In a vote taking place this week, crypto investment firms Polychain Capital and Arca are proposing yield cuts to the Anchor Protocol, the largest decentralized finance (DeFi) lending protocol in the Terra blockchain ecosystem.

Anchor Protocol advertises a 19.5% yield and has grown its coffers to $12.7 billion in total value locked (TVL), a trajectory some analysts and traders see as unsustainable. The figure makes Anchor the largest DeFi protocol by TVL in the Terra ecosystem and the fourth-largest DeFi protocol across all blockchains, according to data from DeFi Llama.

The proposed yield cuts will decrease Anchor’s payout by between 2 percentage points and 9.5 percentage points of annualized yield for users who deposit more than 100,000 of Terra's dollar-linked stablecoin UST into the protocol.

“After successfully bootstrapping UST adoption with a 20% Anchor Rate, it's time to focus on protocol sustainability by bringing down the overall yield earned by depositors and maintaining high yields for small-and-medium sized users,” the proposal stated.

Deposit Amount | Proposed APY |

|---|---|

Up to 100,000 UST | 19.56% [No change] |

Above 100,000 and up to 500,000 UST | 17.5% |

Above 500,000 UST | 10.0% |

TIERED PAYOUTS: For a depositor of 1,000,000 UST, the first 100,000 is subject to 19.56% APY, the next 400,000 UST will be subject to 17.50% APY, and the remaining 500,000 UST would earn 10.00% APY.

Polychain and Arca, which both have capital locked up in Anchor, also proposed downward rate revisions every 30 days for deposit amounts in the two higher tiers, which would be implemented over one and a half years beginning on April 1.

The proposal, introduced in Anchor’s governance forum on Feb. 25, officially went live for voting on Thursday.

Although voting on the proposal is still in progress – the voting period ends next Wednesday morning – it appears the proposal’s chances of going through are slim.

As of press time, over 70% of Anchor token holders participated in the voting, with 55% voting "No" and 16% voting "Yes."

Anchoring Terra’s growth

Amid the market sell-off, stablecoin farming has attracted large swaths of crypto investors looking to obtain high yields with lower market risk. Unlike yield farming with riskier cryptocurrencies, holding the underlying stablecoins comes with essentially no volatility for the principal investment.

The proposal comes as critics of Anchor say its high yield will become unsustainable and is threatening the long-term viability of the protocol and the larger Terra ecosystem.

