Rising costs on Ethereum, the world’s largest smart-contract blockchain, appear to be driving investors to coins associated with layer 2 products facilitating faster and cheaper transactions and rival programmable blockchains.

The average fee on Ethereum, known as gas, has risen by a staggering 2,300% since late June. It has more than doubled to $56 in the past two weeks alone, according to data provided by the blockchain analytics firm Glassnode, and the seven-day moving average of the mean transaction fee has hit a record high of $52.

Surging costs are drawing the ire of the investor community and forcing the retail crowd to search for relatively cheaper options like layer 2 protocol Loopring and rivals Solana and polkadot.

“Ethereum is a beast (ETH bull here) which is the future of cryptocurrency – but the gas fees really can affect us,” a Redditor complained in a blog post published Tuesday, explaining the rationale behind purchasing Loopring. “We are tired of paying $150+ in gas fees just to transfer or buy $100 worth of a cryptocurrency.”

CoinDesk data show LRC, the native token of Loopring, a layer 2 scaling protocol for Ethereum-based decentralized exchanges (DEXs), has increased 243% from $0.42 to $1.44 in the past seven days, with the price surging by nearly 40% over 24 hours. Rumors that video game store GameStop may team up with Loopring for a non-fungible token (NFT) marketplace could be adding fuel to LRC’s price rally.

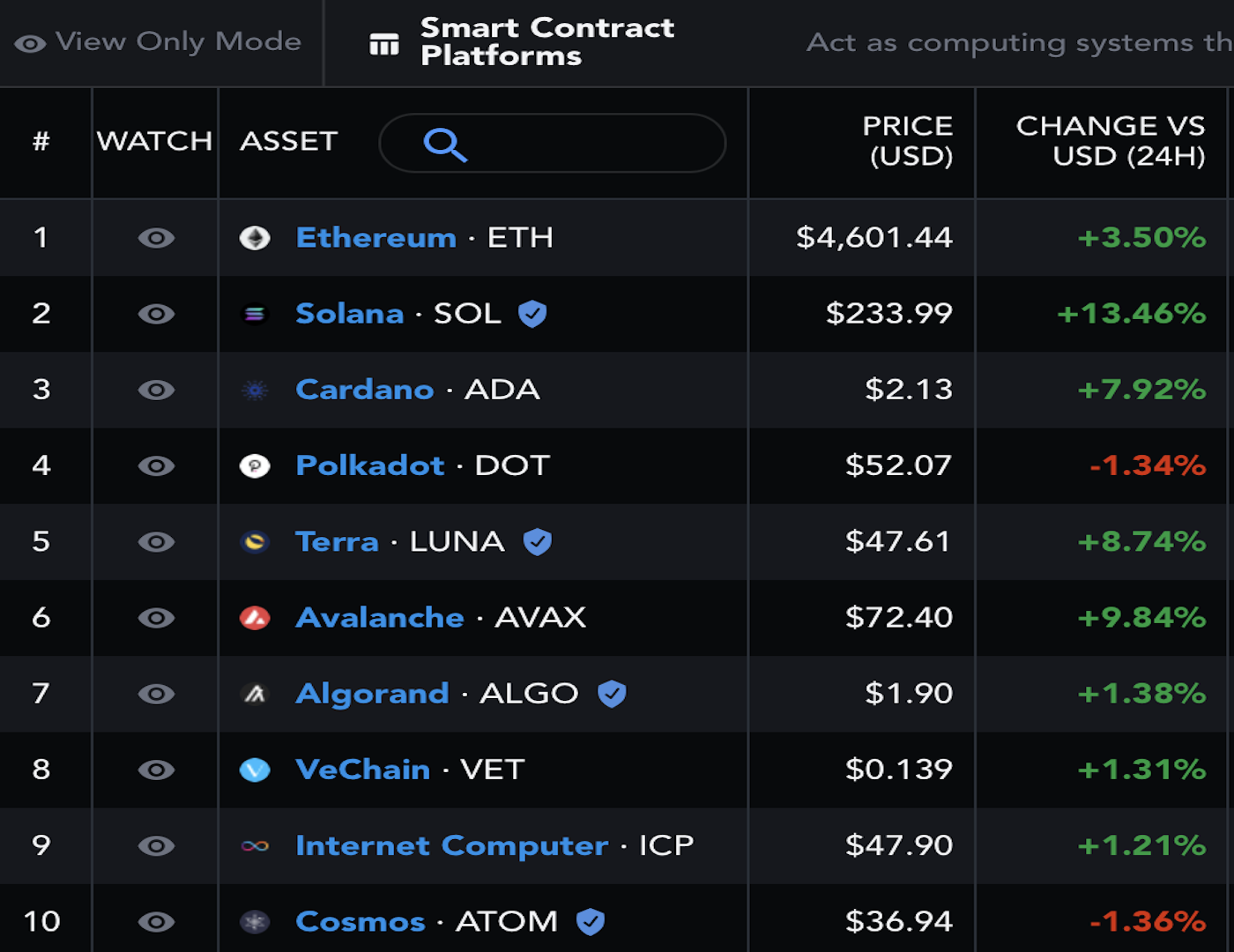

Programmable blockchain Solana’s SOL token has risen by 13% in the past 24 hours to a record high of $234. The cryptocurrency has gained 25% in the past seven days, pushing Solana’s market capitalization to $70 billion – the fifth-largest globally and ahead of another Ethereum rival Cardano’s $67 billion, CoinGecko data show.

