Arthur Hayes, co-founder and former CEO of crypto spot and derivatives exchange BitMEX, sees ether (ETH), the token powering Ethereum's blockchain, drawing a five-digit price by the end of the year.

"When the dust settles at year-end, I believe ETH will be trading north of $10,000," Hayes said in a blog post called "Five Ducking Digits" published Friday. The post-Merge cryptocurrency will have the characteristics of a commodity-linked bond and will have an intrinsic yield, said Hayes, who plead guilty to violating the U.S. Bank Secrecy Act in January. Hayes and a fellow co-founder were accused of violating the Act by operating with weak anti-money laundering (AML) protocols.

Researchers expect Ethereum's impending merge between the mainnet and the Beacon Chain proof-of-stake system to happen by end of June. Last month, developers successfully launched the testnet. Once the transition to proof-of-stake is complete, users will be able to set aside – or stake – coins in a cryptocurrency wallet to support network operations in return for newly minted coins.

In other words, the staked ether becomes a revenue-generating asset, similar to a fixed-income security such as a government bond. The non-staked ether would perhaps still have the commodity-like function. Gas is the fee, or pricing value, required to successfully conduct a transaction or execute a contract on the Ethereum blockchain platform and is priced in ether.

"The ETH 2.0 merge set to occur later this year will completely morph Ethereum into a proof-of-stake (POS) validated blockchain," Hayes said. "The native rewards issued to validators in the form of ETH-based issuance and network fees for staking ETH in validator nodes renders ETH a bond."

