Bitcoin’s (BTC) role in portfolios as a store of value is by now relatively well known. Its hard supply limit in the face of unprecedented money supply increase is encouraging traditional fund managers to allocate funds to a bitcoin portfolio position, and corporations to hold it as a reserve asset.

But what about ether? Could the native cryptocurrency of the Ethereum blockchain hold a similar position?

We know that institutional investor interest in ETH is increasing. The Grayscale ETHE trust had growth of over 40% of its almost $800 million 2020 inflows come in the fourth quarter alone. (Grayscale is a CoinDesk sister company.) A number of ETH investment products have come to market over the past few months, including several exchange-traded funds in Canada. And on Feb. 8, the Chicago Mercantile Exchange, which caters primarily to institutional investors, listened to increasing client demand and launched ETH futures.

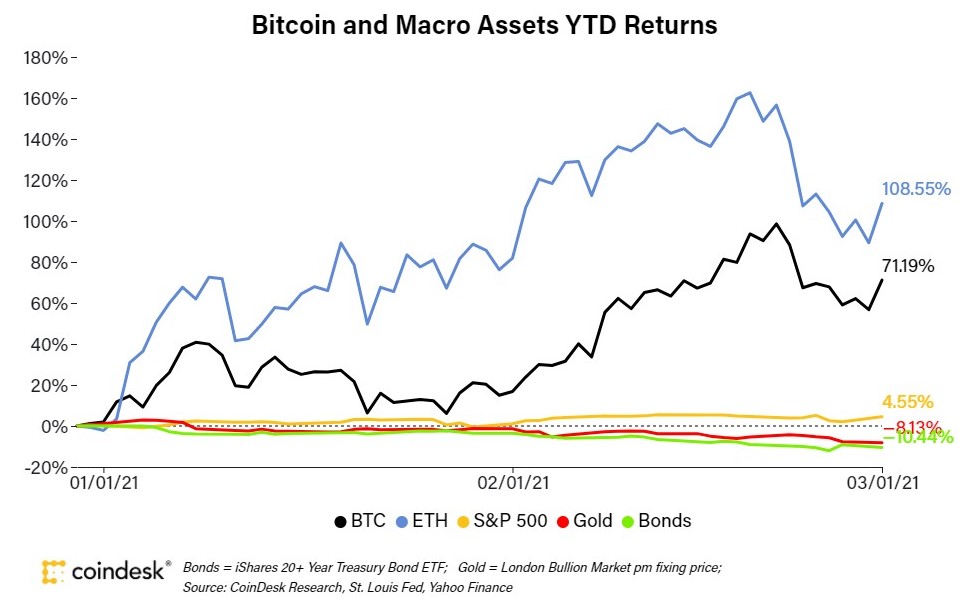

This growing interest can be seen in ETH’s recent performance. Whether looked at for the year to date or over 12 months, ETH has significantly outperformed BTC.

Is that why are investors are becoming increasingly interested in ETH? Or are they seeing it as a cheaper store of value than bitcoin?

A new report from CoinDesk Research looks into the value propositions of bitcoin and ether, as well as the different market structures and on-chain data.

Our report found that while bitcoin is increasingly seen as an emergent store of value, ether is more of a technology play. For this reason, it is a riskier bet, which explains its outperformance.

However, the full story is not quite that simple. Bitcoin is also a technology play, and ether is also a potential store of value asset.

Both assets have considerable potential upside for this reason. Ether and bitcoin could end up being considered one, the other or both. Success does not depend on just one outcome.

Meanwhile, the prevailing narratives of each – emergent store of value for bitcoin, technology play for ether – continue to evolve. Ethereum’s technological development is at an inflection point, with the progress towards migration to a proof-of-stake blockchain. Bitcoin’s disinflationary monetary policy is becoming more obvious as fiat monetary stimulus shows no signs of abating and a growing amount of bitcoin gets moved to long-term storage.

Download our free report to dive into the different value drivers for BTC and ETH, why institutions are interested and what risks lie ahead.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4M2IFB523RH5RLRQWH7YTCB7DA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DV7MYDYKMZETDKRTBUX7B5VOHY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZEHNAVGSVRDSVKX55HSAX4UIHI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SQIA5FR3XZD45C42OHL6ZAFK7Q.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KU3X2OILYJCFFGK42UK5XX35FY.jpg)