Major digital assets exchanges are looking to enter India, the second-most populous country globally, despite the government mulling a blanket ban on private cryptocurrencies.

- Industry sources speaking to Reuters said U.S.-based Kraken, Hong Kong-based Bitfinex, and rival KuCoin are actively seeking information about the nature of the market and potential entry points.

- One exchange has reportedly begun due diligence for acquiring an Indian firm, while the other two have yet to decide whether to establish a subsidiary or buy a domestic firm.

- "All of these exchanges are actively hiring for Indian entry," Gaurav Dahake, founder and CEO of Bangalore-based exchange Bitbns, told CoinDesk.

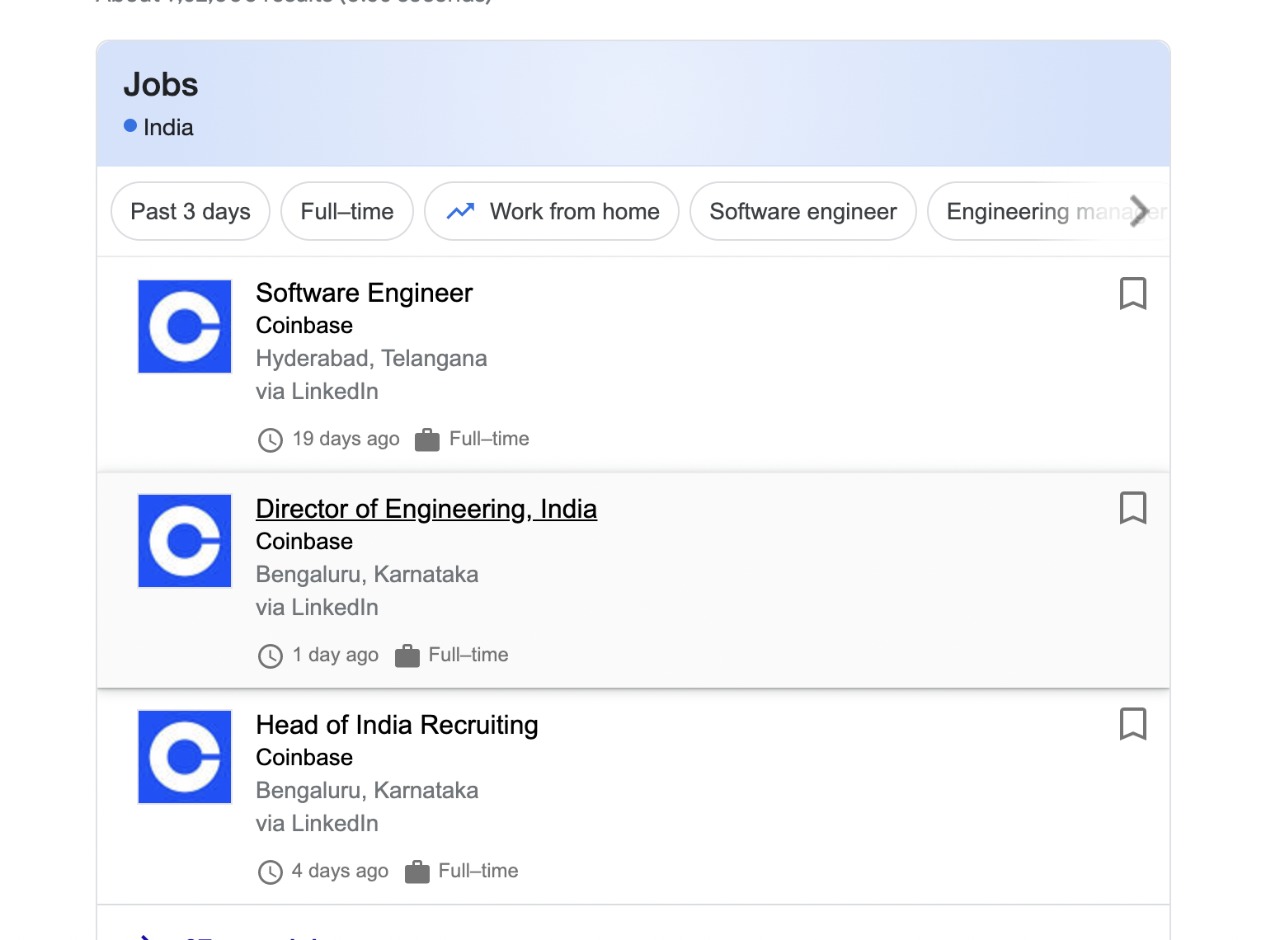

- LinkedIn data shows the U.S.-based Nasdaq-listed Coinbase exchange has been scouting for candidates for its India outpost, announced in March.

- Binance, the world's largest crypto exchange per trading volumes, acquired the Mumbai-based WazirX exchange in 2019.

- With its tech-savvy young generation, India can be a huge market; and its true potential may come to the fore once regulatory uncertainty subsides.

- There is a bill pending in the Indian parliament which seeks to ban trading, owning or holding any form of cryptocurrency.

Coinbase scouting candidates via LinkedIn

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HD5VBX7SDBBM7ONHTSRXBF43HI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)