3SAX7NKI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZBMVVRT44NGC3FKE7I367SV6SA.jpg)