It’s boring bitcoin so far this week, with ether making gains for traders in a crypto market that overall is still signaling bullishness.

- Bitcoin (BTC) trading around $55,502 as of 21:00 UTC (4 p.m. ET). Slipping 1.9% over the previous 24 hours.

- Bitcoin’s 24-hour range: $54,565-$57,043 (CoinDesk 20)

- BTC close to the 10-hour and 50-hour moving average on the hourly chart, a sideways signal for market technicians.

Bitcoin’s hourly price chart on the Bitstamp exchange since April 18.

The price of bitcoin has changed little over the past 24 hours, despite the asset’s notorious volatility causing the spot market to undulate from $54,565 to $57,043 during the session, a $2,478 swing, according to CoinDesk 20 price data.

Nevertheless, BTC has mostly stayed above $55,000 for almost a month. According to CoinDesk 20 historical data, the last time bitcoin closed below that level was back on March 26.

Bitcoin’s daily price so far in 2021.

Since the start of April, bitcoin’s dominance, a measure of the asset against the broader crypto market as calculated by charting firm TradingView, has plummeted. It’s down almost 10% since April 1, and bitcoin is currently at 51% dominance as of press time, roughly half the market. At the beginning of 2021, that figure was over 70%.

“Traders are looking for opportunities elsewhere,” noted David Russell, VP of Market Intelligence at brokerage firm TradeStation Group. ”That’s what seems to be happening now. It’s not bearish but a potential sign of confidence in the space.”

Bitcoin dominance as a percentage of the overall cryptocurrency market’s capitalization over the past two months.

Less bullish bitcoin action after the excitement of Coinbase’s direct listing isn’t a surprise for some, with prices unable to break through all-time high of $64,829.14 reached April 14. “As expected, we saw the April 14 ‘Coinbase top’ we were positioning for that bled into a deleveraging weekend sell-off,” noted quantitative trading firm QCP Capital in an investor note on Wednesday.

