In cryptocurrency markets they call it the "Coinbase effect" – the theory that up-and-coming digital tokens like cardano tend to experience a quick price pop after they're listed on the big U.S. exchange Coinbase.

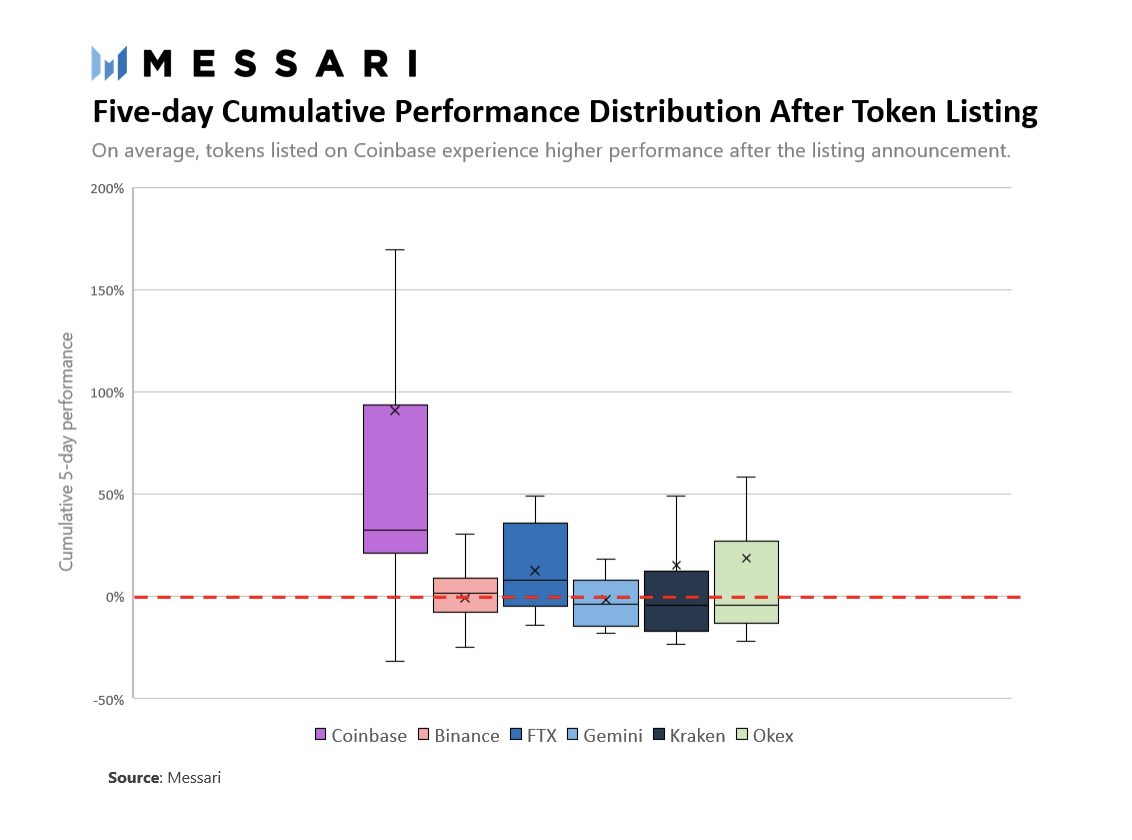

The phenomenon has been exhaustively researched and chronicled, and it happened recently after the digital-token cardano (ADA) listed on Coinbase. But now the cryptocurrency analysis firm Messari has conducted a fresh study looking at the price pops of tokens on Coinbase during their first five days of trading, compared with the impact of listings on other big digital-market venues including Binance, FTX, OKEx, Kraken and the Winklevosses' Gemini.

The conclusion? The Coinbase effect is quite real.

