ETC has almost doubled during the past week alongside other altcoins and bitcoin lagged. Bitcoin rose just 0.65% during the same period.

“We think there are forced Ethereum Classic Trust (ETCG) sellers in the market who are also forced ETC buyers that need to cover borrowed positions in the spot market,” Grider wrote in a research note published on Friday.

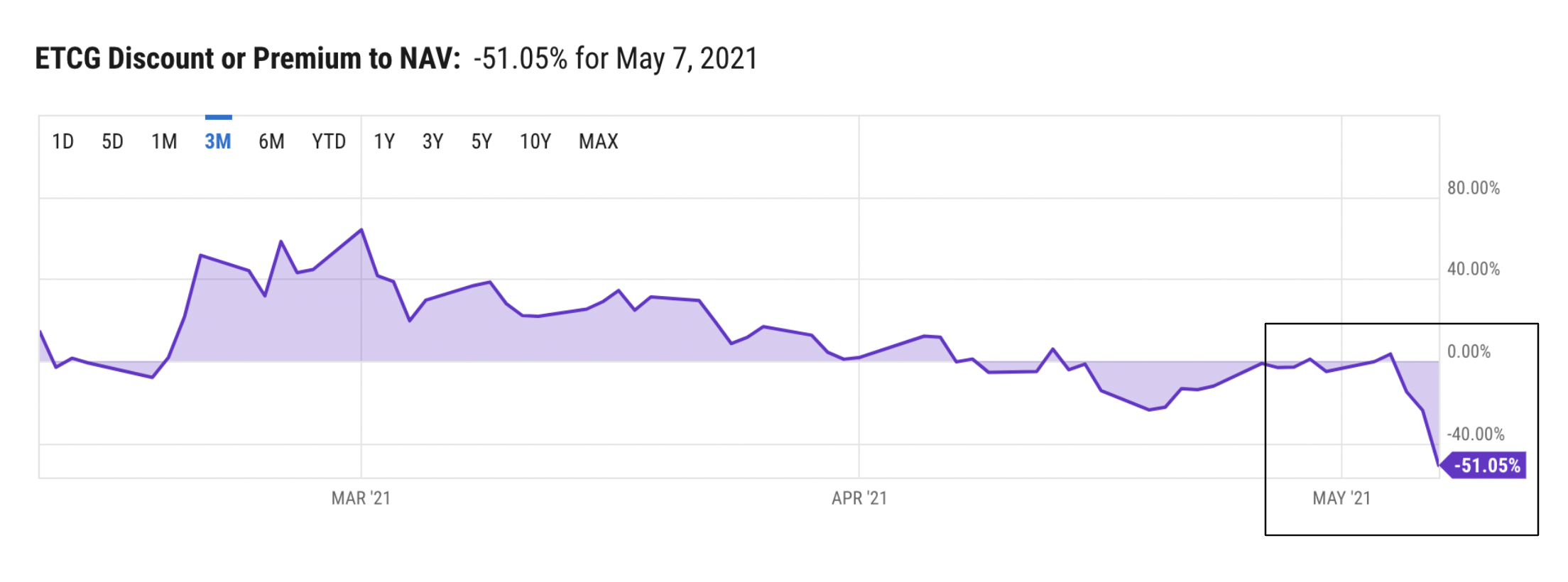

ETCG, a trust product launched by Grayscale in April 2017, trades at a roughly 50% discount to its net asset value (NAV). Grayscale is owned by Digital Currency Group, CoinDesk's parent company.

The discount/premium to NAV is a percentage that calculates the amount that an exchange traded fund or closed end fund is trading above or below its net asset value.

Roughly 2 million ETCG shares were issued between April and May 2020, according to FundStrat. Private placement shares take one year to vest and are likely being released to the market.

“ETCG volume has been spiking recently this month as those shares are coming unlocked to the market,” Grider wrote.

“Many of these same shareholders are now finding themselves in need of covering their ETC denominated loans," he wrote. "This means that these same investors who borrowed ETC to contribute to the trust must now sell ETCG shares and buy back ETC in the spot market to repay these loans.”

Grider said that lower liquidity of ETCG has forced investors to push fund shares to a deep discount from the spot price. Therefore, the demand to cover borrowed positions has likely contributed to an increase in the ETC price.

