Bitcoin traded with great volatility around $44,000 on Monday as some traders were duped by a fake news release stating that Walmart is partnering with Litecoin (LTC). The cryptocurrency is roughly flat over the past 24 hours after Walmart stated that it “had no knowledge of the press release issued by GlobeNewswire, and it is incorrect.”

Also on Monday, business software company MicroStrategy announced that it bought an additional 5,050 BTC. The company now holds 114,042 BTC, which were acquired for a total of $3.16 billion and at an average price of $27,713 per bitcoin, reports CoinDesk’s Tanzeel Akhtar.

On the regulatory front, stablecoins are under increasing pressure as U.S. officials discuss launching a formal review into whether tether and other stablecoins threaten financial stability, according to Bloomberg. President Biden’s working group plans to issue stablecoin recommendations by December.

On Sunday, Cardano, an open-source public blockchain, issued a network upgrade dubbed Alonzo. The update is a key part of the Goguen era, which focuses primarily on building smart contract capabilities, reports CoinDesk’s Sebastian Sinclair. Cardano’s ADA token is down about 10% over the past 24 hours.

Latest Prices

Bitcoin long-term accumulation

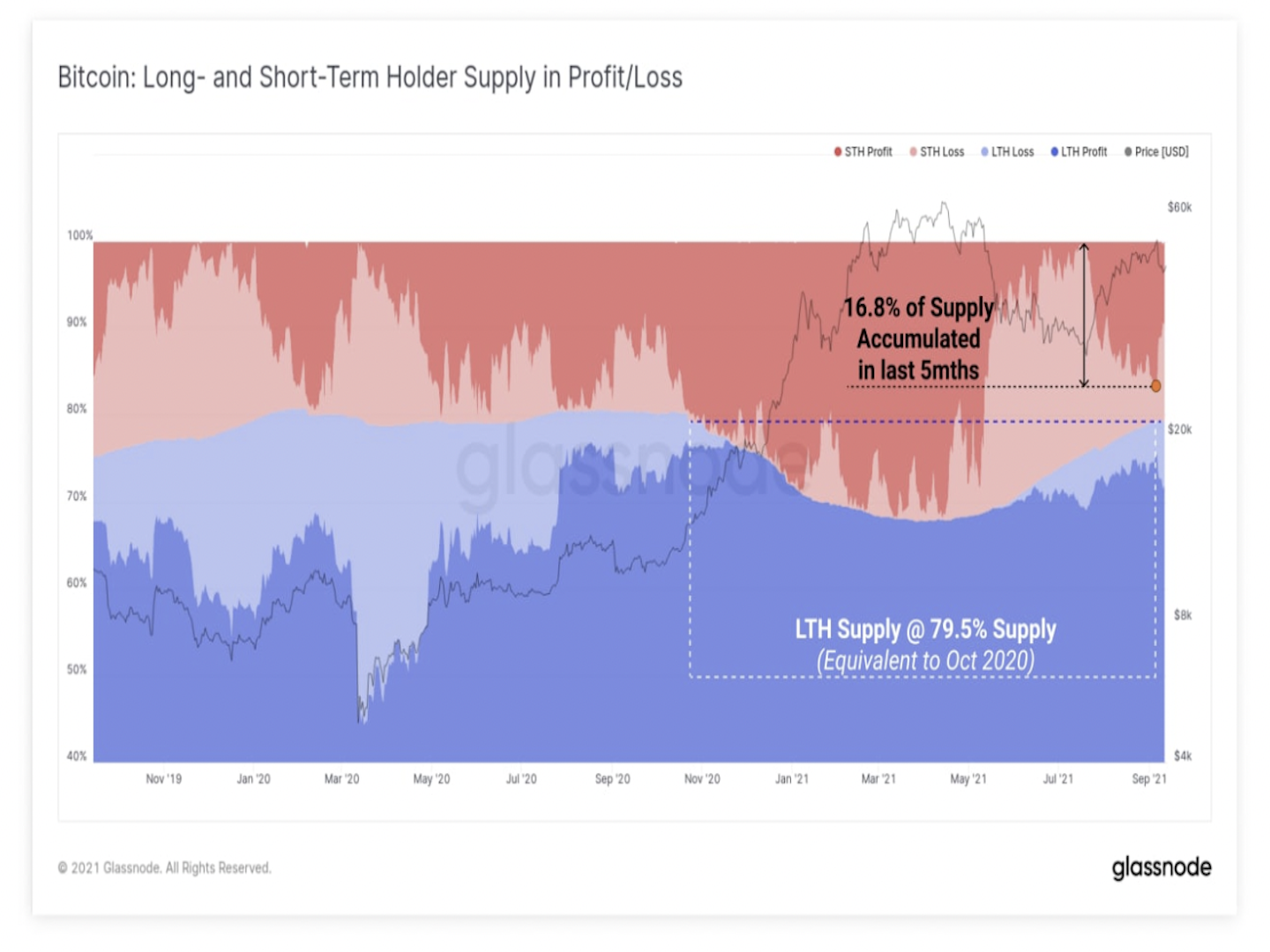

Long-term bitcoin holders appear to be unshaken by the sell-off last week. Blockchain data shows a large accumulation of BTC occurred just between the $29,000 and $50,000 price levels. Buyers can either book a profit at current prices or defend support around the bottom of the two-month price range.