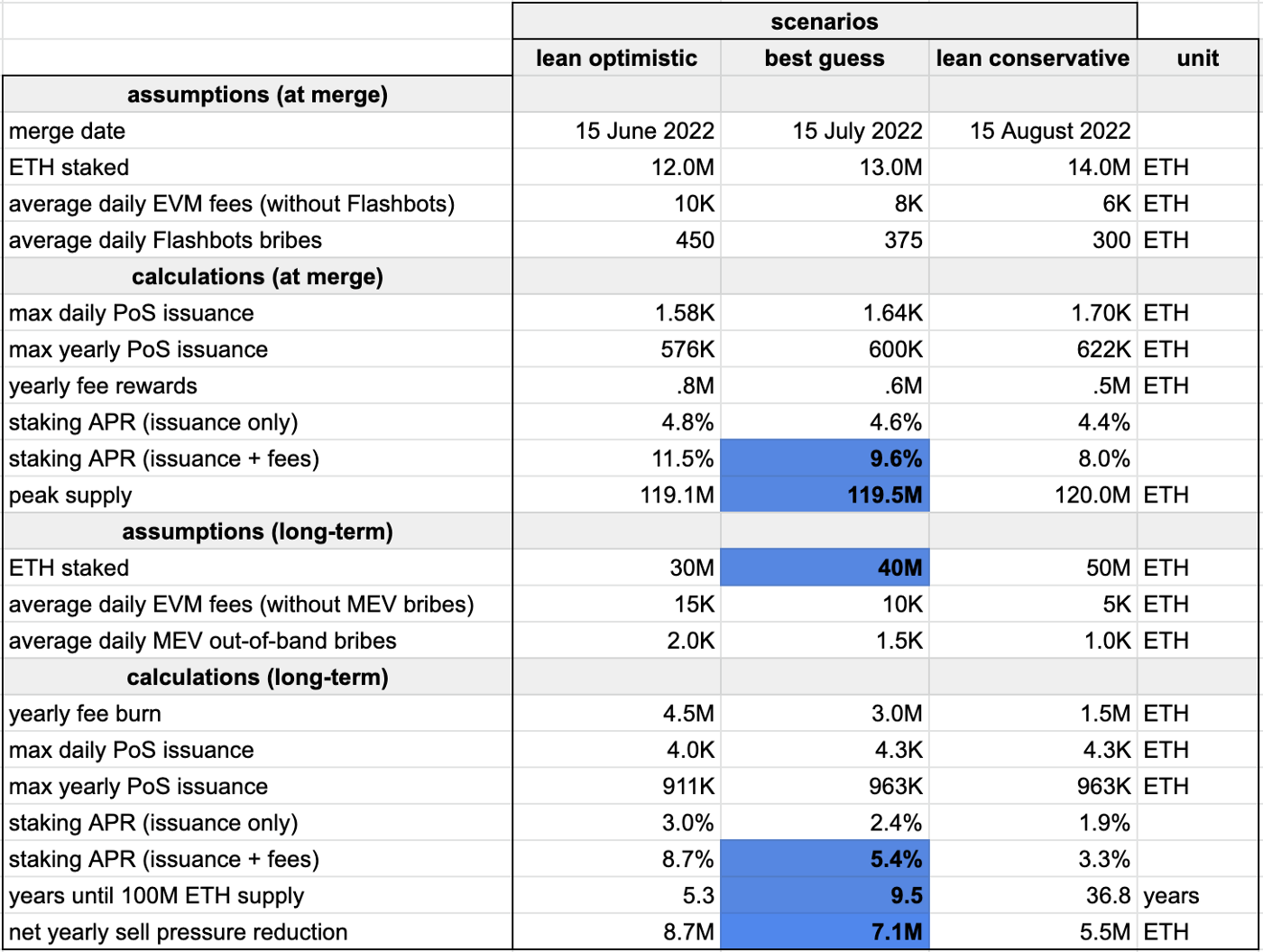

An entity needs to have at least 32 ETH to become a full validator. Per industry experts, annualized ether staking yields are likely to be in the range of 10% to 15%, implying positive returns when adjusted U.S. inflation.

Researcher Justin Drake's estimates of post-merge ether staking yields. (Arthur Hayes, Medium)