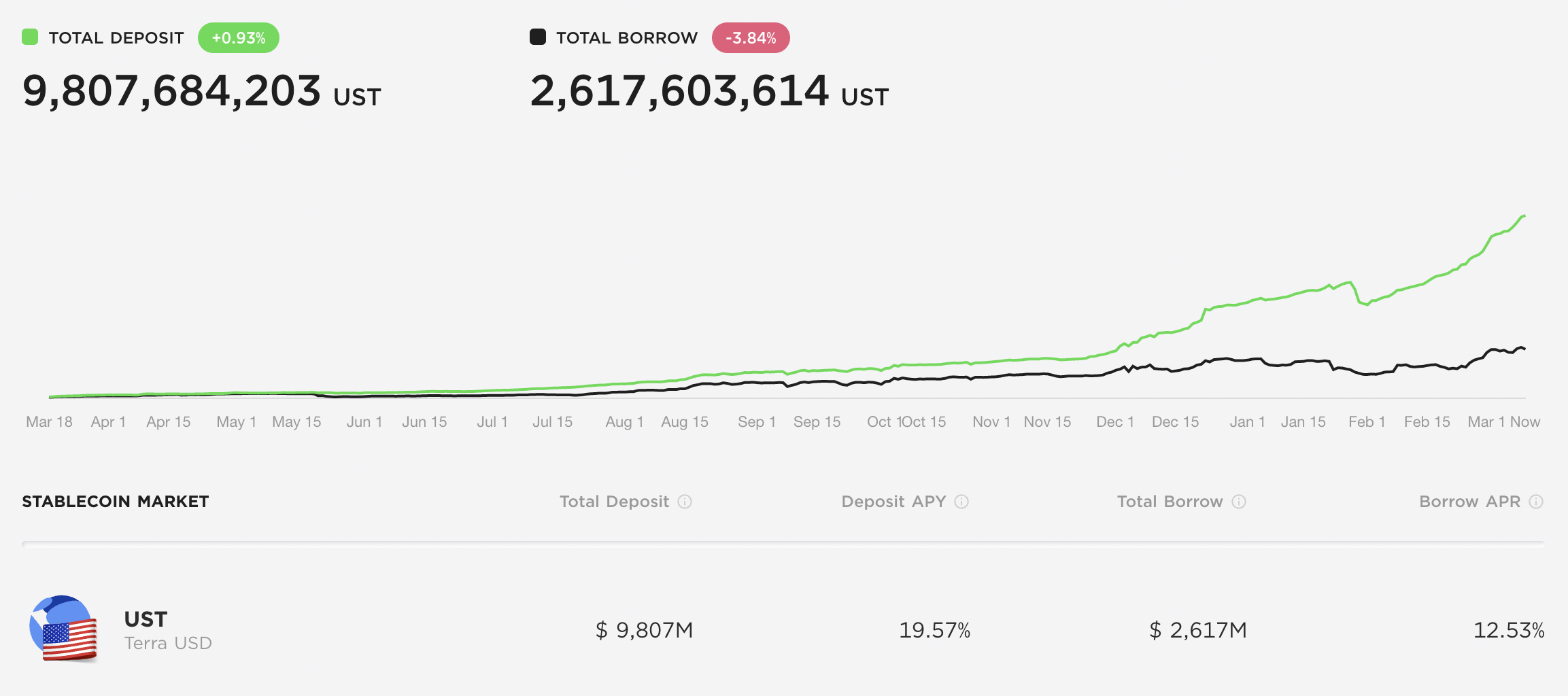

Anchor accepts UST stablecoin deposits and currently advertises a 19.57% annual percentage yield (APY) on those deposits, paid out in its native ANC token.

This figure is far higher than comparable DeFi projects. For example, the popular decentralized stablecoin exchange Curve is offering an APY of between 4.7% to 11.8% for deposits in its UST pool.

Anchor has also spurred rabid demand for UST stablecoins among yield-hungry investors, recently sending UST’s sister token LUNA to a new all-time high, even as other layer-1 tokens have heavily sold off. Anchor’s native ANC token has also seen a big price rally this month.

Anchor’s current borrow rate for UST now sits at 12.7%, a figure lower than the 19.5% yield Anchor is paying out to its depositors. Additionally, the amount of UST deposited far exceeds the amount of UST being loaned out.

UST borrowing and lending on Anchor as of Friday. (Anchor)

The community debates

The proposal has drawn intense discussion from the DeFi community, igniting debates ranging from potential loopholes to whether changes to Anchor’s existing code base proposed by third parties constitute a valid governance proposal.

Many respondents in the proposal’s governance thread highlighted concerns regarding a potential Sybil attack. Such an attack occurs if Anchor users with large amounts of UST create multiple wallets below the 100,000 UST threshold to continue to collect the higher yield.

In response to those critics, Polychain research strategist Josh Rosenthal responded, “We are taking a calculated bet in assuming that this wallet gamesmanship will take place on the margins, but not at a magnitude that will render this proposal ineffective on the whole.”

Another concern highlighted by Gabriel Shapiro (“@lex_node”), general counsel at Delphi Labs, centered around the lack of clear direction regarding the proposal’s implementation.

Shapiro called the proposal “intrinsically meaningless” and “impossible to evaluate,” pointing to the technical legwork required if the proposal were to pass.

Others took to Twitter to say that implementing the proposal would be a poor use of Anchor’s precious developer resources.

Kanav Kariya, president of Jump Crypto, also tweeted that Jump would vote "No."

The proposal also touches upon a long-standing DeFi criticism, namely, that projects are quick to rake up TVL by paying out an unsustainable yield.

Eventually, the critics say, the flywheel will collapse, leading to a mass exodus of capital, token crashes and tears. (The term “Ponzinomics” is now a staple of the crypto vernacular.)

It appears DeFi "degens" will have to choose between higher short-term gains or longer-term sustainability of the protocol.

While Terra co-founder Do Kwon has remained silent on which side he supports, Anchor Protocol’s official Twitter account retweeted a post from a Twitter user voicing objections to the proposal.

Even if the proposal fails, it appears that the effort is at least igniting much-needed discussion over the sustainability of Anchor, with some dissenters objecting to the proposal in its practice, but not in its spirit.

“We should welcome new brains thinking about Anchor’s future and participating in its governance,” Kwon tweeted.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MNOGJ7NSDRHQFFDX3RT66RVYZ4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)