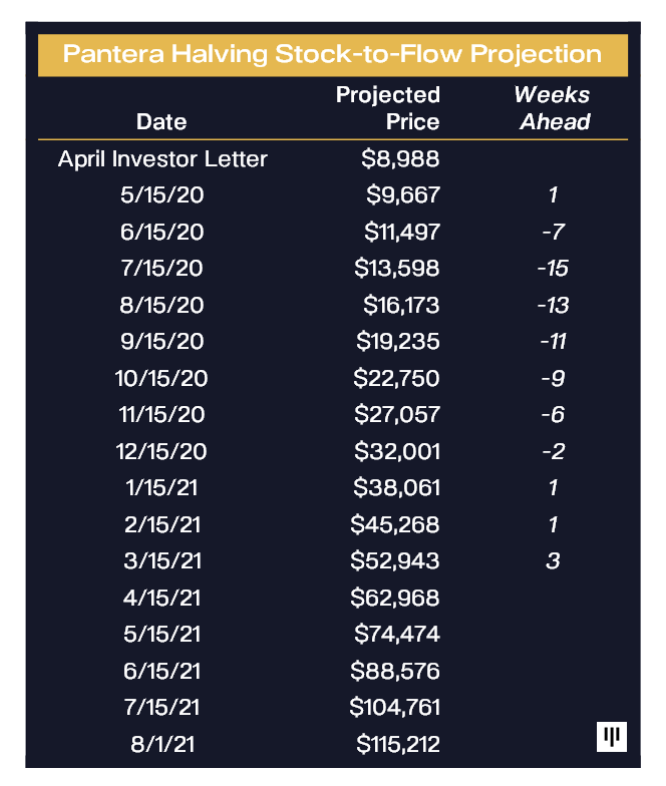

“Bitcoin is now ahead of our April 2020 forecast schedule – to hit $115K this summer,” wrote Dan Morehead, CEO and co-chief investment officer at Pantera Capital, a blockchain hedge fund, in an emailed newsletter.

The Pantera prediction is based on the stock-to-flow model – an analytical framework that values an asset's price based on its annual issuance schedule. The model measures the scarcity of bitcoin (BTC), which is governed by the underlying network programming coded into the blockchain's design when it was launched 12 years ago.

Under that plan, the number of new bitcoin created with each new data block every 10 minutes or so gets cut in half roughly every four years. In theory, according to the stock-to-flow model, the bitcoin price should rise as the issuance rate declines.

Morehead's predictions carry weight partly because of his prior Wall Street experience: Before founding Pantera in 2003, he served as head of macro trading for the hedge fund Tiger Management, and before that he worked as a trader at Deutsche Bank and Goldman Sachs.

Table shows Pantera's bitcoin price projections, reaching $115K this summer.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5PS6FFH6ZBBY7CXV2HRZWNZD6A.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TPIELPTEOFCFBMZMK37FF3FBA4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2K6KHE7MI5E77JNGFZR2PHPKPE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ASBYAI7RH5D7DLS3IM6FCSR7EA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BIYJNJIUNZCSLPQIMFT76Z57XE.png)