Crypto research firm Glassnode defines long-term holders as high-conviction buyers with BTC aged around 155 days.

“We can also see that LTH (long-term holders) owned supply has reached 79.5% of all BTC coins this week, which is equivalent to the level reached in October, prior to the bull market kicking off,” Glassnode wrote in a blog post.

The firm also noted that peaks in LTH supply typically coincide with the late stage of a bear market. It is possible that investors accumulated positions after the May sell-off, although buying momentum has weakened over the past month.

Meanwhile, blockchain data also shows short-term bitcoin holders selling at a loss (below their cost basis). Some analysts believe that is a bullish sign.

“When short-term (holders) are in disbelief and unloading their bags, that’s an indication of a start to the next bull run,” CryptoQuant wrote in a blog post.

Solana funds outshined bitcoin last week

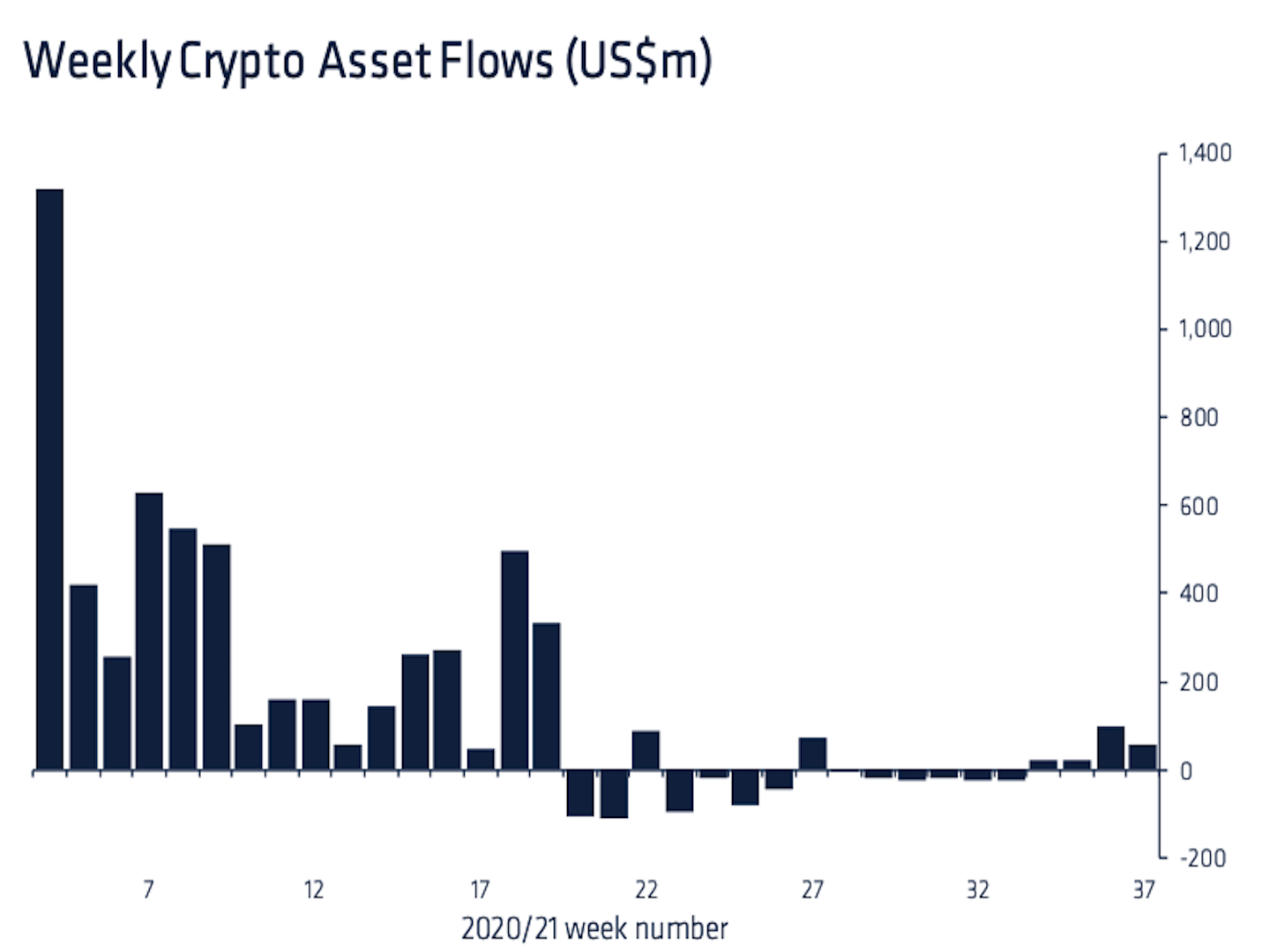

Crypto funds focused on Solana’s SOL token garnered almost $50 million of inflows last week, while bitcoin funds brought in a “paltry” $200,000.