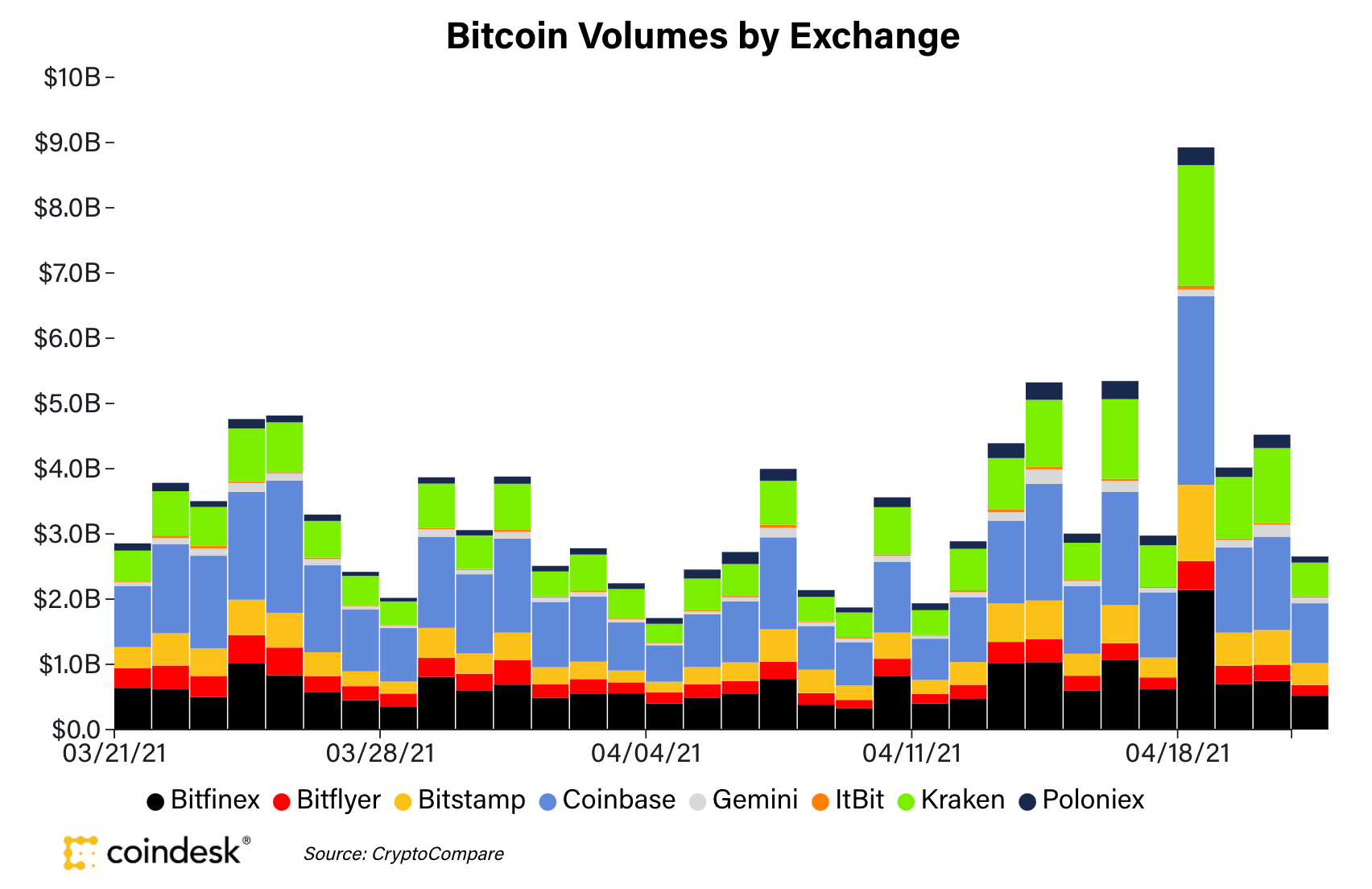

A week later, traders are looking at other markets to play in. Volumes on major spot exchanges are much lower than average Wednesday, below $3 billion on the eight major exchanges tracked by the CoinDesk 20.

Bitcoin volumes on eight major exchanges over the past month.

