As ether (ETH) slipped to a 10-day low on Monday, market participants took bets that would offer protection against a deeper slide in the second-largest cryptocurrency.

A single trader or several traders bought more than 36,000 contracts of Deribit-listed ether put option expiring on March 18, of which more than 20,000 were blocked on institution-focused over-the-counter tech platform Paradigm, according to Swiss-based data tracking firm Laevitas. The put option buyers would make money if ether drops below $2,200 by March 18. That's a roughly 13% decline from the current market price of $2,514.

"We witnessed strong demand for 18 March, 2200, puts yesterday as players looked to buy short-dated protection on the key 2,200 pivot level in ETH," Patrick Chu, director of institutional sales and trading at over-the-counter tech platform Paradigm, told CoinDesk in a Telegram chat.

Deribit, the world's largest crypto options exchange by trading volumes and open positions, and Paradigm introduced an institution-focused block-trading service three years ago. Trades facilitated by Paradigm are automatically executed, margined and cleared at Deribit. A block trade is typically a high-volume transaction privately negotiated between two parties and executed over-the-counter.

On Deribit, one ether options contract represents one ETH. A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the market, while a call option purchaser is bullish.

Savvy traders holding long positions in the spot or futures market typically buy put options when they are concerned about a temporary drop in the asset's price. However, sometimes traders treat options as vehicles for speculation, expressing their bearish bias through a long position in put options or by creating spreads – buying puts near the current market price and selling an equal amount of puts below the market price.

According to Laevitas, most of the trades in the $2,200 put registered on Monday were straight forward longs and did not appear to be part of a complex options strategy. "Most of them were outright trades, possibly short-term hedges," Laevitas said in a Twitter chat.

Ether's daily price chart (TradingView)

Since November, ether has been trending lower. Sellers ran out of steam around $2,200 in late January, establishing the psychological figure as crucial support.

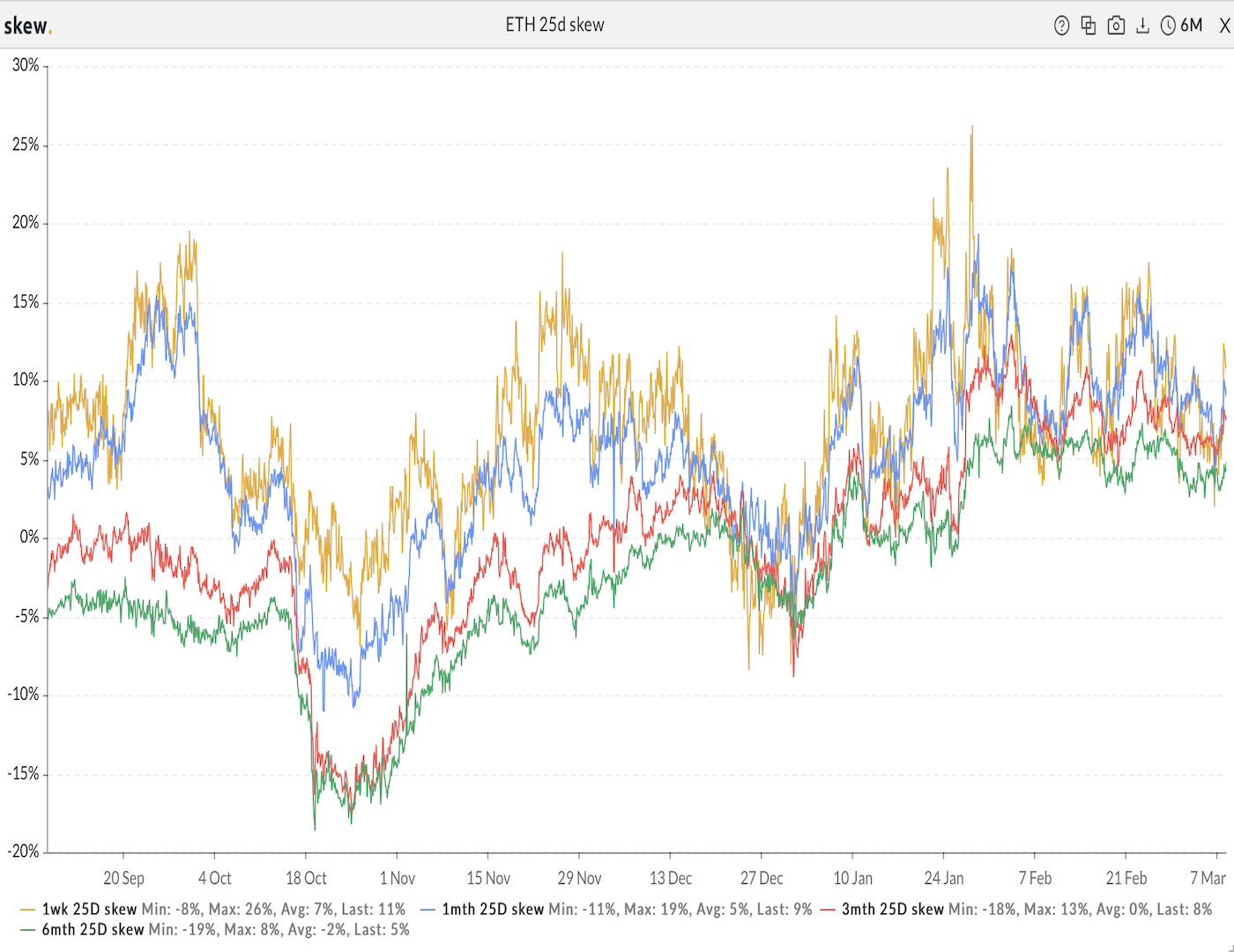

Since late January, the options market has consistently shown a bearish bias across all timeframes, with the one-week, one-, three- and six-month put-call skews returning positive values. Put-call skews measure the cost of puts relative to calls.

Ether put-call skews (Skew)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GMLFNDN5DNEVJILJBFZU6EOBHA.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)