In a sign of just how dramatically the coronavirus vaccine has altered the market calculus on Wall Street, the fear of soaring inflation has displaced the pandemic as fund managers’ biggest worry, according to the latest monthly survey by Bank of America.

And betting on a bitcoin rally remains one of the hottest trades.

According to the survey, higher-than-expected inflation is now seen as the biggest “tail risk” – an event that’s seen as statistically unlikely but with potentially dramatic consequences. The coronavirus slipped from the No. 1 concern for the first time since February 2020.

"This implies that global fund managers think vaccination will finally lead us to re-opening and that the extremely loose monetary policy in times of economic recovery is not without risk," Jeroen Blokland, portfolio manager for the Robeco Multi-Asset funds, noted in a daily analysis.

Concerns about rising inflation could boost hedging demand for the store of value assets such as bitcoin and gold, although recently investors have started to wonder whether the Federal Reserve might unwind stimulus as the economy reheats. That might set up the cryptocurrency’s price for a fall because the 12-year-old digital asset is still seen as a risky investment, similar to stocks.

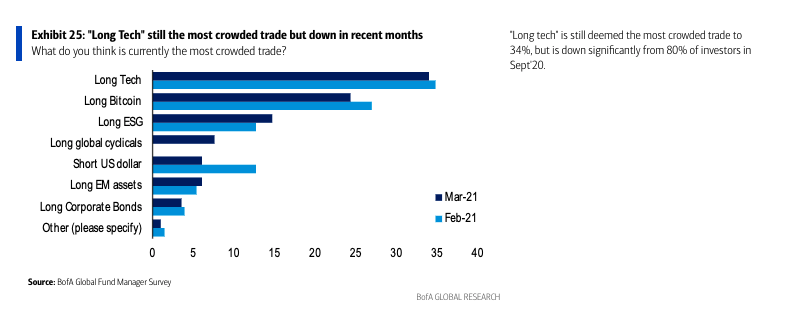

However, the survey shows "long bitcoin," or a bullish bet on the cryptocurrency, is the second-most crowded trade in the financial market. A crowded trade is one that is extremely popular, but also so widely held that a market pullback could trigger a violent unwind as traders scramble to exit positions.

Fund managers saw "long tech" as the the most-crowded trade for the second-straight month, while betting against the U.S. dollar was the fourth-most crowded.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZK6EAOZUR5HEJIQNX4257UUJLI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)