A lone trader lost more than $11 million on a single futures trade involving Theta Networks’ THETA token as the price jumped 18% in 24 hours.

The trade, among the largest for mid-cap cryptos in recent months, occurred on crypto exchange Binance and formed the largest part of the $11.67 million in liquidations on THETA futures. Usually, the largest liquidations occur on futures tracking bitcoin (BTC) or ether (ETH), the two most-traded cryptocurrencies.

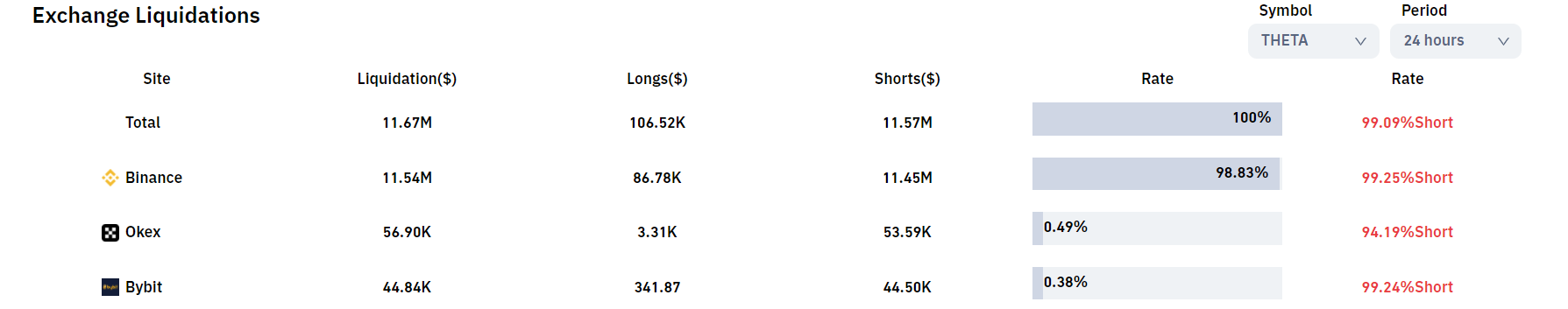

A single THETA trader lost over $11 million to liquidations. (Coinglass)

Liquidations occur when a trader has insufficient funds to fill a margin call – a demand for extra collateral by the exchange to keep the trading position funded. They’re especially common in high-risk trading due to the volatility of assets.

Of the $11.67 million in liquidation losses to THETA futures traders, one person was short $11.08 million of THETA, meaning that person was betting the token's price would drop, data from analytics service Coinglass show. The position was liquidated as prices jumped 18% from Monday’s lows of $2.73.

Binance, the largest crypto exchange, alone saw $11.54 million worth of shorts placed on THETA futures. Rival exchange OKX had $53,000 worth.

THETA hit resistance near the $3.50 level and tumbled 30 cents at the time of writing. It could fall to the $2.90 level if the selling pressure continues.

THETA faced resistance at the $3.50 level. (TradingView)

The THETA token forms the backbone of decentralized video-streaming service Theta Network and can be staked by those wishing to become “Validator” or “Guardian” nodes to earn returns. THETA allows nodes to validate transactions, produce blocks, vote on changes to the network and earn TFUEL as a reward, according to the technical documents.

THETA rose to $3.39 in early Asian hours amid a broader revival in the crypto market. Bitcoin rallied through $44,000, while ETH, Terra’s LUNA, and other major cryptocurrencies have all posted gains in excess of 10% in the past 24 hours.

At the time of writing, THETA is the 45th-largest cryptocurrency and has a market capitalization of $3.2 billion.

UPDATE (March 1 21:22 UTC): Corrects the trading symbol for ether to bitcoin.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RWZ7UXOKGJF2NFKPNO3Z656W3Q.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)