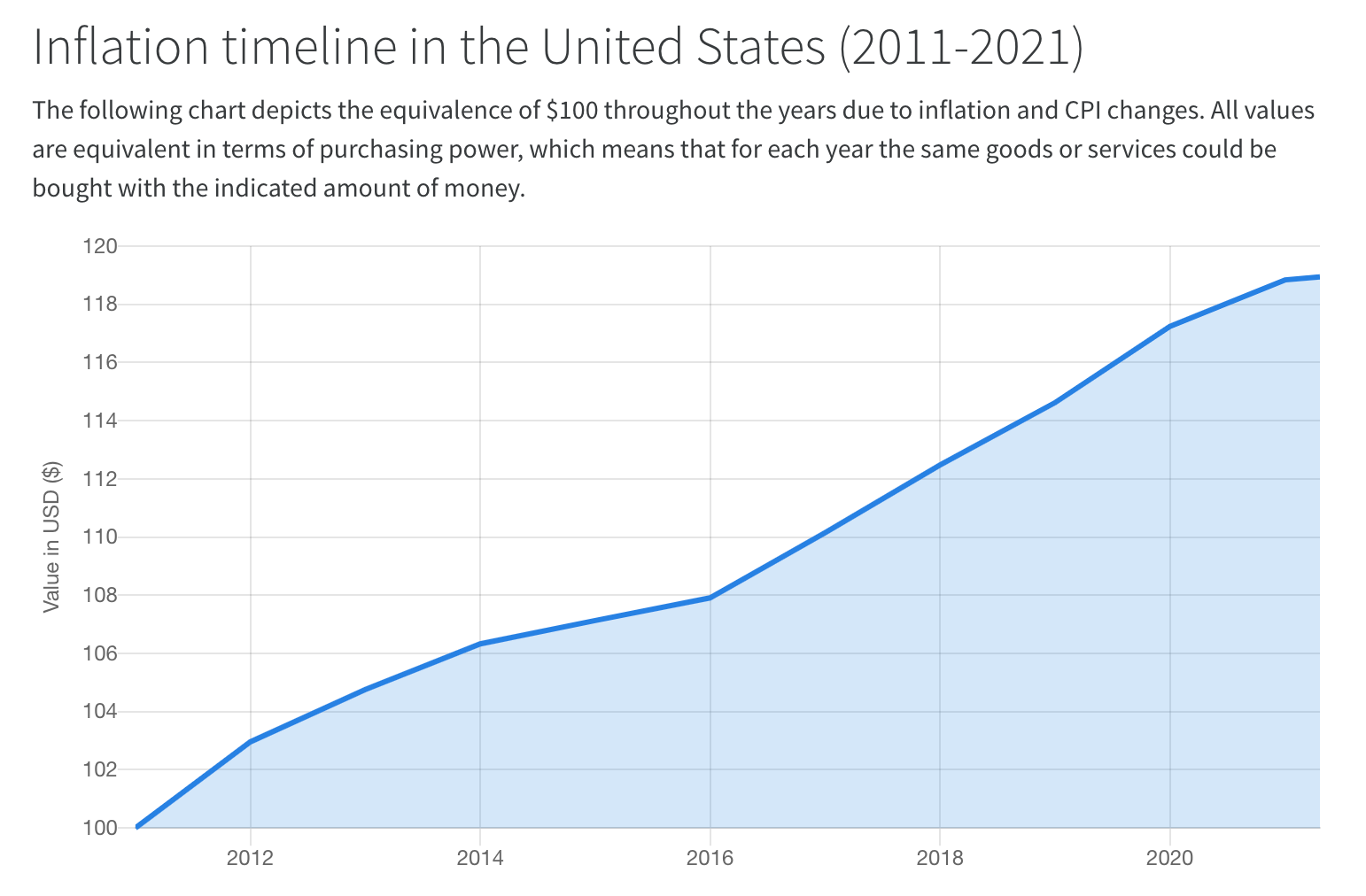

TradeStation’s Russell told CoinDesk that U.S. dollar inflation will continue to be a key driver for investment into cryptocurrencies, and the case for crypto remains. According to data aggregator Inflation Tool, in the past decade the greenback’s value has decreased in purchasing power,so that it takes $118 in 2021 to pay for something that would have cost $100 in 2011.

“Procter & Gamble is raising prices and the [Federal Reserve] isn’t raising interest rates. Signs of inflation are mounting throughout the economy,” added Russell. ”Inflation and scarcity value could emerge as newer drivers for the crypto space, especially with a Fed meeting next week.”

Dollar inflation timeline from 2011-2021 based on inflation and consumer price changes. Source:

Ether bullish over bitcoin

The ether/bitcoin trading pair on Coinbase since April 18.

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Wednesday, trading around $2,425 and climbing 4.2% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

While bitcoin’s price has been mostly stagnant this week, ether is popping. A good measure for comparing the world’s oldest cryptocurrency to ether is by viewing charts on the ETH/BTC pair, available on most major cryptocurrency exchanges.

When the pair on the charts goes bullish, it means traders are selling bitcoin for ether, the case right now.

The ETH/BTC went bullish on Tuesday, with the price now well above the 10-day and 50-day moving averages on the hourly chart; it’s up over 5% so far today on Coinbase.

“It's interesting to note at the current ETH/BTC ratio we are back to levels last seen at the beginning of February,” noted Andrew Tu, and executive at quantitative trading firm Efficient Frontier.

“In February we saw this top out at 0.046 BTC. So this is the level we should be looking at, to see whether it breaks out of that resistance,” Tu added. As of press time, ETH/BTC was trading at 0.043 BTC on Coinbase.

Nick Mancini, research analyst at crypto sentiment analytics firm Trade The Chain, told CoinDesk a breakout in bitcoin's price performance could cause ETH and other crypto markets to see red. “If bitcoin breaks bullish out of the current trend, we will likely see ETH and [altcoins] take a small hit.”

Other markets

Digital assets on the CoinDesk 20 are mostly higher Wednesday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- kyber network (KNC) + 7.4%

- orchid (OXT) + 3.3%

- omg network (OMG) + 2.7%

Notable losers:

- ethereum classic (ETC) - 4.3%

- stellar (XLM) - 2.9%

- cosmos (ATOM) - 2.2%

Equities:

- Asia’s Nikkei 225 index closed down 2% despite positive export data from March, with engineering firm Chiyoda and retailer Rakuten both slipping more than 5%.

- The FTSE 100 in Europe closed in the green 0.52% as traders digested positive corporate earnings reports, motivating them to buy stocks.

- The United States’ S&P 500 index was up 0.93% Wednesday as traders navigated positive earnings results although Netflix stock dropped 7% on poor subscriber numbers.

Commodities:

- Oil was down 2.1%. Price per barrel of West Texas Intermediate crude: $61.04.

- Gold was in the green 0.90% and at $1,794 as of press time.

- Silver is gaining, up 2.9% and changing hands at $26.57.

Treasurys:

- The 10-year U.S. Treasury bond yield fell Wednesday to 1.554 and in the red 0.22%.

The CoinDesk 20: The Assets That Matter Most to the Market

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2VYH2KVS6NDFZNIRYGEI33VLR4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)