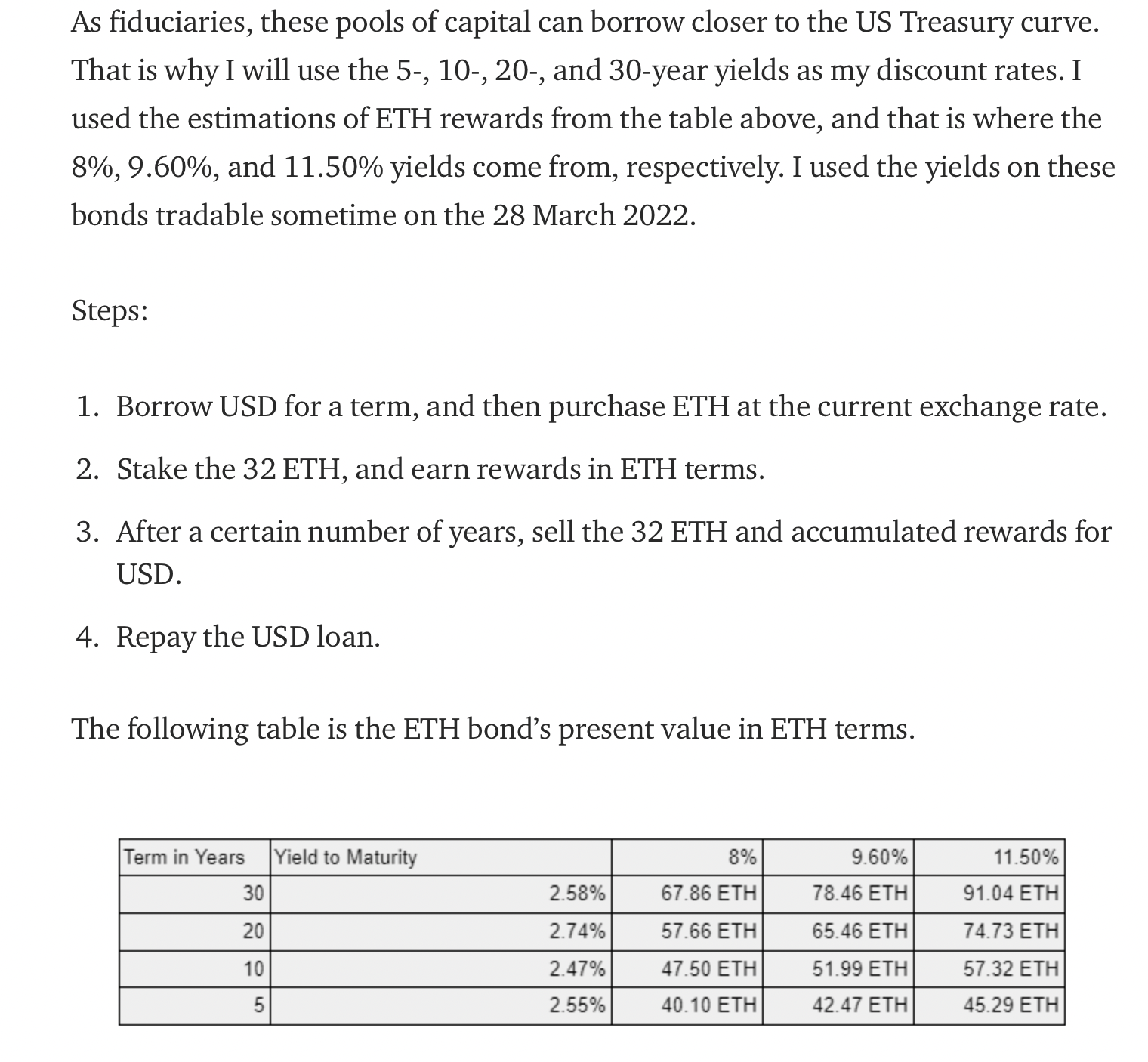

According to Hayes, the classification of ether as a bond could see money managers take on exposure to the second-largest cryptocurrency. "If we can convince the fiduciaries that the classification of ETH is a bond rather than a currency, then a whole new set of fiduciary clowns can be mentally primed to allocate into the ecosystem," Hayes noted, adding that fiduciaries can make a carry trade once ETH rests in a bond basket.

A carry trade is a strategy of borrowing at a low-interest rate and investing in an asset that provides a higher rate of return. The trader profits from the spread between the interest rates.

According to Hayes, fiduciaries can borrow U.S. dollars at rates equivalent to Treasury yields to purchase 32 ETH, which will be staked. The entire Treasury yield curve is below 2.5%, according to data provided by charting platform TradingView, which means the cost of getting dollars is significantly less than the forecast staking yields.

BitMEX's Arthur Hayes discussing a potential ETH staking carry trade. (Arthur Hayes, Medium) (Arthur Hayes)

The risk is a potential slide in ether's dollar price. That's similar to one associated with local currency bonds – where the issuer's domestic currency and the borrowed currency are the same.

However, according to Hayes, for investors to lose money on a five-year ether local currency bond, the token's price would have to decline by nearly 30%, assuming an 11.5% yield – the upper end of researcher Justin Drake's estimates. Further, investors can sell a one-year ETH/USD futures contract to hedge the downside risk. "The broker quoted me a mid-market premium of +6.90%. That means to hedge my local currency ETH bond, I actually RECEIVE income," Hayes wrote.

"I sell the ETH/USD forward at a premium to spot. This is a positive carry trade. There are very few trades in which you get a higher yield investing foreign currency bonds, and the act of hedging back into your home currency actually earns you money," he said.

Hayes also argued that more institutions might adopt ether following the merge because the proof-of-stake mechanism is considered more environmentally friendly than the supposedly energy-intensive proof-of-work mechanism.

"This fact [ETH's post-merge bond-like appeal], paired with ETH 2.0’s [environment, social, government]-compliant label (another stamp of intellectual ossification), and protocol metrics that are more attractive than the cadre of layer 1 [or base] “ethereum killers” makes ETH supremely undervalued on a relative basis vs. Bitcoin, fiat and other [layer 1] competitors," Hayes said, adding that MicroStrategy (MSTR) should issue debt and purchase ether instead of bitcoin (BTC).

Ether's options market has seen increased activity in higher strike call options in the wake of Hayes' bullish forecast. According to Patrick Chu, director of institutional sales and trading at over-the-counter tech platform Paradigm, about 7,000 contracts of the $10,000 ether December expiry call options changed hands over the weekend.

A call option gives the purchaser the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A call buyer is implicitly bullish on the market.

Ether was last trading near $3,480, down 1% on the day, CoinDesk data show.

UPDATE (April 4, 17:36 UTC): Added information on Hayes' guilty plea in second paragraph, and updated that Hayes is a co-founder of BitMEX.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/X63NPKGVFNA7LGMW5GHTYE26F4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)