Overall, crypto funds brought in $57 million of new money in the seven days through Friday, the fourth straight week of inflows, according to a report Monday by the digital-asset manager CoinShares.

Altcoin roundup

- Arbitrum vaults onto layer 2 leaderboard. The so-called layer 2 scaling product that works alongside the Ethereum blockchain to accelerate transactions, has seen a nearly 10-fold rise since Friday in the total value locked in decentralized finance (DeFi) projects. The project currently holds $2.23 billion in assets in various DeFi projects, up from $238 million on Friday, reports CoinDesk’s Omkar Godbole.

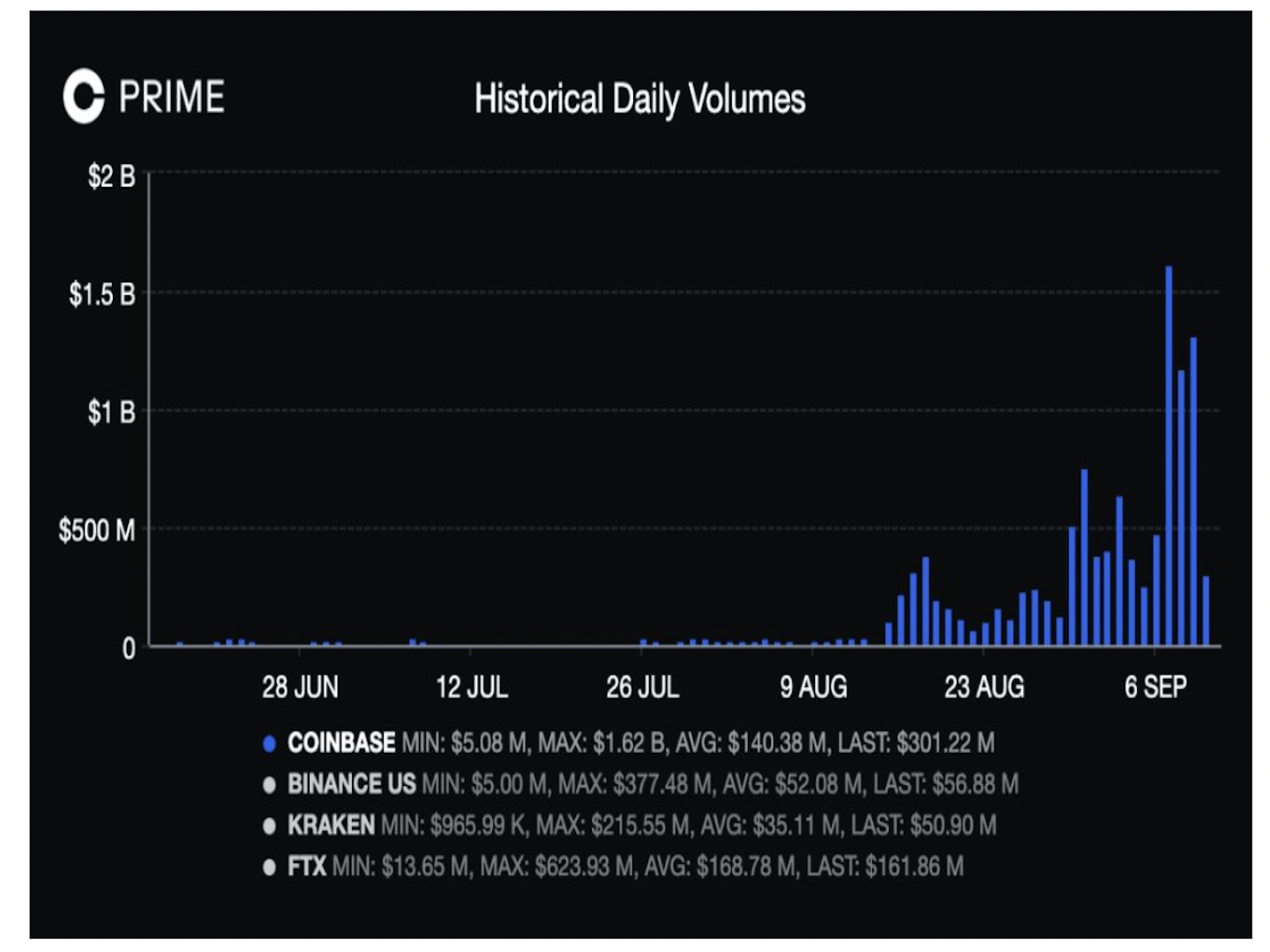

- Solana’s (SOL) trading volume surged over the past month. The cryptocurrency rose 42%, compared with a 9% decline in bitcoin over the same period. “There’s been a lot more interest institutionally,” Sam Bankman-Fried, CEO of crypto derivatives exchange FTX, said during an interview with Bloomberg. Solana is “one of the only blockchains that has a compelling long-term road map” that will be eventually able to support industrial uses of crypto, he added.

Relevant News

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polkadot (DOT), $35.65, +2.4%

Notable losers:

- Cardano (ADA), $2.45, -8.9%

- Polygon (MATIC), $1.25, -7.1%

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GGNRSKLXMJCQXGUF7M2CFX2PGQ.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)