Coinbase shares fell Wednesday below their initial opening price as traders scrambled to assess the largest U.S. cryptocurrency exchange's value in a volatile first day following the historic direct listing on Nasdaq.

After opening at $381 at around 1:30 p.m. ET, Coinbase shares (NASDAQ: COIN) soared to as high as $429.54 before dropping more than 100 points over the next hour and a half to close at $328. That was below the $348 price where the shares last changed hands in private markets.

"There's always a lot of excitement that builds up to this moment," FundStrat analyst David Grider told CoinDesk. "That excitement rolled over a little bit."

Even with their dizzying drop, Coinbase shares were well above their $250 reference price assigned Tuesday evening by the Nasdaq. Compared to the first trade of $381, however, COIN closed down 14% on the day.

COIN's price movement on Day 1

At a share price of $328, Coinbase would have a valuation of about $65 billion, assuming 199.2 million shares outstanding. Using the fully diluted share count of 261.3 million, the implied market capitalization would be about $86 billion.

Earlier in the day, Coinbase had achieved a valuation over $100 billion, based on the higher share count.

"The uninformed were driving price on it more than the informed," said Jeff Dorman, chief investment officer at the cryptocurrency asset manager Arca. "In three to six weeks you'll see higher prices."

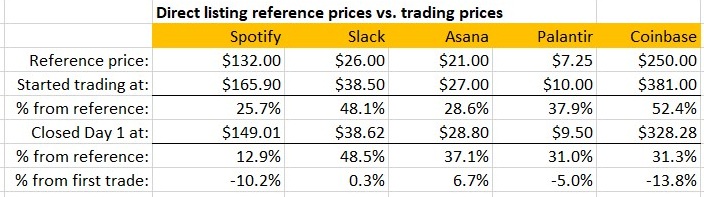

In percentage terms, the COIN listing ranks about even with other similar debuts, according to data compiled by CoinDesk Research:

A comparison of tech-stock direct listings.

“There is bound to be a lot of volatility,” Coinbase board member Fred Ehrsam told CNBC Wednesday. “That’s just the nature of such a huge technology coming into existence.”

Click the image for CoinDesk's full coverage of the Coinbase public listing.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NAF4ULDQJFCTZD5IKGUAS3QLXY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)