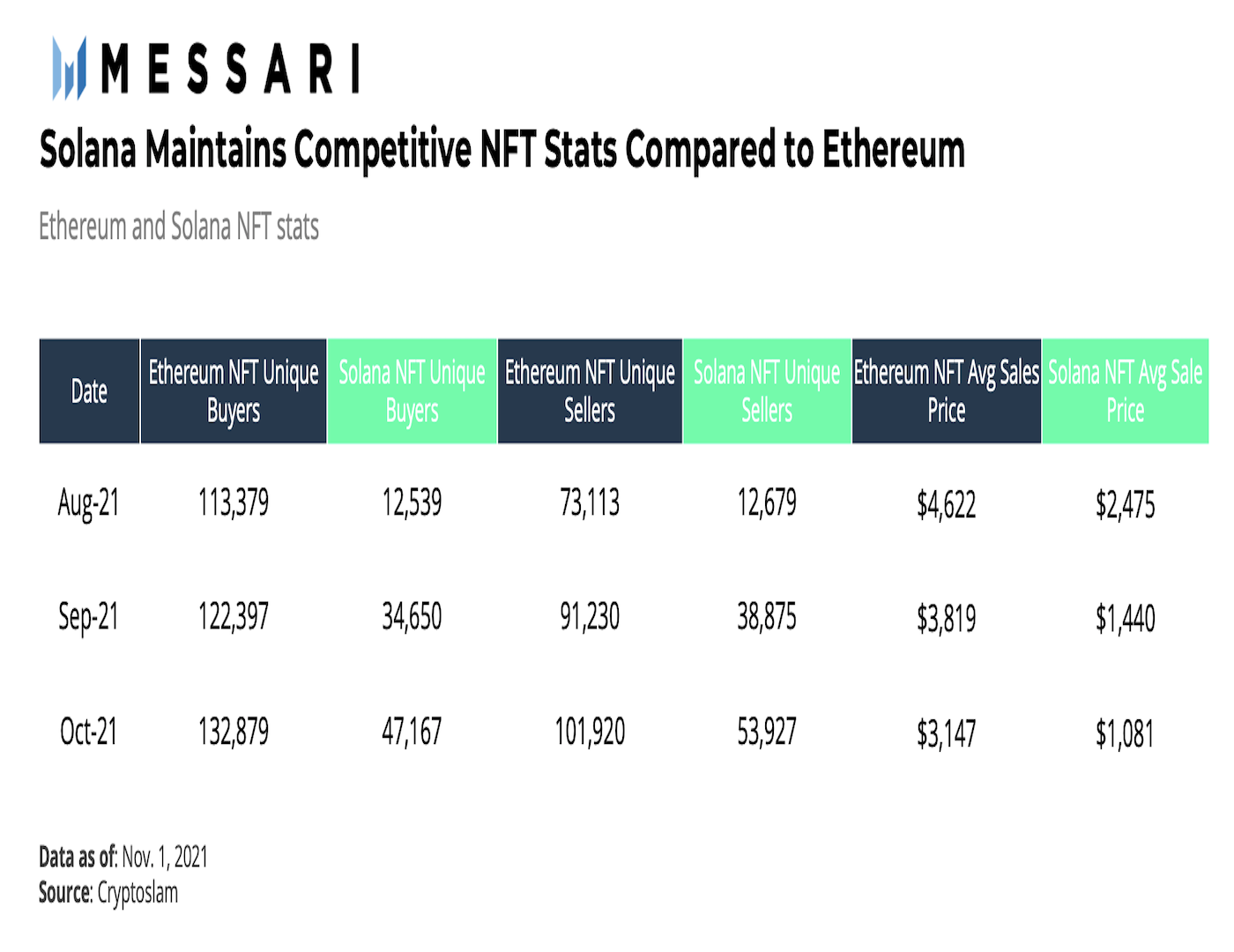

According to Messari’s Mason Nystrom, Solana is also expanding its footprint into Ethereum-dominant crypto market sub-sectors like NFTs.

Solana vs. Ethereum NFT stats

“As the Solana ecosystem continues to expand, NFTs on Solana have similarly witnessed formidable growth as a category,” Nystrom said in a blog post published Wednesday. “Total NFT secondary sales volume on Solana has officially reached $500 million.”

Smart-contract blockchain Polkadot’s DOT token also rallied to an all-time high, touching $53.37 early today and surpassing the previous peak of $49.74 reached in May.

Most coins linked to smart-contract blockchains have outperformed ether in the past 24 hours. Ether was trading near $4,600 at press time, representing a 3.5% gain.

Performance of ether and its rivals in the past 24 hours. (Messari)

According to Delphi Digital, a continued rise in Ethereum’s transaction fees would crowd out retail investors, leading to a drop in network usage and the cryptocurrency’s price.

“It is critical that Ethereum scaling solutions like StarkNet, zkSync, Arbitrum and Optimism gain traction soon, otherwise steep transaction costs will increase activity on alternate L1s such as Solana, Avalanche, Fantom and Polygon (to name a few),” analysts at Delphi Digital said in the market updated published Tuesday.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZCJX5F5FO5ELLDTAEN377UDOAM.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)