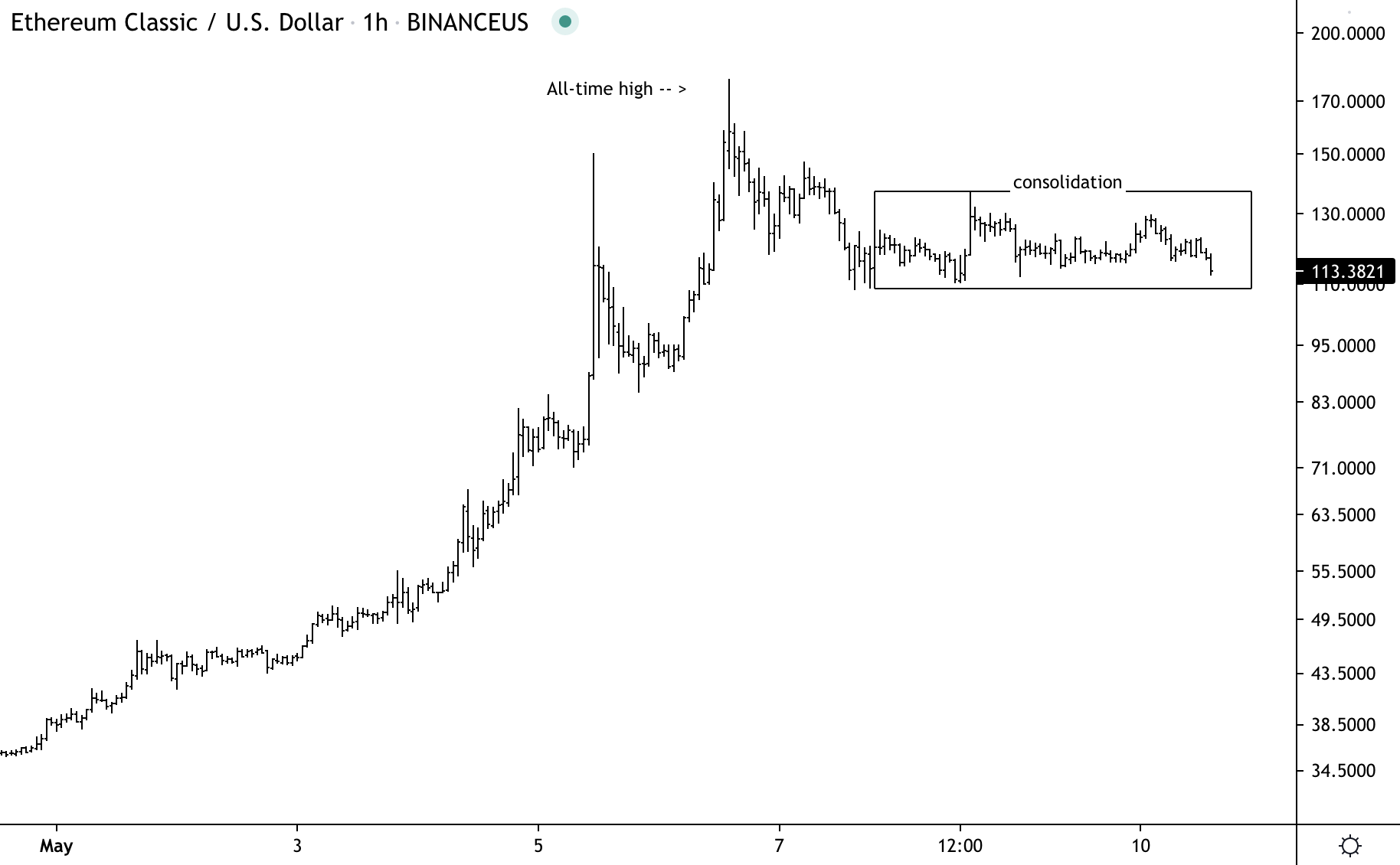

Hourly ETC/USD chart shows sideways trading (consolidation) over the past few days along a strong rally month-to-date.

ETC has traded sideways over the past few days after it reached an all-time high around $178 on Thursday.

“The stability of the price over the weekend is encouraging,” Grider wrote in an email to CoinDesk on Monday. “I think there’s still a bid to cover that could last until the end of Q3. It could provide some steady demand for ETC.”

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZYMD3U76C5EUTF7TYXRCD4VB2U.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)