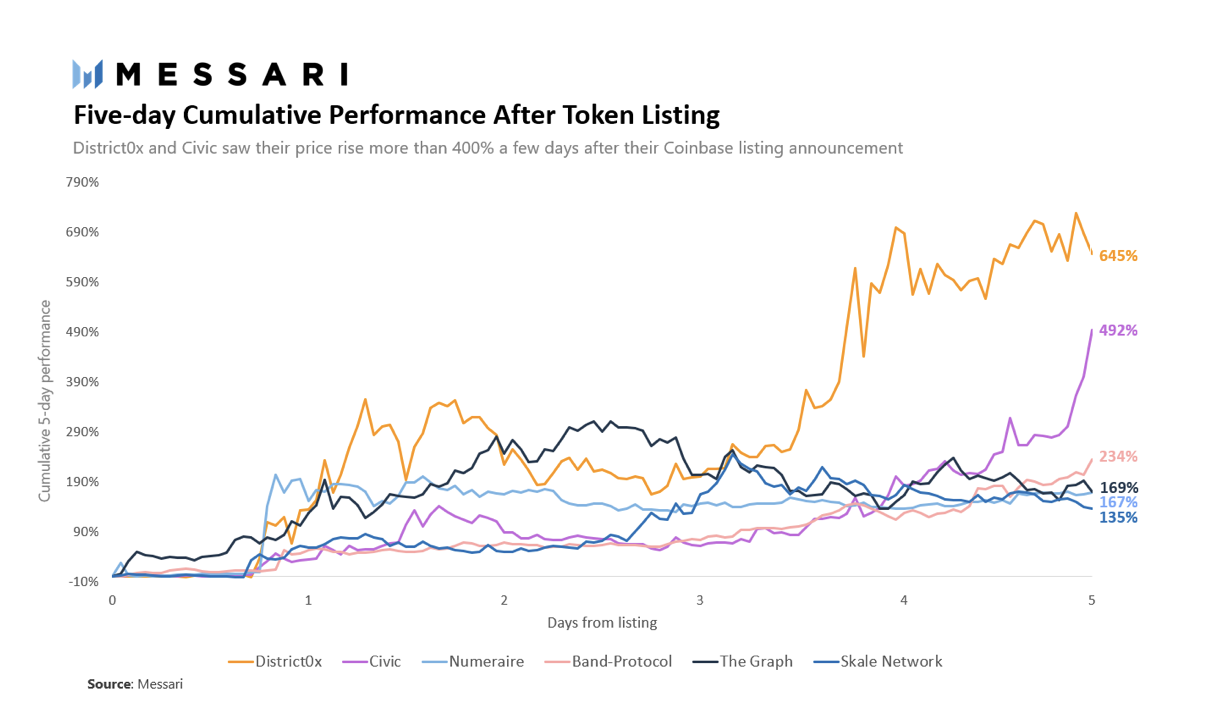

“Coinbase listings have the highest average return standing at 91%, but also have the widest distribution of ranging from -32% to 645%,” wrote Roberto Talamas, analyst at Messari, a cryptocurrency research firm in newsletter post titled "The Crypto Exchange Pump Phenomenon."

Cardano, for its part, jumped 36% in two days on the rival Kraken exchange when Coinbase announced March 16 it planned to list the token, though some of those gains reversed on March 18 when trading actually started on Coinbase. (Messari's analysis looked at the token performance during the first five days following the listing, rather than from the date of the announcement.)

- Messari then scrubbed the data to eliminate "outlier" data points – price reactions seen as so extreme that they might create an unrealistic picture of the effect.

- “Outliers experienced tremendous returns after their listing announcements, drastically skewing the average towards the right side of the distribution.”

- “Among these outliers, District0x (a platform to create decentralized marketplaces and communities) and Civic (an identity verification solution) saw their price increase 645% and 493% respectively,” wrote Talamas.

- Even after controlling for the outliers, Coinbase still had the highest post-listing price response compared with other big exchanges.

Chart shows five-day cumulative token performance after Coinbase listing.

Chart shows five-day cumulative performance distribution of digital tokens after their day of listing, across six big cryptocurrency exchanges, since May 2020. Tail ends identify extreme highs and lows, while shaded areas are upper/lower quartiles surrounding average and median returns. Extreme outliers are removed.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NPJPRMJKYJF2XHXD4DX7ZTTDPY.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)