Traders are getting used to bitcoin (BTC) buying that is concentrated during European hours, with North America lagging behind and Asia inviting more sellers. Yesterday's Asia trading session was no exception.

"Overnight, the Bank of Japan announced [it] would reduce asset purchases in a move that signaled marginal tightening of policy. By the time European markets opened, [those investors] digested this news and immediately went into defensive move ... [which also] put a damper on the strong price action in BTC," wrote Chad Steinglass, head of trading at CrossTower, a digital asset trading firm.

- The BoJ is considering ditching its 6 trillion yen purchase target of buying exchange-traded funds (ETFs), as reported by Bloomberg. The ETF purchase program is expected to only be used in times of market turmoil, which could be interpreted as marginal tightening.

- The quick risk-off reaction to the BoJ news during Asian and European hours is not unusual.

- "It's not uncommon for Europeans to be more skittish than others. Since the Lunar New Year, Asian markets have been relatively weak," Steinglass told CoinDesk in a phone interview.

- "Crypto will trade with risk [assets] intraday. Over the last few weeks, bitcoin has been affected by rocky markets, but has been resilient, which is encouraging."

The recent bounce above $58K is consistent with rising price floors in BTC as the long-term trend remains intact. "Every time we break into a new range, old resistance becomes support – consistently over the last several months," said Steinglass.

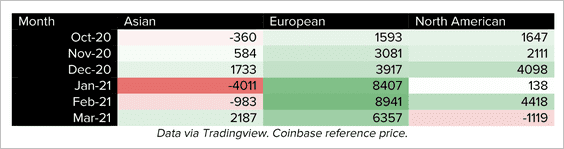

Chart shows BTC performance by Asian, European and North American sessions.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5IGFFZ6XORHFZG2PCVM4QZWMDY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PN2SE2FZFVG3ZPSQW2KBZYRG6Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JBYO5LSILBBOBLPJ7T7MPHUL6U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FFPY6ZJMFBCLXEAG7ILKKF3NBM.webp)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZK7ETSI4G5GNHDXHUA7MNGHQAE.jpg)