Cryptocurrency Bitcoin SV suffered a 51% attack Tuesday morning, according to an analyst from the crypto intelligence firm Coin Metrics. The attack is continuing into Wednesday, according to another security expert.

- The attack was still underway as of 7:30 UTC on Wednesday, said Kim Nilsson, a bitcoin security expert known for his investigation into the Mt. Gox attack.

- The reorgs are continuing and "by now I've lost track of all the various chain tips," Nilsson told CoinDesk via Telegram.

- Coin Metrics corroborated Nuzzi's report later on Tuesday, tweeting that its blockchain security monitoring tool FARUM saw a 14-block reorg of the network.

- According to Nilsson, the first reorg on Tuesday was about 100 blocks deep. Nikita Zhavoronkov, the lead developer at Blockchain analytics platform Blockchair, agreed in a tweet, adding that it wiped 570,000 transactions.

- Coin Metrics said late on Tuesday that the attack had ended, but that there was still confusion between mining pools. Pools are mining on "completely different" block heights at the moment, Nuzzi told CoinDesk in a message late on Tuesday.

- A 51% attack occurs when malicious miners take control of more than 50% of a proof-of-work blockchain. The attackers can take advantage of block reorganization, a feature meant to clear up incidences when two miners have mined the same block.

- Broadly speaking, when two versions of the same blocks are mined, the system defaults to the longest chain. By mining faster than the honest miners during a 51% attack, the assailants can create a longer chain so that the system will render the honest miners' blocks invalid.

- The Bitcoin Association for BSV recommended that node operators invalidate the fraudulent chain.

- This mitigation strategy has "further split the network as different nodes now disagree on the current chain tip," Nilsson said.

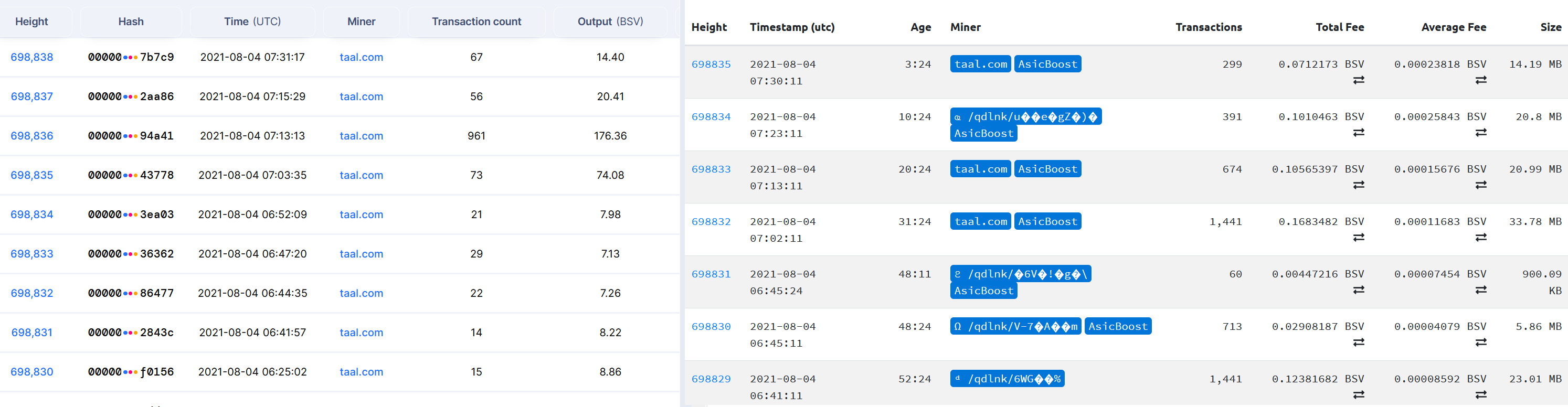

Blockchain analytics platforms Blockchair (left) and WhatsOnChain.com disagreed about the latest blocks being mined at 7.30 AM UTC on Wednesday August 4.

- Bitcoin SV, which was born through a hard fork of Bitcoin Cash, suffered four attacks in July.

- There is no "clear indication" of the attacker's identity, and Coin Metrics is still looking into the attacker's chain for "traces of double spends targeting exchanges," Nuzzi said.

- Major BSV mining pools are still struggling to align on the same blockchain, he said.

- The BSV hashrate fell by almost 50% from Monday to Tuesday, according to Bitinfocharts. But Nuzzi said that due to the confusion after the reorg, it's hard to estimate how much the hashrate has dropped.

- Attacks on BSV and similar cryptocurrencies are "cheap and straightforward to perform" because they use the same algorithm as Bitcoin but are not protected by a large hashrate, Nilsson said.

UPDATE (AUG. 4, 04:00 UTC): Added quote from Lucas Nuzzi and information on hashrate and block reorgs.

CORRECTION (AUG. 4, 4:00 UTC): The block reorg was 14 blocks, according to CoinMetrics.

UPDATE (AUG. 4, 07:00 UTC): Added quotes and analysis from Kim Nilsson, as well as screenshots from Blockchair and WhatsOnChain.com.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WC3RSYMEKNCCLM2XJJUIBIRUGU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)